Grand Canyon Education Faces Deceptive Advertising Suit from FTC

December 29, 2023

☀️Trending News

The Federal Trade Commission (FTC) has filed a lawsuit against Grand Canyon Education ($NASDAQ:LOPE), Inc. for allegedly engaging in deceptive advertising. It is based in Phoenix, Arizona, and is a provider of online undergraduate and graduate degree programs. According to the FTC, Grand Canyon Education used deceptive advertising to induce prospective students to sign up for its online courses. The FTC claims that Grand Canyon Education employed misleading and deceptive tactics such as suggesting that its online programs would be free or low cost to students, but then failing to disclose the full costs of tuition and fees. The FTC also alleges that the company falsely represented that credits earned through its courses could be transferred to other institutions, when in fact, they could not.

Additionally, the FTC claims that Grand Canyon Education misled consumers by representing that some of its online courses had been reviewed and approved by an independent accreditation agency, when in fact they had not. The FTC has filed a complaint against Grand Canyon Education, Inc. and is seeking injunctive relief and civil penalties for the deceptive practices alleged in the complaint. If the FTC is successful in its case, Grand Canyon Education could face significant penalties and be required to change its practices going forward.

Share Price

On Wednesday, the stock of Grand Canyon Education (GCE) faced a downturn when it opened at $142.5 and closed at $141.6, a decrease of 0.7% from its prior closing price of 142.6. This downturn was a result of a deceptive advertising suit filed against GCE by the Federal Trade Commission (FTC). The FTC alleges that GCE unlawfully used high-pressure sales tactics, false advertising, and deceptive loans to market their educational programs to prospective students. As part of the lawsuit, the FTC has requested that GCE halt its alleged deceptive practices and pay damages to those affected by its deceptive marketing. If found guilty, GCE could face severe financial penalties, which could have a significant impact on its stock price. The FTC’s action highlights the need for increased oversight and regulation of for-profit education companies, particularly those that use deceptive or unethical practices to target vulnerable populations. GCE has yet to respond to the allegations and it is unclear how the case will play out.

However, it is clear that the FTC is taking a hard stance against companies that engage in deceptive advertising and marketing practices. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for LOPE. More…

| Total Revenues | Net Income | Net Margin |

| 941.32 | 195.3 | 20.7% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for LOPE. More…

| Operations | Investing | Financing |

| 237.63 | -72.35 | -148.29 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for LOPE. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 863.16 | 212.63 | 21.68 |

Key Ratios Snapshot

Some of the financial key ratios for LOPE are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 4.7% | -2.6% | 26.7% |

