nVent Electric Announces Acquisition of ECM Industries for $1.1B, Projected to Increase Earnings by 2023

April 5, 2023

Trending News ☀️

NVENT ($NYSE:NVT): nVent Electric, a global leader in electrical connection and protection solutions, has announced its acquisition of ECM Industries for $1.1 billion. The acquisition of ECM Industries marks a major milestone for nVent Electric, as it will expand the company’s product portfolio and customer base on a global scale. The acquisition of ECM Industries will expand nVent Electric’s reach even further, enabling it to offer a broader range of innovative solutions to its customers. The addition of ECM Industries to the nVent family is expected to provide long-term value for shareholders and customers alike.

The combined entity will have access to a larger customer base, while also benefiting from combined research and development capabilities. This acquisition also positions nVent Electric to become a leader in the electrical connection and protection industry. Overall, nVent Electric’s acquisition of ECM Industries is a strategic move that will increase the company’s growth potential and position it for long-term success.

Share Price

This acquisition is projected to increase NVENT ELECTRIC‘s earnings by 2023 and, as a result of the news, stocks opened at $43.8 and closed at $44.5, up by 3.6% from last closing price of $42.9. Investors are hopeful that this move will continue to bring NVENT ELECTRIC into greater success, as their previous expansions have done in the past. This acquisition marks a major milestone for the company, as it furthers their growth in the industry and gives them the resources to continue to expand even further. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Nvent Electric. More…

| Total Revenues | Net Income | Net Margin |

| 2.91k | 399.8 | 13.7% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Nvent Electric. More…

| Operations | Investing | Financing |

| 394.6 | -52.5 | -82.1 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Nvent Electric. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 4.9k | 2.17k | 16.52 |

Key Ratios Snapshot

Some of the financial key ratios for Nvent Electric are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 9.7% | 9.8% | 17.3% |

