Zillow Group Intrinsic Value Calculation – ZILLOW GROUP Reports Record Second Quarter Earnings for FY2023

August 4, 2023

🌥️Earnings Overview

ZILLOW GROUP ($NASDAQ:ZG) announced on June 30th 2023, its earnings results for the second quarter of the fiscal year 2023 which had ended on August 2nd. The total revenue for this quarter was USD 506 million, representing a 49.9% decline compared to the same period from the previous year. Reported net income was at USD -35 million, compared to a profit of 8 million in the same period of the prior year.

Stock Price

The company’s stock opened at $53.2 and closed at $53.0, down 2.3% from its previous closing price of 54.3. Despite this strong financial performance, the company’s stock price still declined on Wednesday due to investor concerns about the potential economic impact of the coronavirus pandemic. Some investors are worried that a slowing economy could affect ZILLOW GROUP’s business.

However, ZILLOW GROUP executives remain optimistic about the future and have emphasized that they are well-positioned to weather any economic downturn. They believe that their extensive portfolio of online real estate services and tools will continue to be in high demand, regardless of the current market conditions. The company remains confident in its long-term prospects and hopes to continue its upward trajectory despite the current economic climate. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Zillow Group. More…

| Total Revenues | Net Income | Net Margin |

| 1.89k | -182 | -8.9% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Zillow Group. More…

| Operations | Investing | Financing |

| 442 | -515 | -542 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Zillow Group. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 6.62k | 2.13k | 19.28 |

Key Ratios Snapshot

Some of the financial key ratios for Zillow Group are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -19.2% | 41.2% | -7.2% |

