WEIBO CORP Reports Fourth Quarter Results for 2022 Fiscal Year

April 6, 2023

Earnings Overview

WEIBO ($LTS:0LUG): Net income for the quarter, however, was USD 448.0 million, a 27.3% decrease from the same quarter in the previous year.

Price History

On Wednesday, WEIBO CORP reported results for the fourth quarter of its 2022 fiscal year. The company’s stock opened at €101.4 and closed at €101.4, indicating that the overall performance of the company was strong. This was driven by the company’s continued focus on expanding its digital and social media presence across multiple markets.

With this impressive performance, WEIBO CORP has positioned itself for continued success in the coming quarters. As the company continues to build a stronger presence in the digital media space, investors should expect to see further positive results and progress in the near future. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Weibo Corp. More…

| Total Revenues | Net Income | Net Margin |

| 1.84k | 85.56 | 18.1% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Weibo Corp. More…

| Operations | Investing | Financing |

| 814.02 | -423.96 | 189.44 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Weibo Corp. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 7.13k | 3.74k | 15.07 |

Key Ratios Snapshot

Some of the financial key ratios for Weibo Corp are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 1.3% | -6.4% | 9.1% |

| FCF Margin | ROE | ROA |

| 28.6% | 3.2% | 1.5% |

Analysis

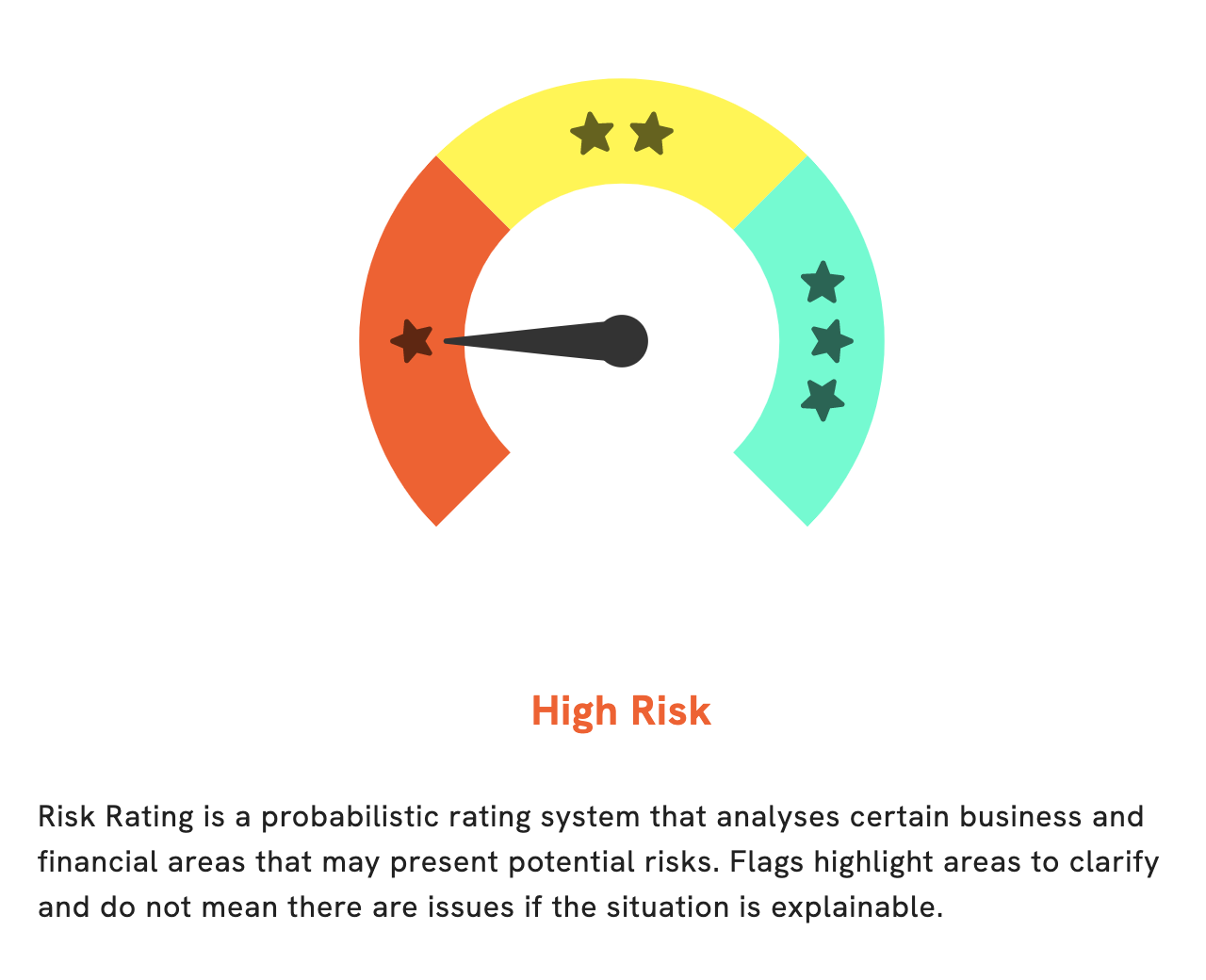

At GoodWhale, we’ve conducted an extensive analysis on WEIBO CORP‘s wellbeing. Our findings indicate that WEIBO CORP is a high risk investment, both in terms of financial and business aspects. Specifically, our Risk Rating detected four risk warnings that are present in the company’s income sheet, balance sheet, cash flow statement and financial journal. These risks include failing to meet revenue targets, inadequate cash flow and liquidity levels which may increase the risk of insolvency, and overall financial instability. To gain a better understanding of the current state of WEIBO CORP and its potential future performance, we encourage our registered users to take a closer look at these findings. More…

Summary

For the fourth quarter of 2022, WEIBO CORP reported total revenue of USD 141.9 million, a 22.6% increase from the same quarter in the prior year. Net income for the quarter was USD 448.0 million, a 27.3% decrease compared to the same quarter in the prior year. This indicates that despite a significant increase in revenue, the company still saw a decrease in net income due to higher operating costs. Investors should consider this information when making their investment decisions in WEIBO CORP as it may indicate that the company is still trying to optimize their operations in order to see improved profitability in the future.

Recent Posts