ZIMMER BIOMET Reports Record Fourth Quarter Earnings for Fiscal Year 2022

March 27, 2023

Earnings Overview

ZIMMER BIOMET ($NYSE:ZBH) announced their financial results for Q4 of FY2022 on December 31 2022 for the period ending February 3 2023. Total revenue for this period was USD -130.5 million, a 55.4% decrease compared to the same period the year prior. Net income, however, increased by 2.7% year over year, standing at USD 1825.1 million.

Transcripts Simplified

Zimmer Biomet expects foreign currency exchange to be a headwind of 150 basis points, which would flow through to earnings at a rate of 20-30%.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Zimmer Biomet. More…

| Total Revenues | Net Income | Net Margin |

| 6.94k | 231.4 | 9.3% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Zimmer Biomet. More…

| Operations | Investing | Financing |

| 1.28k | -529.2 | -843.8 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Zimmer Biomet. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 21.07k | 9.04k | 57.51 |

Key Ratios Snapshot

Some of the financial key ratios for Zimmer Biomet are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -4.6% | -2.1% | 8.2% |

| FCF Margin | ROE | ROA |

| 15.8% | 2.9% | 1.7% |

Market Price

On Friday, ZIMMER BIOMET reported record fourth quarter earnings for fiscal year 2022. In response to the strong earnings report, investors showed confidence in the company, pushing up the stock price 1.6% from the prior closing price of 127.4 to 129.4. Going forward, the company is expected to continue to benefit from its innovative solutions and strategies developed over the past year. Live Quote…

