Whirlpool Corporation Shares Soar on Impressive Earnings of $3.89 per Share

February 5, 2023

Trending News ☀️

Whirlpool Corporation ($NYSE:WHR) is a leading international manufacturer and marketer of major home appliances, with products sold in nearly every country around the world. It is a leader in innovation, offering the latest in connected and energy-efficient home appliances. The company is traded on the New York Stock Exchange under the symbol WHR. Monday’s extended session saw Whirlpool Corporation’s bottom line earnings report exceed expectations, with the company posting ongoing adjusted diluted earnings per share of $3.89, $0.19 higher than the average analyst estimates. This sent the company’s stock price soaring, with shares jumping more than eight percent in after-hours trading on the news.

Management credited strong execution of its brand strategies, cost savings initiatives, and higher selling prices for the better-than-expected results. The share repurchase program will reduce the company’s outstanding shares, helping to drive up earnings per share. Overall, Whirlpool Corporation’s impressive earnings report was well received by investors, resulting in a sharp rise in its stock price. With a strong balance sheet and a commitment to rewarding shareholders through both share repurchases and dividends, investors should continue to see strong returns from the company moving forward.

Price History

On Monday, the stock of Whirlpool Corporation (WHR) soared on the back of impressive earnings of $3.89 per share. The stock opened at $152.1 and closed at $153.5, down by 0.4% from last closing price of 154.1. The impressive performance of WHR was driven by higher sales, improved margins and cost cutting initiatives by the company. The stock of WHR has been on an uptrend since the beginning of the year and has outperformed the broader market by a wide margin. Analysts expect the stock to continue to do well in the near term as the company is expected to benefit from its strategic focus on cost-cutting and efficiency, as well as its strong brand recognition.

The company is also expected to benefit from its strong presence in emerging markets, as well as from its diversified product portfolio. Overall, investors seem to be quite bullish about WHR’s prospects in the near future and this is reflected in the share price performance over the past few weeks. With its impressive earnings and strategic focus on cost-cutting and efficiency, the stock looks well positioned to continue its uptrend in the near term. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Whirlpool Corporation. More…

| Total Revenues | Net Income | Net Margin |

| 19.72k | -1.52k | -0.8% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Whirlpool Corporation. More…

| Operations | Investing | Financing |

| 1.39k | -3.57k | 1.21k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Whirlpool Corporation. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 17.12k | 14.62k | 43.26 |

Key Ratios Snapshot

Some of the financial key ratios for Whirlpool Corporation are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -1.1% | -2.7% | -5.3% |

