Comparing American Public Education and NaaS Technology: A Look at the Differences

January 10, 2023

Trending News 🌥️

American Public Education ($NASDAQ:APEI), Inc. (APEI) is a leading provider of online post-secondary education and services. The company offers a wide range of academic programs and services to meeting the needs of the rapidly growing, diverse student population. American public education focuses on providing quality education to students through traditional academic programs such as degree and certificate programs. NaaS technology focuses on providing software as a service to customers, with an emphasis on automation, scalability, and cost-effectiveness. American public education has several established pathways for students to follow in order to complete their academic goals. These include traditional campus-based instruction, online courses, and hybrid programs. NaaS technology is more focused on delivering automated services to customers. This can include anything from automated customer service requests to automated software updates.

Generally speaking, public institutions are more affordable than private institutions. NaaS technology is typically more cost-effective than traditional software solutions due to its automated nature. The curriculum and instruction are tailored to the individual needs of the student. NaaS technology is more focused on automation and scalability. This means that customers can scale their services up or down as needed, eliminating the need for manual intervention. Depending on the individual needs of the student or customer, one or the other may be the better option.

Price History

While news coverage of both has been mostly positive, there are some distinct differences between them. American public education is an area that has been around for centuries, involving the delivery of educational services to the public. It is funded by public money and is managed and regulated by local, state, and federal governments. It is widely seen as an important part of the social fabric, providing opportunities for all members of society to access quality education. On the other hand, NaaS technology is a relatively new field of technology, providing services such as cloud computing and software-as-a-service. It enables businesses to reduce their costs and increase their efficiency by leveraging cloud-based solutions.

In addition, it can provide a more efficient way for businesses to access data and applications. On Monday, American Public Education stock opened at $13.5 and closed at $13.2, down by 1.5% from prior closing price of 13.4. While both have potential for success in their respective fields, it is important to understand the differences between them before making any investments. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for APEI. More…

| Total Revenues | Net Income | Net Margin |

| 607.89 | -99.08 | 1.6% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for APEI. More…

| Operations | Investing | Financing |

| 67.93 | -13.53 | -10.39 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for APEI. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 660.83 | 345.48 | 16.69 |

Key Ratios Snapshot

Some of the financial key ratios for APEI are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 28.2% | 4.0% | -19.0% |

