Legato Capital Management LLC Invests in Advanced Energy Industries,

April 21, 2023

Trending News ☀️

On April 19, 2023, it was reported that Legato Capital Management LLC had acquired a stake in Advanced Energy Industries ($NASDAQ:AEIS), Inc., a leading provider of power and control technologies for high-growth, specialty applications. This investment was valued at a significant amount, and is a reflection of the trust and confidence Legato Capital Management LLC has in Advanced Energy Industries, Inc. Their products are used across a wide range of industries including oil & gas, aerospace, automotive, semiconductor manufacturing, and many more. Their solutions help customers increase efficiency, reduce emissions, and reduce costs while still maintaining the highest quality standards. Advanced Energy Industries, Inc.’s stock has been steadily rising in recent months, with their market cap growing to over $1 billion.

This investment from Legato Capital Management LLC is sure to give the stock an added boost of confidence, as the company looks to continue to increase sales and profitability. With their robust product offering and technical expertise, Advanced Energy Industries, Inc. is well-positioned for continued growth and success in the years ahead.

Stock Price

On Thursday, Legato Capital Management LLC announced that it had invested in Advanced Energy Industries, Inc. This investment saw the stock of Advanced Energy Industries, Inc. open at $87.7 and close at $89.0, a 0.6% increase from its previous closing price of 88.5. With this investment, Advanced Energy Industries, Inc. is well-positioned to continue to drive innovation and growth in the energy industry. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for AEIS. More…

| Total Revenues | Net Income | Net Margin |

| 1.85k | 199.66 | 11.2% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for AEIS. More…

| Operations | Investing | Financing |

| 183.59 | -208.27 | -61.87 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for AEIS. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.99k | 925.9 | 28.49 |

Key Ratios Snapshot

Some of the financial key ratios for AEIS are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 32.7% | 59.2% | 13.0% |