Analysis

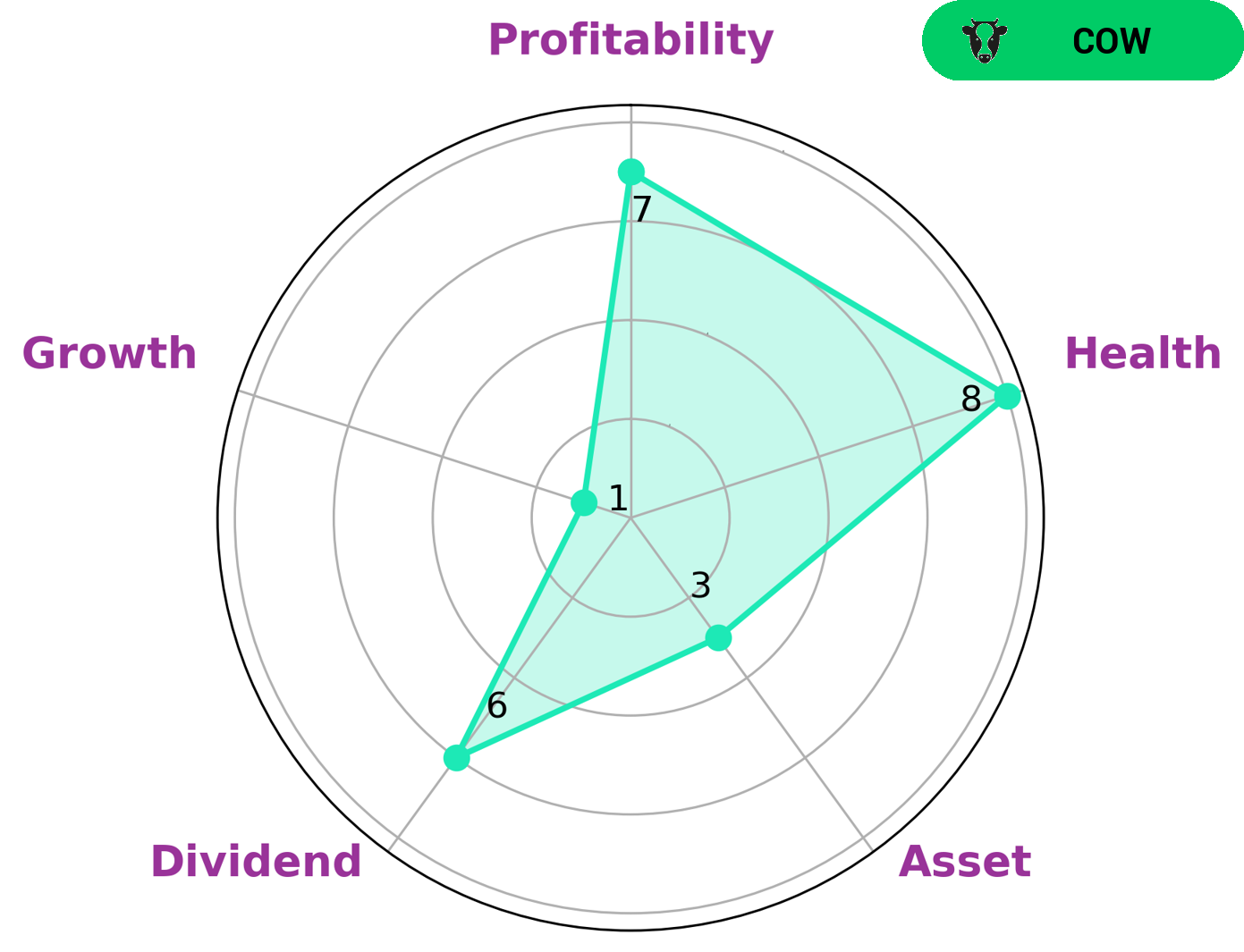

At GoodWhale, we conducted an analysis of ZIMMER BIOMET‘s wellbeing. According to our Star Chart, ZIMMER BIOMET is classified as ‘cow’, a type of company that has the track record of paying out consistent and sustainable dividends. As such, this makes ZIMMER BIOMET an attractive investment opportunity for investors who are looking to diversify their portfolio with a reliable company. Furthermore, ZIMMER BIOMET is strong in profitability, medium in dividend and weak in asset, growth. This makes it an ideal longer-term investment for investors who are looking for steady returns. Additionally, ZIMMER BIOMET has a high health score of 8/10 with regard to its cashflows and debt, making it capable to safely ride out any crisis without the risk of bankruptcy. More…

Peers

The company operates in two segments, Reconstructive and Dental. It offers knee, hip, shoulder, elbow, hand and wrist, foot and ankle, and biologics products. The company also provides dental prosthetics, including dental implants and CAD/CAM systems; and digital equipment for dentists and laboratories. Zimmer Biomet has a market cap of $24.4 billion and is headquartered in Warsaw, Indiana.

– Alcon Inc ($LTS:0A0D)

Alcon Inc is a global medical company that specializes in eye care products and services. The company’s market cap as of 2022 is 30.09B, and its return on equity is 1.87%. Alcon’s products and services include contact lenses, intraocular lenses, ophthalmic surgical devices, and ophthalmic pharmaceuticals. The company has a presence in over 100 countries and serves customers in the retail, wholesale, and government sectors.

– Sonova Holding AG ($LTS:0QPY)

Sonova Holding AG is a Swiss manufacturer of hearing aids. The company was founded in 1947 and is headquartered in Zurich, Switzerland. As of 2020, Sonova Holding AG had a market cap of 15.37 billion Swiss francs and a return on equity of 18.9%. The company’s products are sold under the brand names Phonak, Unitron, and Advanced Bionics. Sonova Holding AG’s products are available in more than 100 countries.

– Tandem Diabetes Care Inc ($NASDAQ:TNDM)

Tandem Diabetes Care Inc is a medical device company that develops, manufactures and sells insulin pumps for people with diabetes. The company has a market cap of $2.56 billion and a return on equity of -8.79%. Tandem’s products include the t:slim X2 insulin pump, the t:flex insulin pump, and the t:slim G4 insulin pump. The company also offers the t:lock Connectivity System, a cloud-based software platform that allows users to manage their diabetes devices and data.

Summary

Investing in Zimmer Biomet on December 31st 2022 may be a prudent decision. Their fourth quarter of FY2022 saw total revenue decrease by 55.4% year over year, however their net income increased 2.7%. Despite the overall drop in revenue, the company’s net income growth is positive and suggests a potential for a rebound in the coming quarters.

The growth in net income indicates that their cost cutting measures and strategic investments are beginning to pay off. Investors should consider Zimmer Biomet in their portfolios as they look to capitalize on potential gains in the upcoming quarters.

Recent Posts