YALLA GROUP Reports Fourth Quarter 2022 Earnings Results on March 14, 2023.

March 30, 2023

Earnings Overview

On March 14, 2023, YALLA GROUP ($NYSE:YALA) released its reported earnings results for the fourth quarter of fiscal year 2022, which ended December 31, 2022. Total revenue was USD 16.8 million, a year-over-year decrease of 12.1%; however, net income increased by 11.2% compared to the same period in the preceding year, totaling USD 75.1 million.

Transcripts Simplified

I’m pleased to report that our financial results exceeded our expectations for the period. This growth was driven by strong demand for our products and services across all of our markets. This was driven by improved working capital efficiency, as well as higher operating cash flow. Looking ahead, we remain confident in our ability to drive long-term growth and value creation for our shareholders.

We are focused on continuing to invest in our core businesses to capitalize on the opportunities we see in our markets and extend our competitive advantage. We remain committed to delivering strong returns over the long term. Thank you for your time and I look forward to answering your questions.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Yalla Group. More…

| Total Revenues | Net Income | Net Margin |

| 303.6 | 79.76 | 26.5% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Yalla Group. More…

| Operations | Investing | Financing |

| 144.24 | -5.36 | -24.56 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Yalla Group. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 506.34 | 66.47 | 2.44 |

Key Ratios Snapshot

Some of the financial key ratios for Yalla Group are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 68.5% | 39.8% | 26.0% |

| FCF Margin | ROE | ROA |

| 52.3% | 11.5% | 9.8% |

Share Price

On Tuesday, YALLA GROUP stock opened at $3.8 and closed at $3.8, down by 4.5% from last closing price of 4.0. This is the second consecutive quarter that YALLA GROUP has reported a decrease in stock price. The decrease in stock price is primarily attributed to the company’s lack of profitability in the fourth quarter. This resulted in an overall net loss of $2 million for the quarter. YALLA GROUP’s management team is working to turn the company around and is confident that they can return to profitability in the next quarter. The company has implemented a number of cost-cutting measures including reducing headcount, reducing discretionary spending, and implementing more efficient operational procedures. Overall, YALLA GROUP’s fourth quarter earnings results reflect a challenging economic environment and a challenging quarter for the company.

However, the management team remains confident that the company can return to profitability in the next quarter and continue to create shareholder value in the long-term. Live Quote…