| FCF Margin | ROE | ROA |

| 6.8% | 14.6% | 7.5% |

Analysis

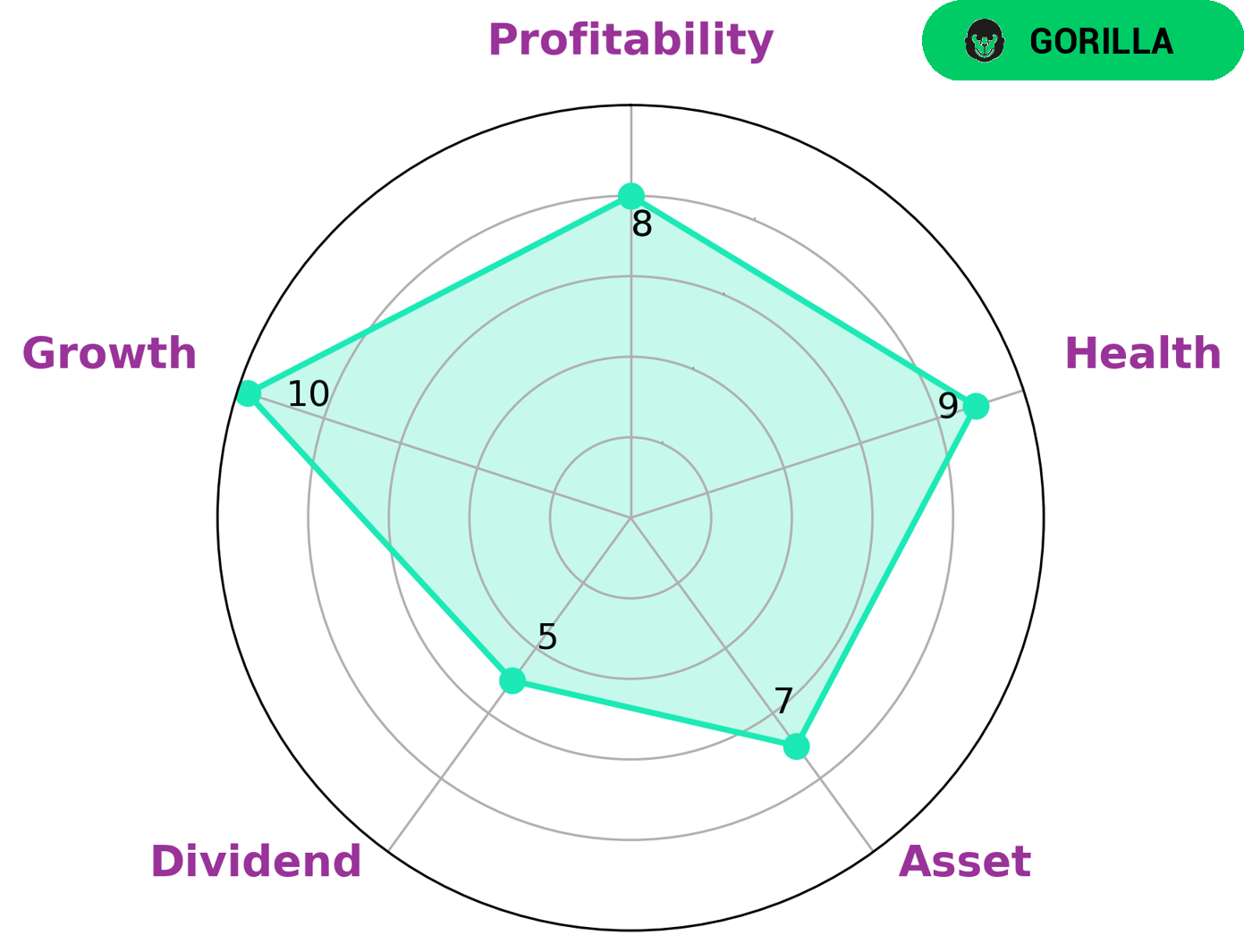

GoodWhale has conducted an analysis of ADVANCED ENERGY INDUSTRIES’s fundamentals, and classified it as ‘gorilla’, a type of company with strong competitive advantage that has achieved stable and high revenue or earning growth. We believe that this would be of interest to a variety of investors. ADVANCED ENERGY INDUSTRIES has shown high overall financial health, with a score of 9/10 when considering its cashflows and debt. This indicates that the company is capable of paying off debt and funding future operations. Additionally, the company is strong in asset, growth, and profitability, and medium in dividend. All of these factors make ADVANCED ENERGY INDUSTRIES an attractive option for investors. More…

Peers

The competition between Advanced Energy Industries Inc and its competitors is fierce. All of the companies are vying for market share in the highly competitive solar industry. Advanced Energy Industries Inc has a strong product portfolio and a strong presence in the market.

However, its competitors are also strong and have their own strengths.

– Hiwin Mikrosystem Corp ($TWSE:4576)

Hiwin Mikrosystem Corp is a technology company that specializes in the manufacture of micro-precision products and components. The company has a market cap of 7.85 billion as of 2022 and a return on equity of 8.73%. Hiwin Mikrosystem Corp is a publicly traded company listed on the Taiwan Stock Exchange. The company’s products are used in a variety of industries including automotive, aerospace, electronics, and medical.

– Kinergy Corp Ltd ($SEHK:03302)

Kinergy Corp. Ltd., through its subsidiaries, engages in the exploration and production of oil and gas in the United States. The company was founded in 2004 and is headquartered in Perth, Australia.

– Sinfonia Technology Co Ltd ($TSE:6507)

Sinfonia Technology Co., Ltd. is a Japanese company that manufactures and sells electronic and electrical products. It has a market capitalization of 38.5 billion as of 2022 and a return on equity of 11.24%. The company’s products include semiconductors, printed circuit boards, and electronic components. It also provides contract manufacturing services.

Summary

Legato Capital Management LLC recently announced the acquisition of a new stake in Advanced Energy Industries, Inc., worth an undisclosed amount. This investment indicates a bullish outlook for the company, which provides high quality power conversion and control technologies for the global energy industry. The potential for growth in this sector is strong, as the demand for reliable and efficient energy sources continues to increase.

The core customers of Advanced Energy Industries include electrical equipment manufacturers, solar and wind companies, oil and gas companies, and other energy-focused industries. With this investment, Legato Capital Management is showing confidence in Advanced Energy Industries’ ability to capitalize on the growing demand for energy and energy efficiency technologies.

Recent Posts