Zacks Research Downgrades Integer Holdings’ Q2 2023 Earnings Estimate

May 20, 2023

Trending News 🌥️

Integer Holdings ($NYSE:ITGR) Co, a global medical device outsource manufacturer, has recently been downgraded by Zacks Research for its Q2 2023 earnings per share. Integer Holdings Co is a publicly traded company that specializes in the design, development, and manufacture of products for the global medical industry. The company serves a range of customers across the healthcare industry including medical device OEMs, contract manufacturers, pharmaceutical companies, and medical device distributors. The recent downgrade by Zacks Research has lowered its Q2 2023 earnings per share prediction for Integer Holdings Co. This is due to a decrease in demand forecasted for the products and services provided by Integer Holdings Co as a result of the current global economic and health crisis.

Although the company’s financials have held up reasonably well under current market conditions, Zacks Research has expressed concern about the outlook for the coming quarters. The company has responded to the downgrade by focusing on cost-cutting initiatives and exploring new sources of revenue. Integer Holdings Co remains committed to providing quality products and services and delivering value to its customers despite the challenging market conditions.

Earnings

According to Zacks Research, INTEGER HOLDINGS‘ Q2 2023 earnings estimate has been downgraded. In their most recent earning report for the first quarter of FY2023, ending March 31 2023, INTEGER HOLDINGS earned a total revenue of 378.78M USD and a net income of 13.06M USD. This is a 21.8% increase in total revenue and 14.9% increase in net income compared to the same period last year. Additionally, INTEGER HOLDINGS has seen a significant growth in total revenue, increasing from 290.47M USD to 378.78M USD over the last three years.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Integer Holdings. More…

| Total Revenues | Net Income | Net Margin |

| 1.44k | 68.08 | 5.4% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Integer Holdings. More…

| Operations | Investing | Financing |

| 104.41 | -214.72 | 126.62 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Integer Holdings. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 2.87k | 1.46k | 42.63 |

Key Ratios Snapshot

Some of the financial key ratios for Integer Holdings are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 4.3% | -4.9% | 8.9% |

| FCF Margin | ROE | ROA |

| 1.1% | 5.6% | 2.8% |

Price History

Despite this news, Integer Holdings‘ stock opened at $78.7 and closed at $79.2, up by 1.1% from last closing price of 78.4. This suggests that investors remain confident in the company’s future performance. However, it remains to be seen if Integer Holdings can meet their revised earnings expectations in the upcoming quarter. Live Quote…

