ZTO EXPRESS Reports Fourth Quarter FY2022 Earnings Results as of December 31, 2022

March 28, 2023

Earnings Overview

For the fourth quarter of FY2022, ZTO EXPRESS ($NYSE:ZTO) reported total revenue of CNY 2.2 billion, a 22.7% improvement from the same period in the prior year.

Transcripts Simplified

Before we get started, I’d like to remind you that today’s call may contain forward-looking statements. These forward-looking statements involve inherent risks and uncertainties. A number of potential factors could cause actual results to differ materially from those discussed in these forward-looking statements. Also, please note that all numbers mentioned during this call are in renminbi, unless otherwise noted. Now, I would like to turn the call over to Mr. Chen, ZTO’s Chairman and CEO. Mr. Chen, please go ahead. Chairman and Chief Executive Officer Remarks Thank you, Moderator. We have taken proactive steps to ensure the safety of our employees and to maintain our operational efficiency. To adapt to the changing demand patterns and service requirements arising from the pandemic, we have made adjustments in our network coverage and rolled out innovative services such as contactless drop offs and B2B services.

We have also expanded our presence in pharmaceuticals and cold chain services with new product lines such as ZTO Medical Express, ZTO Cold Chain Express, and ZTO Fresh Express. We are committed to providing comprehensive and reliable logistics and supply chain solutions to our customers and partners in order to meet their needs in this dynamic business environment. Looking ahead, we remain focused on driving long-term growth while continuing to prioritize the safety of our employees, customers and partners as well as ensuring operational excellence. We believe we are well positioned to benefit from China’s ongoing development of its logistics infrastructure and the shift towards e-commerce that is taking place in China. We thank you for your continued support, and we remain optimistic about our future growth prospects. Thank you. And now, I’d like to turn the call over to the moderator for your questions.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Zto Express. More…

| Total Revenues | Net Income | Net Margin |

| 35.38k | 6.81k | 18.7% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Zto Express. More…

| Operations | Investing | Financing |

| 11.48k | -16.04k | 7.06k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Zto Express. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 78.52k | 24.05k | 66.76 |

Key Ratios Snapshot

Some of the financial key ratios for Zto Express are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 17.0% | 12.3% | 24.0% |

| FCF Margin | ROE | ROA |

| 32.4% | 10.0% | 6.7% |

Share Price

On Thursday, ZTO EXPRESS reported its fourth quarter FY2022 financial results as of December 31, 2022. The stock opened at $26.0 and closed at $28.0, a 7.9% increase from the prior closing price of 25.9. This marks a positive end to the year for the company, which reported strong growth in overall revenues, operating income, and earnings per share. The year-end results demonstrate the success of ZTO’s core business strategy and overall financial stability through the pandemic.

By delivering strong operational performance and continuing to focus on customer satisfaction, the company has been able to maintain healthy financials despite the difficult economic environment. Going forward, ZTO EXPRESS is looking to capitalize on growth opportunities within the express delivery market and build upon its existing customer base. The company is optimistic that its fourth quarter results mark the start of a new era of growth and profitability. Live Quote…

