Yalla Group Stock Fair Value Calculator – YALLA GROUP Reports Financial Results for Q2 FY2023, Ending June 30 2023

August 17, 2023

🌥️Earnings Overview

The YALLA GROUP ($NYSE:YALA) announced its financial performance for the quarter ending June 30 2023 on August 15 2023. With total revenue of USD 79.2 million, the company experienced a 4.2% rise compared to the same period in 2022. Net income for the quarter soared 43.1% year on year to USD 29.5 million.

Share Price

The stock opened at $5.1 and closed at $5.2, with a 0.6% increase from the prior closing price of 5.2. The financial report revealed impressive numbers for YALLA GROUP. Overall, it appears that YALLA GROUP is well-positioned to continue its financial growth in the coming quarters.

With its competitive pricing strategies and solid product offerings, the company appears to be well on its way to reaching its financial targets. Investors can look forward to seeing YALLA GROUP’s stock prices increase along with positive financial results in the near future. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Yalla Group. More…

| Total Revenues | Net Income | Net Margin |

| 307.94 | 91.32 | 29.5% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Yalla Group. More…

| Operations | Investing | Financing |

| 119.55 | -62.57 | 0.37 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Yalla Group. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 571.55 | 73.14 | 3.21 |

Key Ratios Snapshot

Some of the financial key ratios for Yalla Group are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 50.8% | 23.3% | 26.1% |

| FCF Margin | ROE | ROA |

| 33.5% | 10.4% | 8.8% |

Analysis – Yalla Group Stock Fair Value Calculator

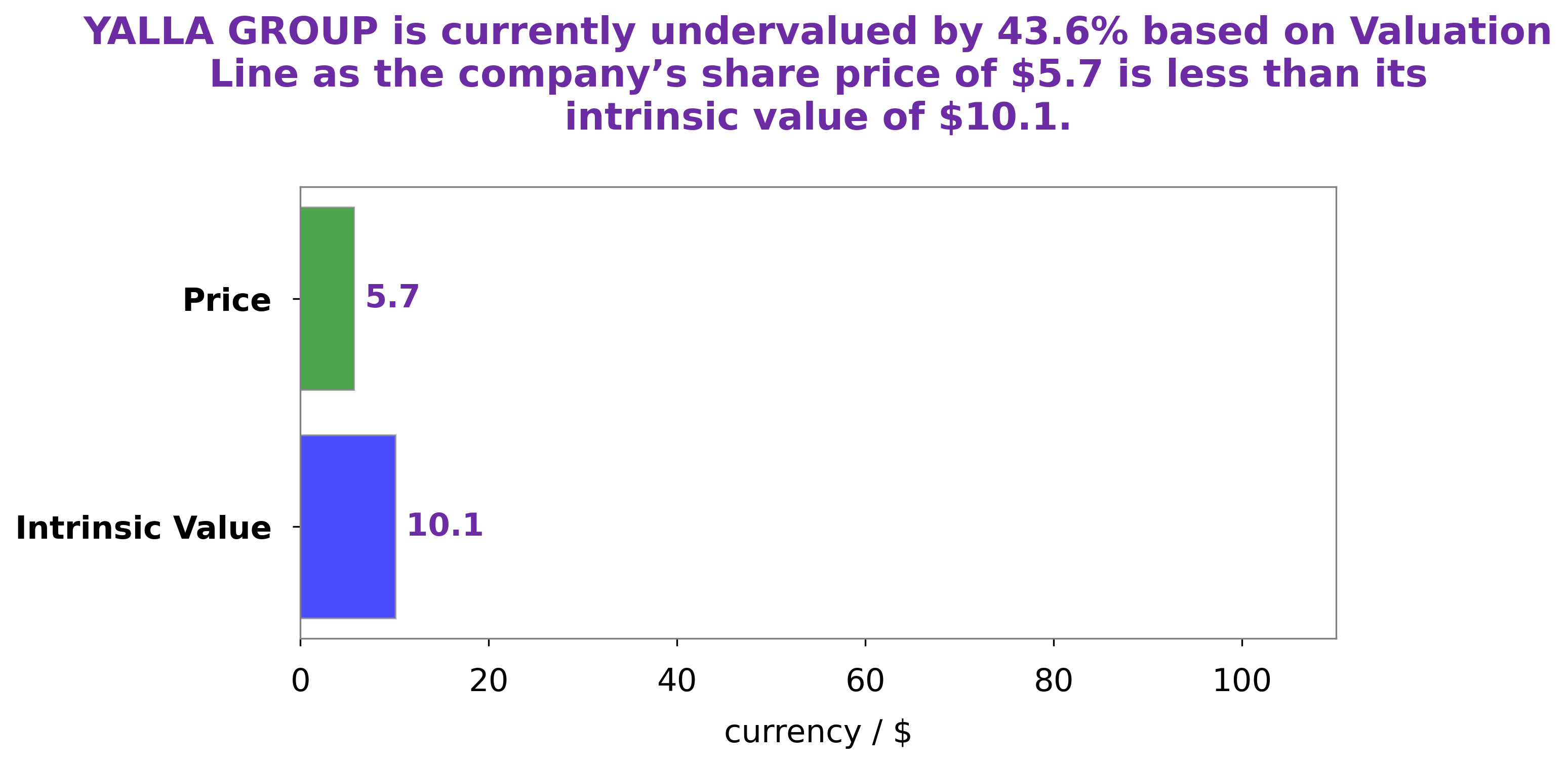

At GoodWhale, we have performed an analysis of YALLA GROUP‘s financials. Our proprietary Valuation Line has indicated that the intrinsic value of YALLA GROUP’s share is around $11.0. Currently, YALLA GROUP’s stock is trading at $5.2, which is undervalued by 52.9%. This presents investors with an attractive opportunity to purchase the stock at a discount. More…

Peers

The company was founded in 2012 and is headquartered in Tel Aviv, Israel. Yalla Group Ltd operates in the Mobile Marketing industry. The company provides its services to app developers and publishers worldwide. Yalla Group Ltd’s main competitors are ironSource Ltd, Wewards Inc, and Bowmo Inc. These companies are also involved in the Mobile Marketing industry.

– ironSource Ltd ($NYSE:IS)

Wewards Inc is a publicly traded company with a market capitalization of 236.46M as of 2022. The company has a strong return on equity of 7.1%. Wewards Inc is engaged in the business of providing loyalty programs and rewards to its customers. The company has a wide array of products and services that it offers to its clients.

Summary

YALLA Group has reported strong financial results for the second quarter of the fiscal year ending June 30, 2023. Total revenue for the period increased by 4.2% year over year to USD 79.2 million, with net income for the quarter reaching USD 29.5 million, a 43.1% increase from the same quarter last year. This marks the company’s sixth consecutive quarter of positive growth and indicates a bullish outlook for investors.

YALLA Group’s share price has also been trending upwards, reflecting an increasingly optimistic sentiment amongst shareholders. Given the strong performance, YALLA Group appears to be a promising investment opportunity in the near future.

Recent Posts