Analysis

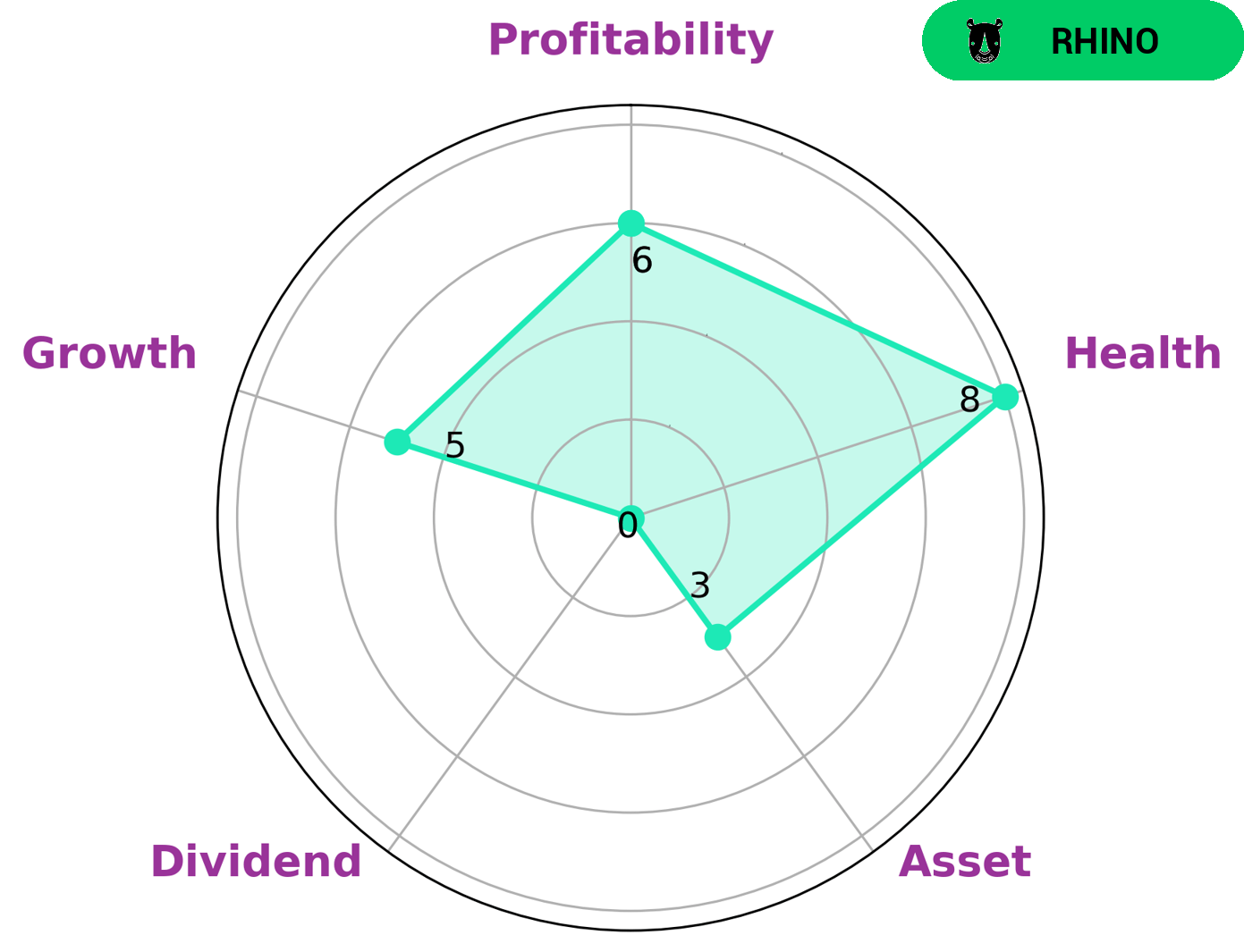

GoodWhale provides an in-depth analysis of INTEGER HOLDINGS‘s financials. Our star chart shows that INTEGER HOLDINGS has a high health score of 8/10, which indicates that it is capable of sustaining future operations in times of crisis. Specifically, INTEGER HOLDINGS is strong in cashflows and debt, medium in growth, profitability, and weak in asset and dividend. We classify such companies as ‘rhinos’, meaning they have achieved moderate revenue or earnings growth. Considering this profile, investors that are looking for a stable, mid-level growth company may be interested in investing in INTEGER HOLDINGS. With its strong cashflow and debt, it is well-positioned to weather any potential market downturns. Additionally, its moderate growth rate makes it an attractive option for investors who want to make steady returns over time. More…

Peers

The company designs, develops, manufactures, and markets medical devices and services worldwide. Integer’s competitors in the orthopedics industry include Polynovo Ltd, Globus Medical Inc, and Shenzhen Mindray Bio-Medical Electronics Co Ltd.

– Polynovo Ltd ($ASX:PNV)

Polynovo Ltd is a medical device company that designs, manufactures, and markets biodegradable scaffolds for use in tissue regeneration. The company has a market cap of 1.32B as of 2022 and a Return on Equity of -3.08%. Polynovo’s products are used in a variety of applications, including orthopedics, plastic surgery, and wound care. The company’s products are sold in over 30 countries worldwide.

– Globus Medical Inc ($NYSE:GMED)

Globus Medical Inc is a leading musculoskeletal solutions company. They design, develop, manufacture and market a comprehensive line of products for the orthopedic market. Their products are used in a wide variety of procedures, including spine, hip, and extremities. Globus Medical Inc has a market cap of 7.02B as of 2022, a Return on Equity of 7.24%. Globus Medical is committed to helping improve the quality of life for patients with musculoskeletal disorders. Their products are designed to provide solutions that enable patients to return to their active lifestyles.

– Shenzhen Mindray Bio-Medical Electronics Co Ltd ($SZSE:300760)

Shenzhen Mindray Bio-Medical Electronics Co Ltd is a medical device company that manufactures a range of medical devices and equipment. The company has a market capitalization of $366.53 billion as of 2022 and a return on equity of 23.24%. The company’s products are used in a variety of medical applications, including diagnostics, patient monitoring, and imaging.

Summary

Integer Holdings Co. is a publicly traded company on the stock market. Analysts at Zacks Research have recently downgraded their earning per share estimates for Q2 2023 due to various investment factors. Investors in Integer should take note of the reduced earnings expectations and consider potential risks associated with the company, such as sector performance and external economic factors. Fundamental analysis of the company’s financials is recommended to assess potential value and future performance.

Additionally, investors should pay attention to any news or developments surrounding Integer’s operations and consider any changes in its competitive landscape or corporate strategy. A long-term outlook should be taken and portfolio diversification should be considered when investing in Integer.

Recent Posts