| FCF Margin | ROE | ROA |

| 15.3% | -1.9% | -1.3% |

Analysis – Zillow Group Intrinsic Value Calculation

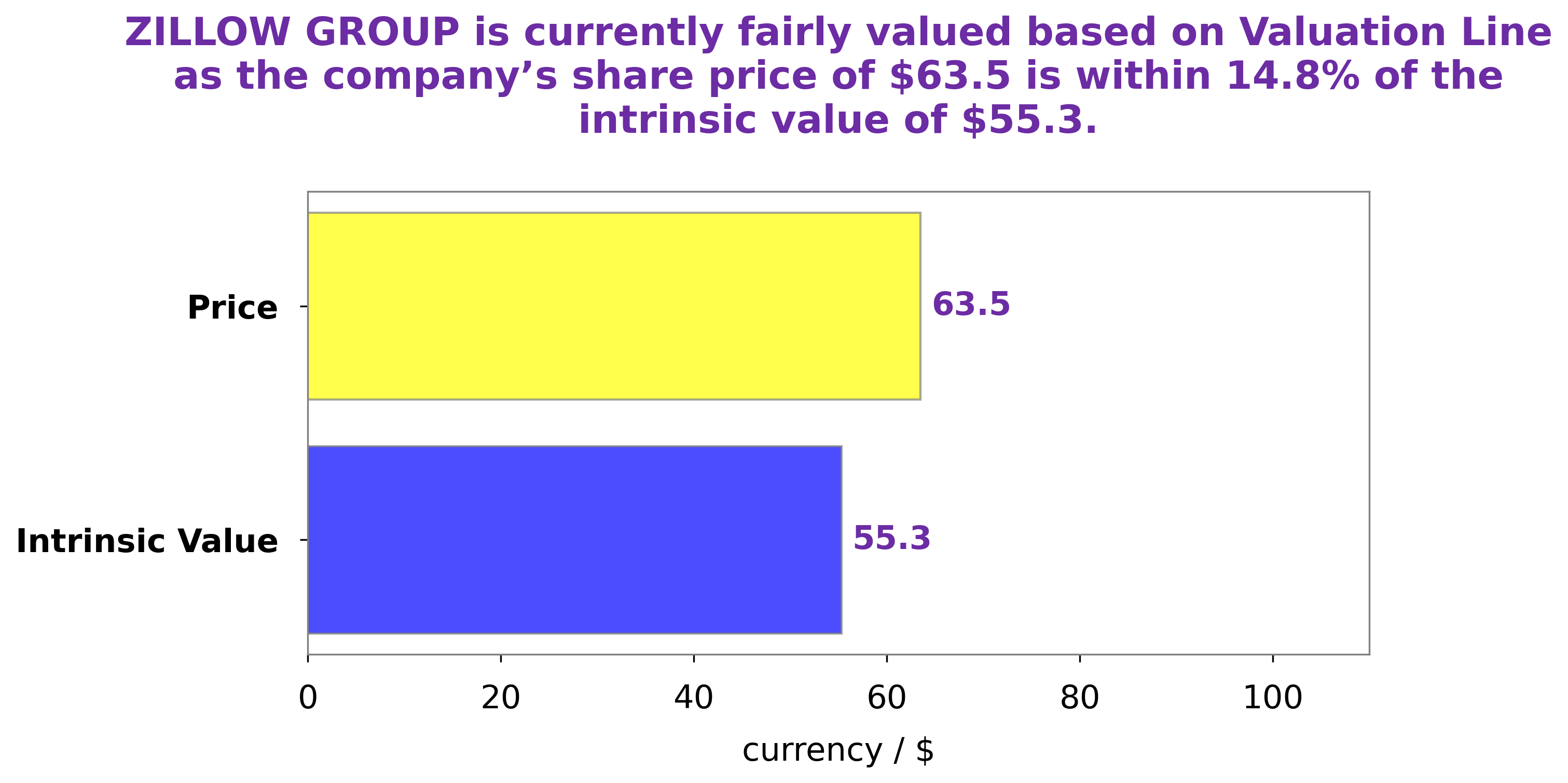

At GoodWhale, we conducted an analysis of ZILLOW GROUP‘s financials and found that the intrinsic value of ZILLOW GROUP share is around $66.9, as calculated by our proprietary Valuation Line. This means that the current stock price of $53.0 is undervalued by 20.8%. We believe that this presents a good opportunity for investors to purchase shares at a discounted rate. However, as always, we recommend that investors do their own due diligence before making any investment decisions. More…

Peers

Founded in 2006, Zillow Group Inc operates the largest real estate and home-related marketplaces in the United States. The company’s mission is to empower consumers with information and tools to make better decisions about homes, real estate, and mortgages. Zillow Group Inc is a publicly traded company listed on the NASDAQ stock exchange under the ticker symbol Z. BCW Group Holding Inc, Baltic Classifieds Group PLC, and Hemnet Group AB are all leading competitors of Zillow Group Inc in the online real estate database market.

– BCW Group Holding Inc ($LSE:BCG)

Baltic Classifieds Group PLC is a classified ads company that operates in the Baltics, Russia, and other countries in Eastern Europe. It has a market cap of 698.23M as of 2022 and a return on equity of 1.31%. The company was founded in 2006 and is headquartered in Riga, Latvia.

– Baltic Classifieds Group PLC ($OTCPK:HMNTY)

Hemnet Group AB is a Swedish real estate company. The company operates in the online real estate market in Sweden. It offers a platform for buying and selling homes and apartments. The company also offers a range of other services, such as home financing, home insurance, and home moving services. Hemnet Group AB was founded in 2002 and is headquartered in Stockholm, Sweden.

Summary

ZILLOW GROUP has seen a sharp decline in revenue for the second quarter of FY2023, with total revenue standing at USD 506.0 million, a 49.9% drop year over year. Net income also decreased to a loss of USD -35.0 million, compared to a profit of 8.0 million in the same period last year. Investors may want to take into consideration the company’s current financial performance when making decisions about investing in ZILLOW GROUP shares. It is also important to keep an eye on the company’s future performance to see if they can turn their current financial prospects around.

Recent Posts