| FCF Margin | ROE | ROA |

| 20.6% | 24.2% | 18.2% |

Analysis

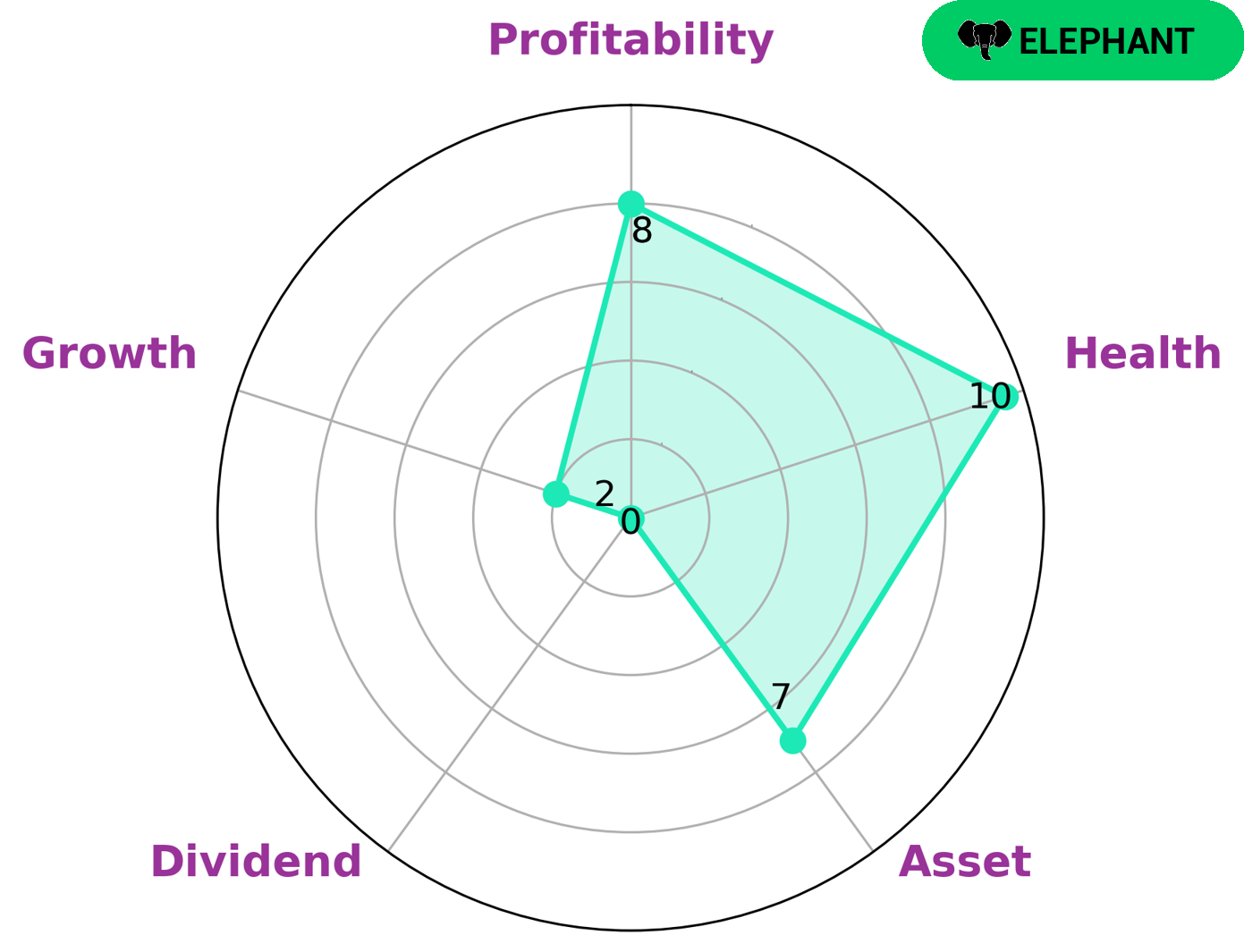

At GoodWhale, we conducted an analysis of GRAND CANYON EDUCATION’s wellbeing and our Star Chart shows that the company is strong in asset, profitability, and weak in dividend and growth. GRAND CANYON EDUCATION has a high health score of 10/10 with regard to its cashflows and debt, which indicates that it is capable to sustain future operations in times of crisis. Moreover, GRAND CANYON EDUCATION is classified as an ‘elephant’, a type of company we conclude that is rich in assets after deducting off liabilities. As such, this type of company may be interesting to investors looking to increase their assets and stocks, or those looking to diversify their portfolio. More…

Peers

The company offers a variety of educational programs and services to its students.Grand Canyon Education Inc’s competitors include Koolearn Technology Holding Ltd, CognaEducacao SA, Adtalem Global Education Inc.

– Koolearn Technology Holding Ltd ($SEHK:01797)

Koolearn Technology Holding Ltd is a technology company that provides online education services. The company has a market cap of 42.23B as of 2022 and a Return on Equity of -3.35%. Koolearn Technology Holding Ltd offers a variety of online courses and programs that cater to different age groups and levels of educational attainment. The company’s services are available in multiple languages, making it a convenient and affordable option for students from all over the world.

– CognaEducacao SA ($OTCPK:COGNY)

Cogna Educacao SA is a leading provider of educational services in Brazil. The company offers a wide range of educational services, including primary and secondary schools, higher education institutions, and language schools. Cogna Educacao SA has a market cap of 1.17B as of 2022, a Return on Equity of 2.54%. The company has a strong presence in Brazil, with over 1,000 schools and over 2 million students enrolled.

– Adtalem Global Education Inc ($NYSE:ATGE)

Adtalem Global Education Inc. is a leading global provider of educational services. The company offers a variety of educational programs and services to students worldwide through its institutions, including medical and healthcare schools, business schools, and other higher education institutions. Adtalem Global Education is committed to providing quality education and training services that meet the needs of students and employers. The company’s mission is to empower students to achieve their potential and to prepare them for success in a global economy.

Summary

Grand Canyon Education (GCE) is a publicly traded education company that offers online college programs. Recently, the Federal Trade Commission (FTC) has filed a lawsuit against GCE for deceptive advertising. In terms of investing analysis, GCE has seen significant growth in revenue over the past few years and has an excellent balance sheet. Overall, GCE is a solid company with potential for long-term growth and should be watched for future investment opportunities.

Recent Posts