Analysis

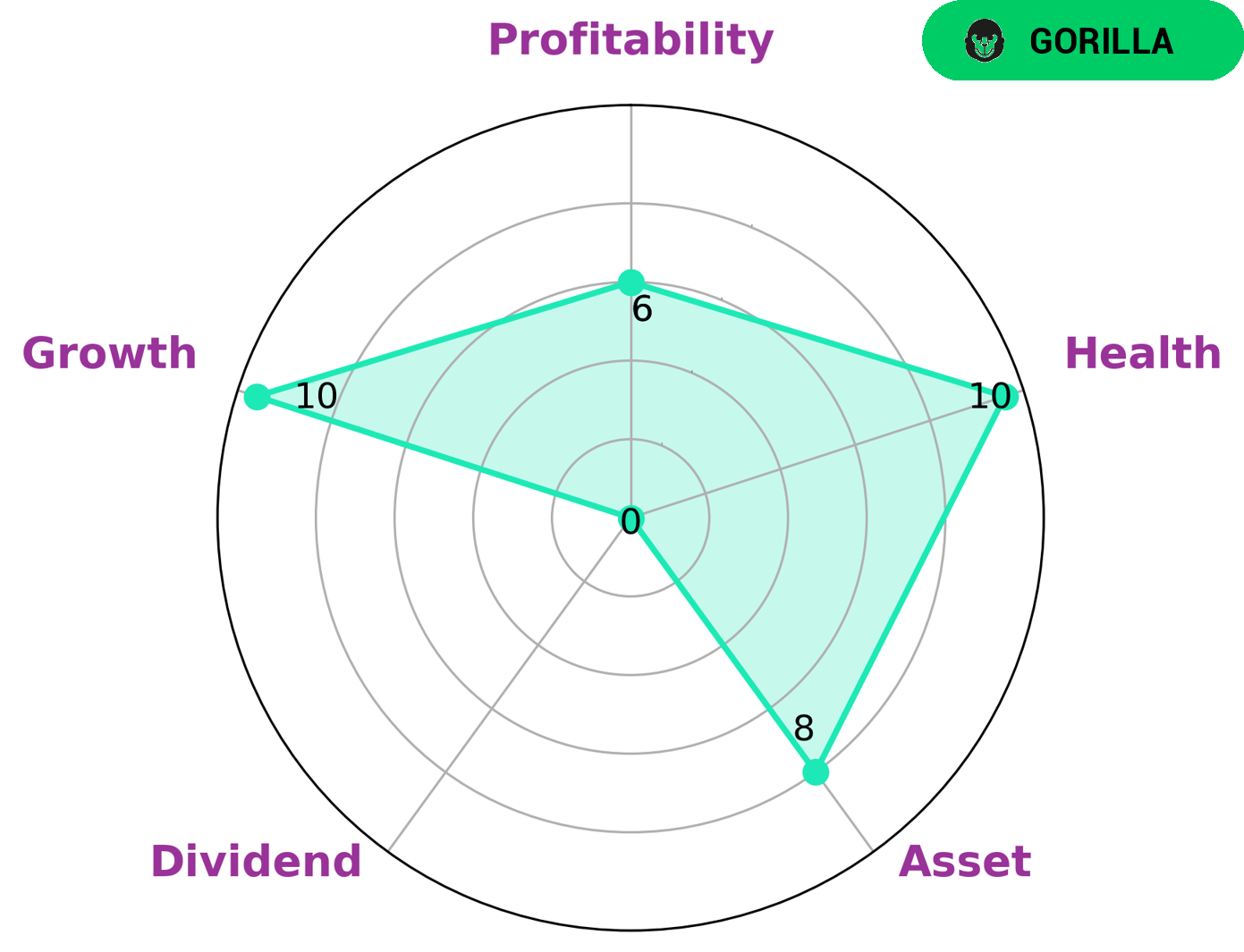

GoodWhale has conducted an analysis of YALLA GROUP‘s financials and found that according to Star Chart, YALLA GROUP is strong in asset, growth and medium in profitability and weak in dividend. Based on this, we categorized YALLA GROUP as a ‘gorilla’, meaning it has achieved stable and high revenue or earning growth due to its strong competitive advantage. This makes it an attractive choice for investors who are looking for long-term, stable investments. Additionally, YALLA GROUP has a high health score of 10/10 with regard to its cashflows and debt, indicating its capability to sustain future operations even in times of crisis. This can make it an especially attractive option for investors who are looking for long-term, safe investments. More…

Peers

The company was founded in 2012 and is headquartered in Tel Aviv, Israel. Yalla Group Ltd operates in the Mobile Marketing industry. The company provides its services to app developers and publishers worldwide. Yalla Group Ltd’s main competitors are ironSource Ltd, Wewards Inc, and Bowmo Inc. These companies are also involved in the Mobile Marketing industry.

– ironSource Ltd ($NYSE:IS)

Wewards Inc is a publicly traded company with a market capitalization of 236.46M as of 2022. The company has a strong return on equity of 7.1%. Wewards Inc is engaged in the business of providing loyalty programs and rewards to its customers. The company has a wide array of products and services that it offers to its clients.

Summary

YALLA GROUP released its fourth quarter earnings for FY 2022, with total revenue of USD 16.8 million, representing a 12.1% drop year over year. Despite the decrease in revenue, net income was up 11.2% year over year to USD 75.1 million. The stock price dropped on the news of the earnings release. Investors should proceed with caution when considering investing in YALLA GROUP as the decrease in revenue could signal potential issues with the company’s performance.

However, the increase in net income could indicate that there may still be potential for long-term investments in the company. A thorough analysis of the company’s financials and industry trends should be conducted before taking any investment position.

Recent Posts