| FCF Margin | ROE | ROA |

| 8.4% | -22.9% | -10.9% |

VI Analysis

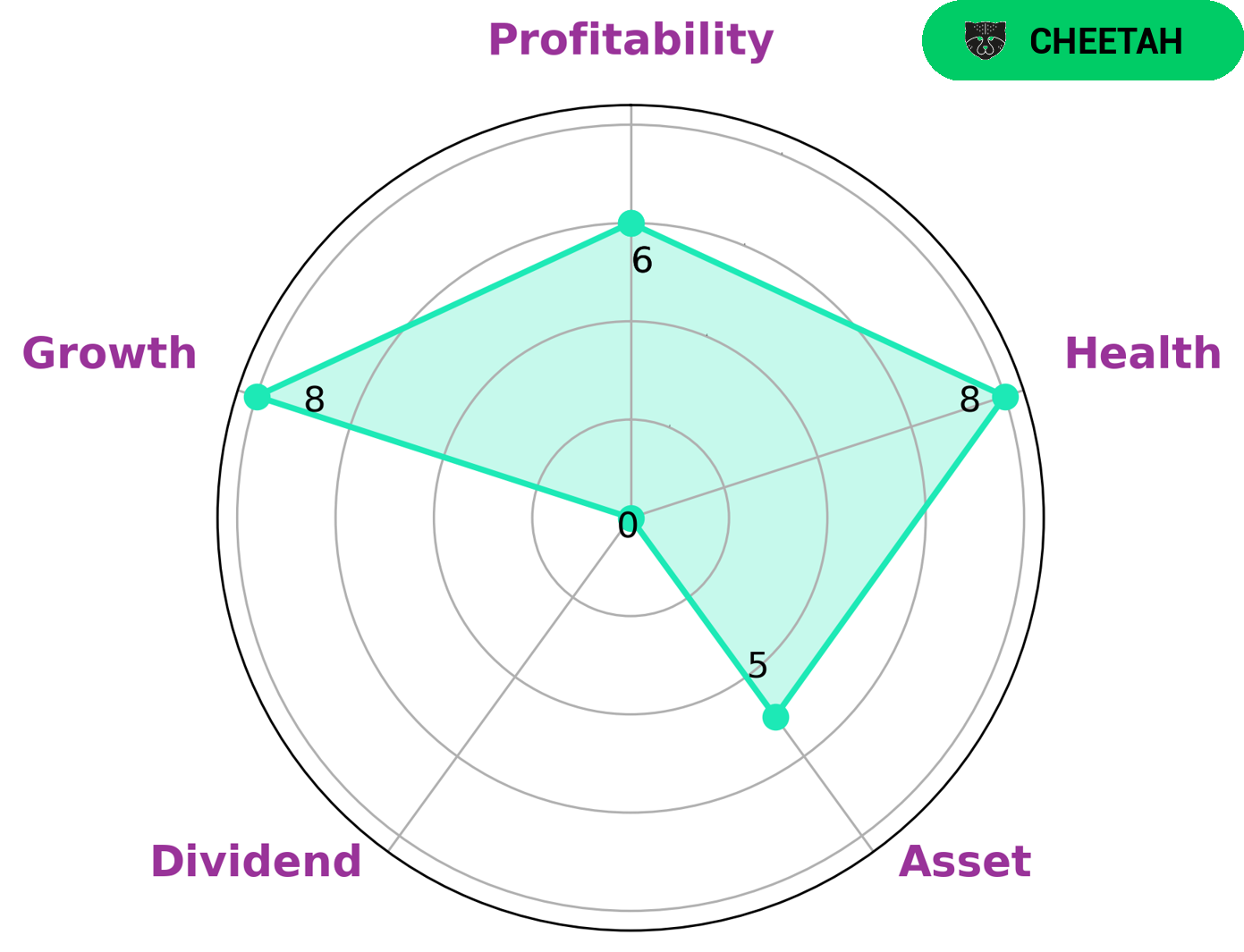

According to the VI Star Chart, the company is strong in growth, medium in asset and profitability, and weak in dividend. With a health score of 8 out of 10 for its cashflows and debt, it is considered capable of safely riding out any crisis without the risk of bankruptcy. American Public Education is classified as a ‘cheetah’, which is a type of company that has achieved high revenue or earnings growth but is considered less stable due to lower profitability. This kind of business is usually attractive to investors who are looking for short-term gains such as traders and speculators who are comfortable with taking on higher risks in return for potentially higher returns. Investors interested in this type of company should be aware of the risks involved and should always do their due diligence before investing. Investors should also be aware that companies like American Public Education may be more volatile than those with higher profitability and more stable fundamentals. As such, investors should be prepared to take on the risk associated with investing in this company in order to potentially reap the rewards. More…

VI Peers

As the for-profit education industry continues to grow in the United States, so does the competition among the companies that provide these services. American Public Education, Inc. (APEI) is one of the largest for-profit education providers in the country and competes with other companies such as Grand Canyon Education, Inc. (GCEI), Koolearn Technology Holding Ltd., and BExcellent Group Holdings Ltd.

– Grand Canyon Education Inc ($NASDAQ:LOPE)

As of 2022, GC Education Inc has a market cap of 2.74B and a ROE of 33.2%. The company provides higher education services, including online programs and on-campus programs in the United States. GC Education Inc is a publicly traded company on the Nasdaq stock exchange.

– Koolearn Technology Holding Ltd ($SEHK:01797)

Koolearn Technology Holding Ltd is a provider of online education services in China. The company offers a range of online courses covering various academic subjects, including mathematics, physics, chemistry, biology, and English. Koolearn Technology Holding Ltd also provides online test preparation services for students preparing for various exams, such as the Chinese College Entrance Examination, or “gaokao.” The company was founded in 2006 and is headquartered in Beijing, China.

– BExcellent Group Holdings Ltd ($SEHK:01775)

BExcellent Group Holdings Ltd is a Hong Kong-based company principally engaged in the provision of educational services. The Company operates its business through four segments. The Language Training segment offers language courses to individuals and corporate clients. The Test Preparation segment offers courses to prepare students for academic tests, such as the Graduate Record Examinations, the Test of English as a Foreign Language and the Scholastic Aptitude Test, among others. The International Education segment provides international education services. The Others segment is engaged in the provision of professional training courses and the operation of kindergartens.

Summary

Investing in American public education is a popular option for many investors. It provides a steady and reliable income, as well as the potential for capital appreciation over the long term. Public education is funded at the federal, state and local levels, which can make it a more reliable investment than other options.

Additionally, it is a socially responsible choice, as it helps to fund the education of future generations. When investing in public education, investors should research the policies and regulations of the individual states, as well as the overall financial stability of the school district. It is also important to consider the expected return on investment, as well as risks such as declining test scores or budget cuts. Investing in public education can be a wise choice for long-term investors, but it is important to carefully research the opportunity before committing funds.

Recent Posts