Analysis

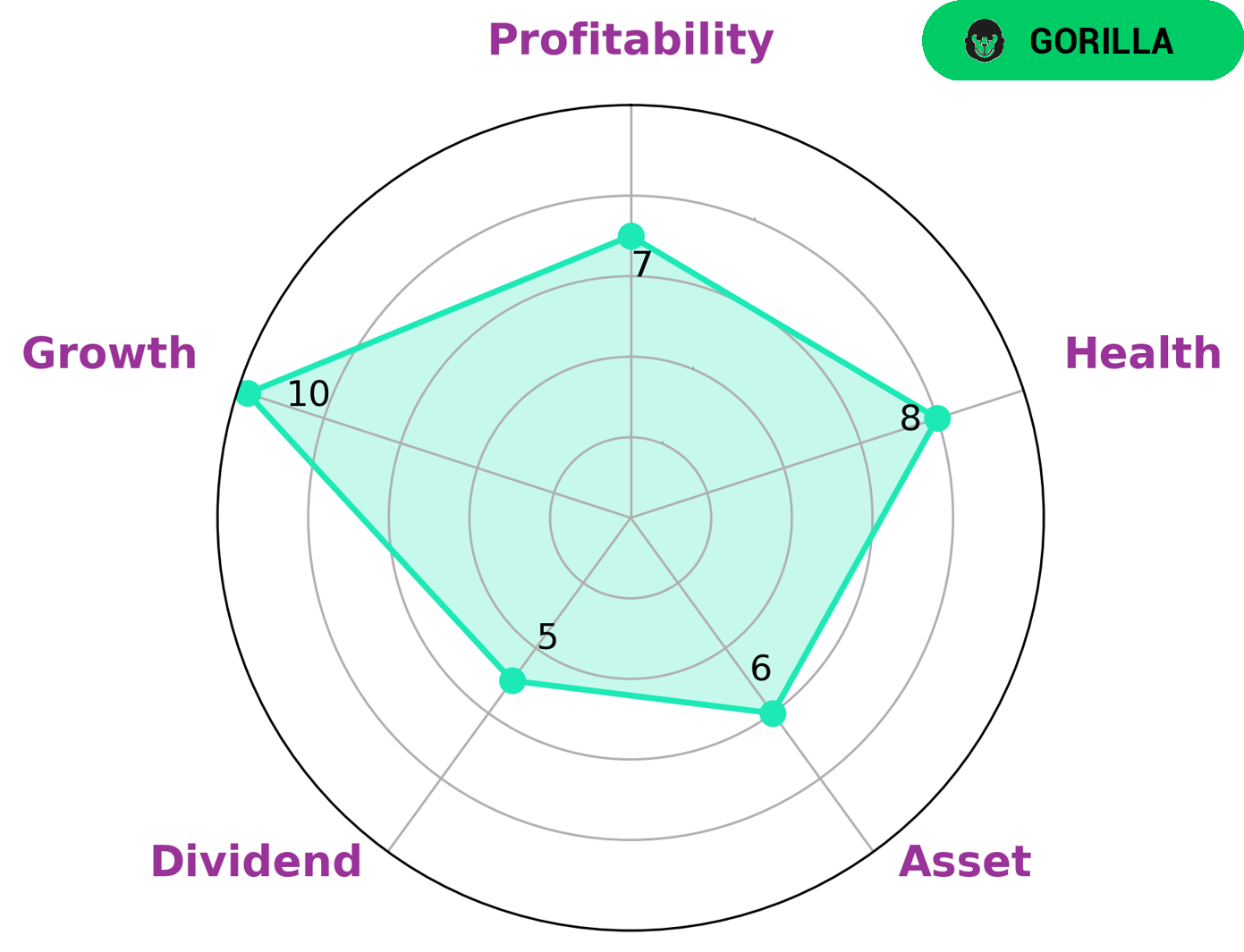

At GoodWhale, we conducted a wellbeing analysis of ZTO EXPRESS. Our Star Chart assessment gave them a high health score of 8/10 in terms of cashflows and debt, indicating that they have the capacity to safely ride out any crisis without the risk of bankruptcy. We classified ZTO EXPRESS as a ‘gorilla’, a type of company that has achieved stable and high revenue or earning growth due to its strong competitive advantage. Given this strong growth, profitability, and medium asset and dividend, we believe that investors with a long-term strategy and an interest in stable growth would be interested in ZTO EXPRESS. This type of investor should look to buy the stock and hold on to it over the long run. Furthermore, given the company’s strong competitive advantage, they should also be able to increase their dividends in the future. More…

Summary

Investors may be encouraged by ZTO Express‘ fourth quarter earnings results for FY2022. Total revenue for the quarter was up 22.7% year-over-year, and net income increased by 7.0%, indicating positive financial performance for the company. As a result of the earnings release, the stock price rose on the day of the announcement. With strong growth in both top line and bottom line figures, as well as a positive reaction from the market, investors may be optimistic about the outlook of ZTO Express as an investment opportunity.

Recent Posts