Exploring the Impact of STRIDE in Education Technology

January 5, 2024

🌥️Trending News

Exploring the Impact of STRIDE ($NYSE:LRN) in Education Technology is an important endeavor for those interested in the current state of educational technology. STRIDE is a company that has become an integral part of the educational technology landscape, offering innovative solutions for teachers and students alike. Their product offerings range from cloud-based learning platforms to virtual learning management systems. They have also been successful in creating an intuitive user interface that makes navigating their products more enjoyable and efficient.

In addition, STRIDE has a strong commitment to providing educators with quality continuing education and support services, which have further contributed to their success in the educational technology field. With their innovative solutions, user-friendly design, and commitment to educators, STRIDE has proven itself to be a valuable asset in the educational technology landscape. As educators and students continue to benefit from their products and services, it’s likely that STRIDE will continue to be a key player in the educational technology world for years to come.

Stock Price

On Wednesday, STRIDE made its first public debut on the stock market and opened at $60.7 per share. By the end of the day, the stock closed at $60.4. The company has developed powerful tools for teachers and students that provide access to educational resources, individualized learning plans, and custom assessments. These tools have allowed educators to personalize education for their students, helping them reach their academic goals faster and more effectively. STRIDE has also implemented advanced security measures for its products, providing a safe and secure learning environment for students.

This allows teachers to focus on teaching, while STRIDE’s tools keep students engaged and on track. The company has also developed powerful analytics capabilities which allow teachers to monitor student progress in real-time, making it easier for them to identify areas of improvement. Overall, STRIDE has had a significant impact on the education technology industry, providing teachers and students with powerful tools and resources that improve learning outcomes. As the company continues to innovate in this field, its stock is sure to continue to grow in value. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Stride. More…

| Total Revenues | Net Income | Net Margin |

| 1.89k | 154.42 | 8.2% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Stride. More…

| Operations | Investing | Financing |

| 210.99 | -98.81 | -52.08 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Stride. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.77k | 809.15 | 22.11 |

Key Ratios Snapshot

Some of the financial key ratios for Stride are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 17.9% | 45.7% | 11.3% |

