WERNER ENTERPRISES Reports Fourth Quarter FY 2022 Earnings Results on February 7, 2023

February 25, 2023

Earnings Overview

On February 7 2023, WERNER ENTERPRISES ($NASDAQ:WERN) announced their earnings results for Q4 2022, ending on December 31 2022. Revenue of USD 60.2 million was reported, dropping by 22.7% compared to the corresponding period of the previous year. Net income, however, increased by 12.6%, accounting for USD 861.5 million.

Transcripts Simplified

Fourth quarter TTS results showed an increase of 13% in revenues and a decrease of 8% in adjusted operating income. Sequentially, TTS adjusted operating income increased 9% quarter-over-quarter. The largest per mile operating expense increases were supplies and maintenance at 18% and insurance and claims at 53%.

Werner Logistics saw a 15% increase in revenues due to eight weeks of ReedTMS, with Truckload Logistics revenues increasing 20% driven by a 34% increase in shipments. Equipment gains on sales of revenue equipment were $22.5 million during fourth quarter and the company is expecting annual equipment gains in the range of $30 million to $50 million for 2023.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Werner Enterprises. More…

| Total Revenues | Net Income | Net Margin |

| 3.29k | 241.26 | 7.1% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Werner Enterprises. More…

| Operations | Investing | Financing |

| 412.19 | -397.3 | 89.67 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Werner Enterprises. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 3.1k | 1.61k | 22.83 |

Key Ratios Snapshot

Some of the financial key ratios for Werner Enterprises are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 10.1% | 12.7% | 10.2% |

| FCF Margin | ROE | ROA |

| -1.3% | 14.9% | 6.8% |

Stock Price

Tuesday, February 7, 2023 marked an important day for shareholders of WERNER ENTERPRISES as the company reported their fourth quarter earnings of the 2022 fiscal year. The stock opened at $48.5 and closed at $49.1, with a 1.3% rise compared to the prior closing price of $48.5. While this increase in the stock price is a positive sign for investors, a closer look at the results over the past quarter would be necessary to fully evaluate the company’s performance. WERNER ENTERPRISES released a report detailing their financial performance over the quarter which will help investors make more informed decisions.

With the release of their fourth quarter earnings report, WERNER ENTERPRISES have set a precedent for reporting important financial information both promptly and accurately. This transparency in reporting has contributed to investor confidence in the company’s performance and will continue to be an important part of their success in the future. Live Quote…