| FCF Margin | ROE | ROA |

| 12.0% | 11.7% | 6.4% |

Analysis

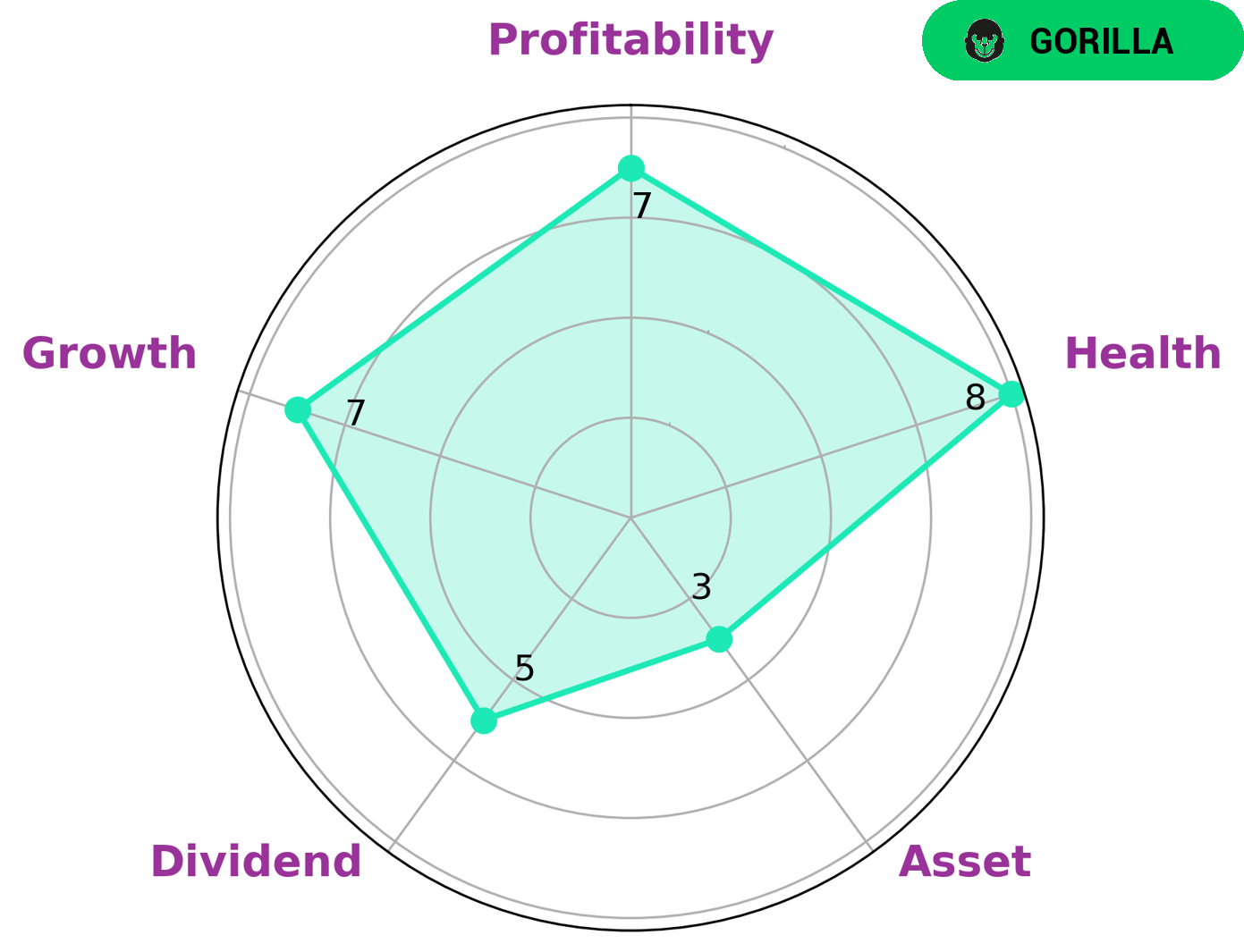

After examining NVENT ELECTRIC‘s financials, it is clear that the company is in a strong position. According to Good Whale’s Star Chart, NVENT ELECTRIC has a high health score of 8/10, indicating that it is capable of safely riding out any crisis without the risk of bankruptcy. NVENT ELECTRIC also has a strong performance in growth, profitability, and medium performance in dividend and weak performance in asset. All this has led Good Whale to classify NVENT ELECTRIC as a ‘gorilla’, a type of company that achieved stable and high revenue or earning growth due to its strong competitive advantage. Given the strong financial position and growth potential of NVENT ELECTRIC, it is likely to be of interest to investors looking for a stable long-term investment. Such investors may include value investors, growth investors, and dividend investors who seek to take advantage of the company’s potential for future growth. With its strong competitive advantage, NVENT ELECTRIC is likely to be a lucrative investment for these kinds of investors. More…

Peers

The company operates in over 40 countries and serves a variety of customers in the commercial, industrial and utility sectors. nVent’s products and solutions include enclosures, connectors, fasteners, thermal management products, circuit breakers and switchgear. The company has a strong presence in Europe and North America, and is expanding its operations in Asia and South America. Shenzhen Genvict Technologies Co Ltd, Easun Reyrolle Ltd, and Global Electrical Technology Corp are among nVent’s major competitors.

– Shenzhen Genvict Technologies Co Ltd ($SZSE:002869)

Shenzhen Genvict Technologies Co Ltd is a Chinese technology company that specializes in Internet of Things (IoT) solutions. The company has a market capitalization of 4.27 billion as of 2022 and a return on equity of -3.9%. The company’s products and services include IoT devices, platforms, and applications.

– Easun Reyrolle Ltd ($BSE:532751)

Easun Reyrolle Ltd is an Indian company that manufactures electrical equipment and provides engineering services. The company has a market cap of 76.99M as of 2022 and a Return on Equity of -1.46%. Easun Reyrolle Ltd is a part of the RPG Group and has its headquarters in Chennai, Tamil Nadu. The company manufactures a range of electrical products such as switchgear, power transformers, and meters. It also provides engineering services in the areas of electrical design, erection, and commissioning.

Summary

NVent Electric (NVT) is an electrical equipment and solutions provider based in the United States. Recently, NVT announced the acquisition of ECM Industries for $1.1 billion. This transaction is expected to be accretive to NVT in 2023, creating potential future value for shareholders. Following the announcement, investors responded positively, as the stock price moved up the same day. Analysts believe this move will improve NVT’s competitive position in the market, providing a strong tailwind for future growth.

Additionally, the acquisition provides access to a wider range of products and services, further enhancing the company’s market presence. This is a positive development for NVT and investors should watch for any additional information about this deal.

Recent Posts