| FCF Margin | ROE | ROA |

| 7.7% | 14.0% | 7.5% |

Analysis

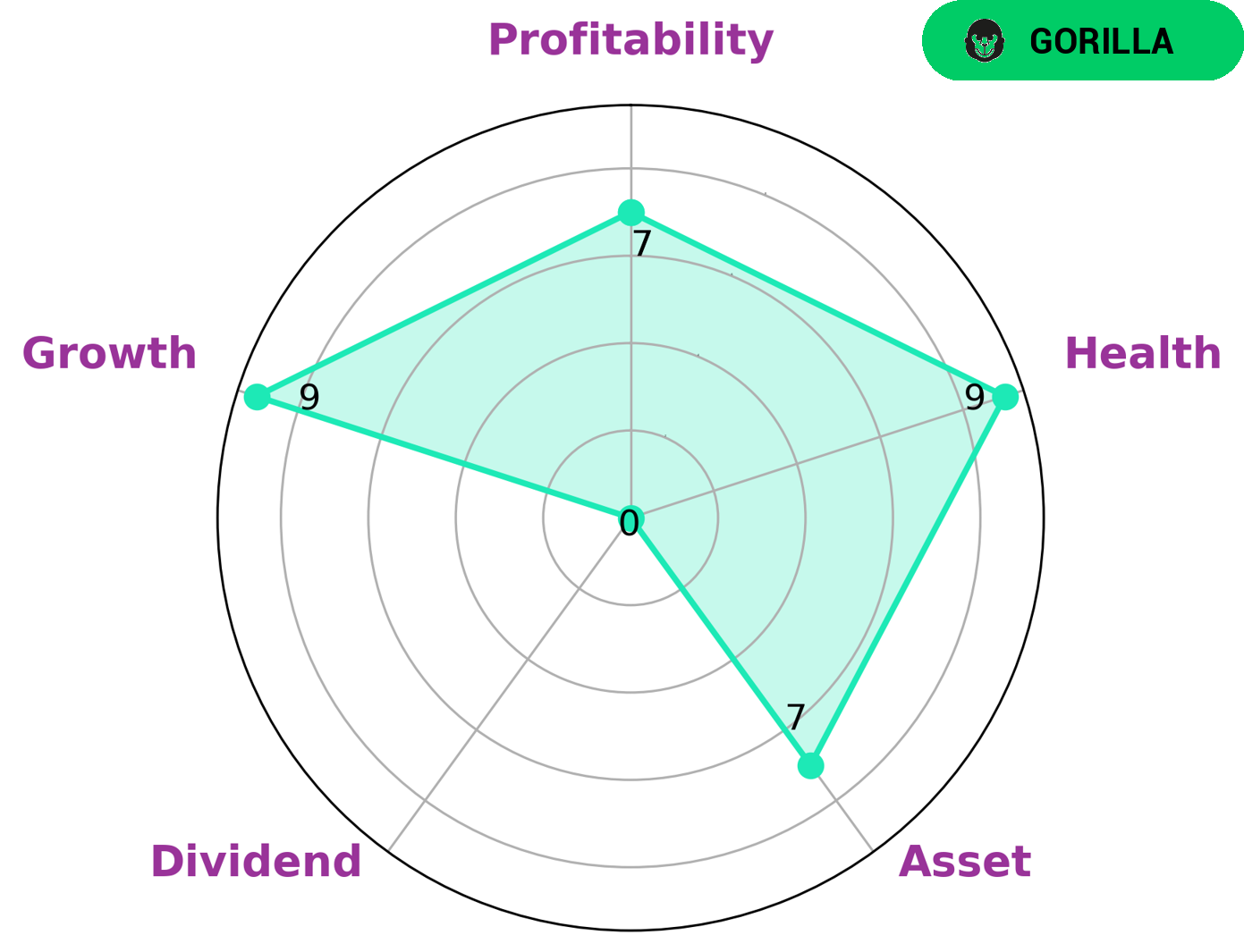

At GoodWhale, we conducted an analysis of STRIDE‘s fundamentals and used our star chart to evaluate them. We concluded that STRIDE is strong in growth and profitability, medium in asset, and weak in dividend. Drawing on these results, we classified STRIDE as a ‘gorilla’ — a company that has achieved stable and high revenue or earning growth due to its strong competitive advantage. STRIDE is likely to attract a variety of investors because of several positive factors. For starters, its health score of 9/10 with regard to cashflows and debt indicates that it’s capable of safely riding out any crisis without the risk of bankruptcy. Additionally, its strong growth and profitability scores indicate that it’s an attractive long-term investment for those looking for market stability. More…

Peers

The company operates online and offline universities and colleges. As of March 31, 2019, the company operated 85 campuses in 29 states of the United States and Puerto Rico and enrolled approximately 75,200 students. The company’s primary competitors are Cogna Educacao SA, Perdoceo Education Corp, and Grand Canyon Education Inc.

– CognaEducacao SA ($OTCPK:COGNY)

Cogna Educacao SA is a leading provider of educational services in Brazil. The company offers a wide range of educational services, including primary and secondary education, higher education, and vocational training. Cogna Educacao SA has a market cap of 1.05B as of 2022 and a return on equity of 2.54%. The company’s primary and secondary education segment provides educational services to students aged 3 to 17 years. The higher education segment offers educational services to students aged 18 years and above. The vocational training segment provides vocational training to students aged 18 years and above.

– Perdoceo Education Corp ($NASDAQ:PRDO)

Perdoceo Education Corp has a market cap of 771.07M as of 2022, a Return on Equity of 16.14%. The company provides higher education services and products to colleges and universities. It offers online and on-campus undergraduate and graduate programs, as well as professional development courses. The company was founded in 1892 and is headquartered in Boston, Massachusetts.

– Grand Canyon Education Inc ($NASDAQ:LOPE)

As of 2022, Canyon Education Inc has a market cap of 2.8B and a ROE of 33.2%. The company provides educational services to students through its online platform. Canyon Education Inc has a strong market position and is well-positioned to continue its growth in the online education space.

Summary

Investing in the EdTech landscape through STRIDE is increasingly becoming a focus for investors. STRIDE, or Student Technology Research, Investment and Development Engagement, is a method of analyzing the potential of EdTech investments through a focus on revenue growth, market size, customer relationships, product innovation, financial performance, and competitive edge. It involves breaking down a company’s financial performance and other data into meaningful information, allowing investors to better assess their investment decisions. STRIDE can help investors identify and capitalize on opportunities in the EdTech space, while also mitigating the risk of investing in EdTech businesses.

Recent Posts