Analysis

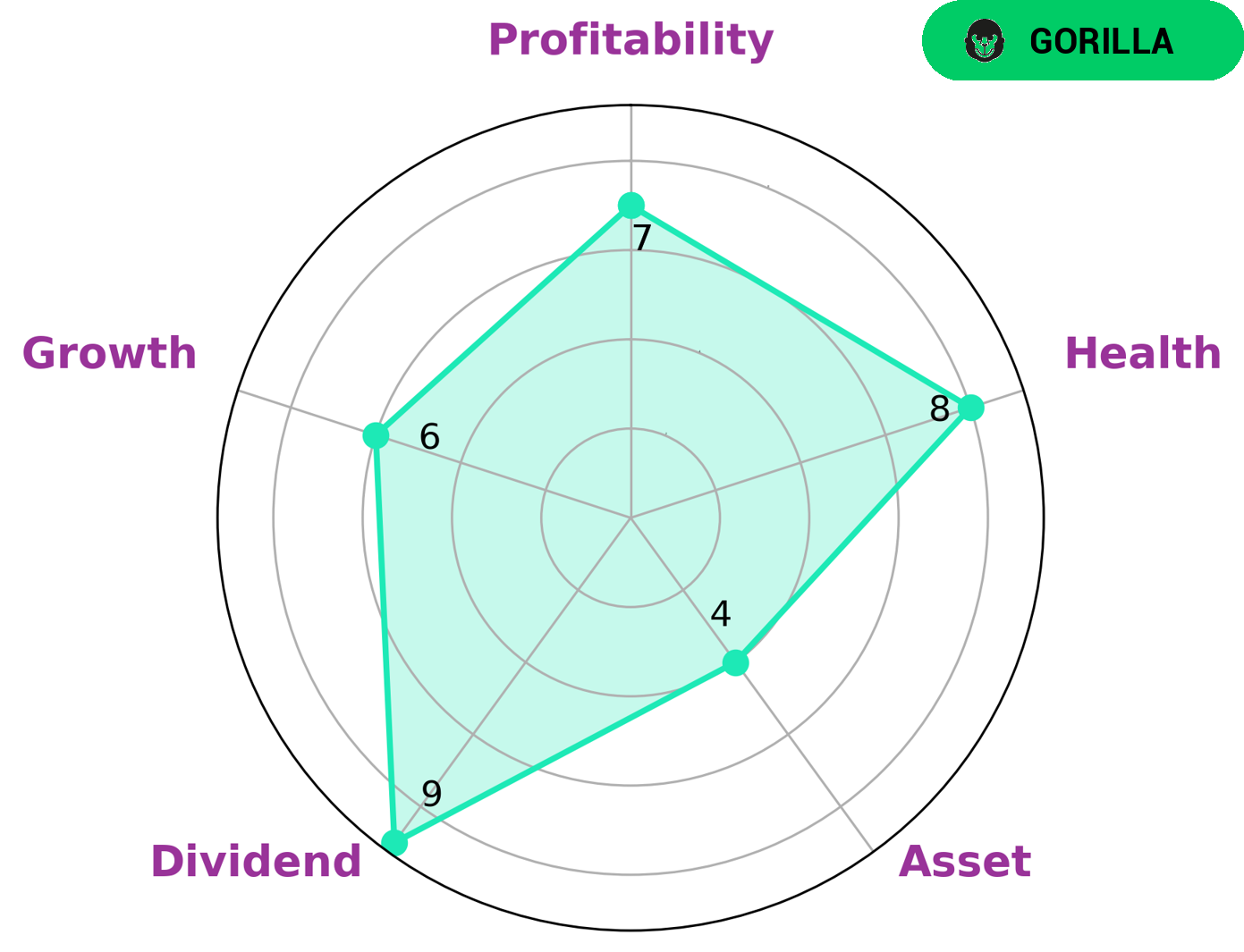

At GoodWhale, we analyze WERNER ENTERPRISES‘s financials to provide investors with a comprehensive picture of the company. According to our Star Chart, WERNER ENTERPRISES is in good health, with a strong 8/10 score for both its cashflows and debt. This indicates that the company is in a strong financial position and able to weather any crisis without the risk of bankruptcy. WERNER ENTERPRISES’s performance across other categories is also impressive. It scores well for dividend and profitable, and medium for asset and growth. This suggests that the company has a reliable source of income, as well as a solid foundation to drive further growth. As such, we classify WERNER ENTERPRISES as a ‘gorilla’ – a type of company that has achieved stable and high revenue or earning growth due to its strong competitive advantage. This kind of company is likely to be attractive to value investors and those looking to secure returns in the long-term. More…

Peers

The trucking industry is extremely competitive. Companies are always vying for new customers and new contracts. Werner Enterprises Inc is no different. It competes against some of the largest trucking companies in the world, including Knight-Swift Transportation Holdings Inc, ArcBest Corp, and XPO Logistics Inc. These companies are all fighting for a piece of the pie, and each one has its own unique advantages and disadvantages.

– Knight-Swift Transportation Holdings Inc ($NYSE:KNX)

Knight-Swift Transportation is one of the largest trucking companies in North America. It has a market cap of 7.76B as of 2022 and a ROE of 11.12%. The company operates in the United States, Mexico, and Canada. It has a fleet of over 16,000 trucks and trailers. Knight-Swift Transportation provides truckload, intermodal, and logistics services.

– ArcBest Corp ($NASDAQ:ARCB)

ArcBest Corporation is an American logistics company with operations in North America, Europe, and Asia. The company was founded in 1923 and is headquartered in Fort Smith, Arkansas. ArcBest provides a range of logistics services, including transportation, warehousing, and supply chain management. The company has a market cap of 1.8 billion as of 2022 and a return on equity of 24.79%.

– XPO Logistics Inc ($NYSE:XPO)

XPO Logistics Inc is a transportation and logistics company with a market cap of 3.87B as of 2022. The company has a return on equity of 44.59%. XPO Logistics Inc provides transportation and logistics services to customers in a variety of industries, including retail, e-commerce, food and beverage, manufacturing, and energy. The company operates a network of over 1,400 locations in more than 30 countries.

Summary

WERNER ENTERPRISES experienced a decrease in total revenue for the fourth quarter of fiscal year 2022 compared to the previous year, with numbers at USD 60.2 million. However, net income was up 12.6% from the prior year with USD 861.5 million. Although Werner Enterprises had lower overall revenue, investors should note that their net income increased and remain optimistic about the company’s potential. Investors should further analyze the company’s financial information to determine if the stock is a worthwhile investment.

Recent Posts