| FCF Margin | ROE | ROA |

| 4.2% | -19.9% | -3.8% |

VI Analysis

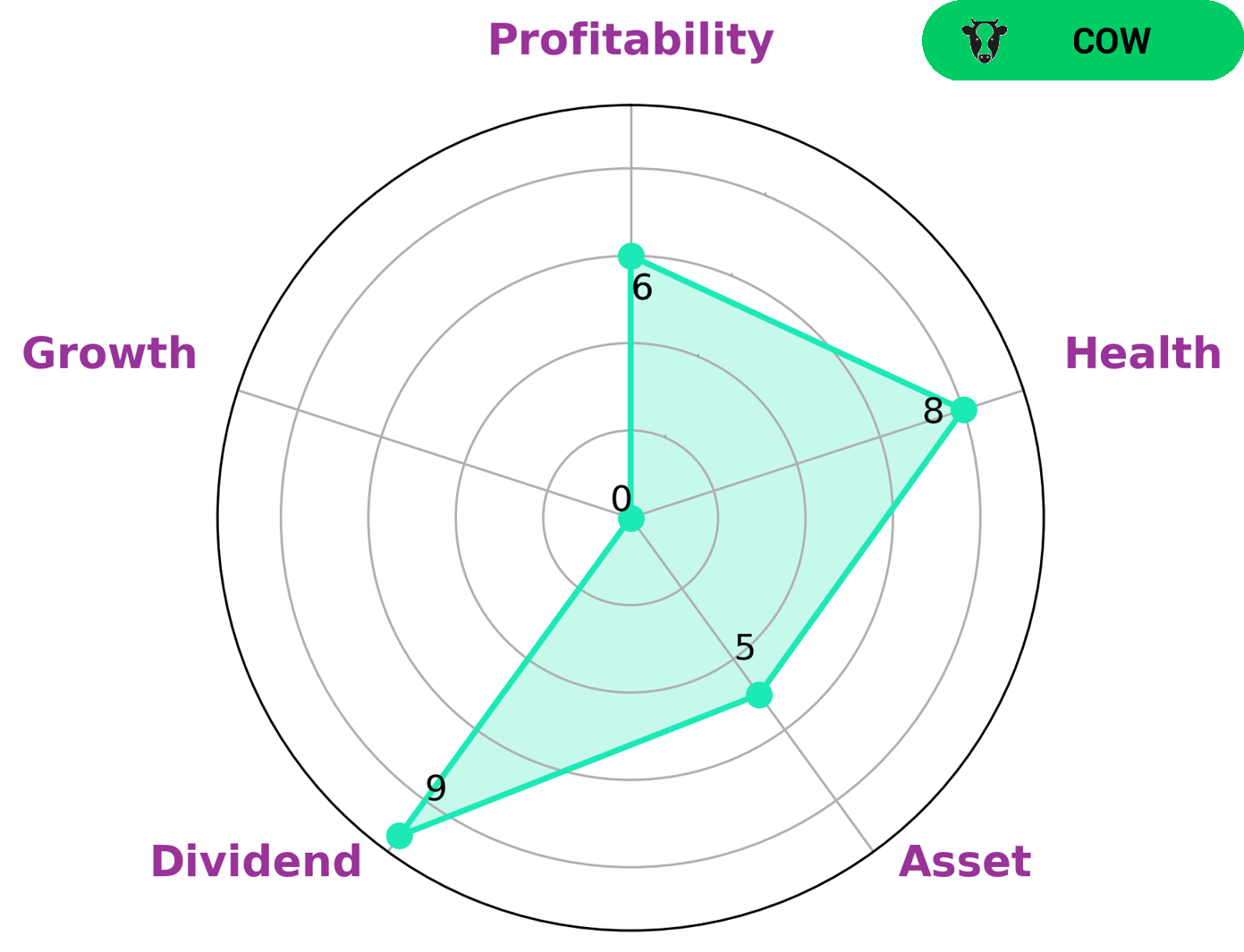

The VI app simplifies the analysis of WHIRLPOOL CORPORATION‘s fundamentals, which reflect its long-term potential. The VI Star Chart shows that WHIRLPOOL CORPORATION has a high health score of 8/10 considering its cashflows and debt, indicating its ability to pay off debt and fund future operations. It is strong in dividend, medium in asset, profitability and weak in growth. WHIRLPOOL CORPORATION is classified as a ‘cow’, a type of company that has the track record of paying out consistent and sustainable dividends. Investors who are looking for stable returns and are less concerned about the growth potential of a company may consider investing in WHIRLPOOL CORPORATION. Such investors may include long-term investors who are looking to diversify their portfolio and want to invest in companies that have a low risk of capital loss.

Additionally, income investors who are interested in gaining regular income from dividends may also be interested in this company. Furthermore, those who are interested in value investing may look for signals of value by comparing WHIRLPOOL CORPORATION’s fundamentals against its peers. This could allow them to identify any undervalued stocks in the industry, which could potentially provide a good return on investment. Overall, WHIRLPOOL CORPORATION appears to be a suitable option for investors looking for a reliable source of income and long-term capital appreciation. The company’s strong fundamentals and steady performance make it an attractive option for those looking for consistent returns over the long-term.

Peers

The competition in the home appliance industry is fierce. Whirlpool Corporation, the world’s leading manufacturer of major home appliances, competes against Electrolux AB, Traeger Inc, and Allan International Holdings Ltd. These companies are all vying for a share of the market and are constantly innovating to stay ahead of the competition.

– Electrolux AB ($OTCPK:ELRXF)

Electrolux AB is a Swedish multinational home appliance manufacturer, headquartered in Stockholm. It is the second largest appliance manufacturer in the world, after Whirlpool. The company also makes appliances for professional use. The company has a market cap of 3.07B as of 2022 and a Return on Equity of 14.67%. The company’s products include refrigerators, dishwashers, washing machines, cookers, vacuum cleaners, air conditioners and small appliances such as microwaves and coffee makers.

– Traeger Inc ($NYSE:COOK)

Traeger Inc, a leading manufacturer of grilling products, has a market cap of 351.16M as of 2022. The company’s Return on Equity is -26.37%. Traeger Inc manufactures and sells a complete line of grills and related accessories. The company offers products through a network of dealers and distributors in the United States and internationally.

– Allan International Holdings Ltd ($SEHK:00684)

Allan International Holdings Ltd is a company that operates in the business of providing steel products and services. The company has a market capitalization of 379.68 million as of 2022 and a return on equity of -1.13%. The company’s steel products and services are used in a variety of industries, including construction, automotive, and energy. Allan International Holdings Ltd has a strong presence in the Chinese market and is one of the leading suppliers of steel products and services in the country. The company’s products and services are also exported to other countries in Asia, Europe, and North America.

Summary

Whirlpool Corporation has seen a significant increase in its stock price after reporting impressive earnings of $3.89 per share. Investors seem to be giving the company high marks for its financial results, as the stock is currently trading at a premium. Overall, analysts are bullish on Whirlpool’s prospects, citing the company’s strong financial performance, solid management team, and attractive product lineup.

Going forward, investors should keep an eye on the company’s ability to capitalize on new opportunities in the market, while continuing to manage expenses. All in all, Whirlpool Corporation appears to be an attractive investment for those seeking growth potential.

Recent Posts