Wedbush Analysts Lower Q2 2023 Earnings Estimates for Steven Madden, Ltd

June 12, 2023

🌧️Trending News

Wedbush analysts have recently revised their Q2 2023 earnings per share (EPS) estimates for Steven Madden ($NASDAQ:SHOO), Ltd., a leading designer and marketer of fashion-forward footwear and accessories for women, men and children. The company has a long history of success and is listed on the NASDAQ stock exchange, making it a popular choice among investors. The analysts at Wedbush have lowered their outlook for the company’s performance in the second quarter of 2023, citing the potential for a decrease in demand due to the ongoing pandemic. Despite this, the analysts remain optimistic about the company’s long-term prospects and believe that they will be well-positioned to capitalize on any economic recovery as well as new product launches and strategic initiatives.

It has also become a major player in e-commerce, which has been a key driver of growth during the pandemic. Despite the current challenges posed by the pandemic, Steven Madden, Ltd. is still well-positioned for long-term success.

Earnings

The latest earnings report of STEVEN MADDEN as of March 31 2021 has shown a decrease in total revenue and net income compared to the previous year. Despite these decreases, STEVEN MADDEN’s total revenue has grown from 361.02M USD to 463.83M USD in the last 3 years, demonstrating a recovery and growth in the company’s overall financial performance. This news has caused a stir in the market and investors are now worried about the company’s future prospects.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Steven Madden. More…

| Total Revenues | Net Income | Net Margin |

| 2.03k | 178.28 | 8.8% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Steven Madden. More…

| Operations | Investing | Financing |

| 274.05 | -26.13 | -206.67 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Steven Madden. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.21k | 367.42 | 10.8 |

Key Ratios Snapshot

Some of the financial key ratios for Steven Madden are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 5.4% | 24.4% | 11.4% |

| FCF Margin | ROE | ROA |

| 12.7% | 17.4% | 11.9% |

Market Price

On Friday, Steven Madden, Ltd (STEVEN MADDEN) stock opened and closed at $33.3, following news that Wedbush analysts had lowered their earnings estimates for the company’s second quarter of 2023. This news is likely to have an adverse affect on the stock price in the short term, although it remains to be seen how long it will take for the market to fully adjust to the new figures. In addition, analysts are also expecting a possible shift in the company’s long-term business strategy in order to address the changed circumstances. Investors should continue to monitor Steven Madden’s performance closely in the coming weeks to determine if its outlook has been affected by this news. Live Quote…

Analysis

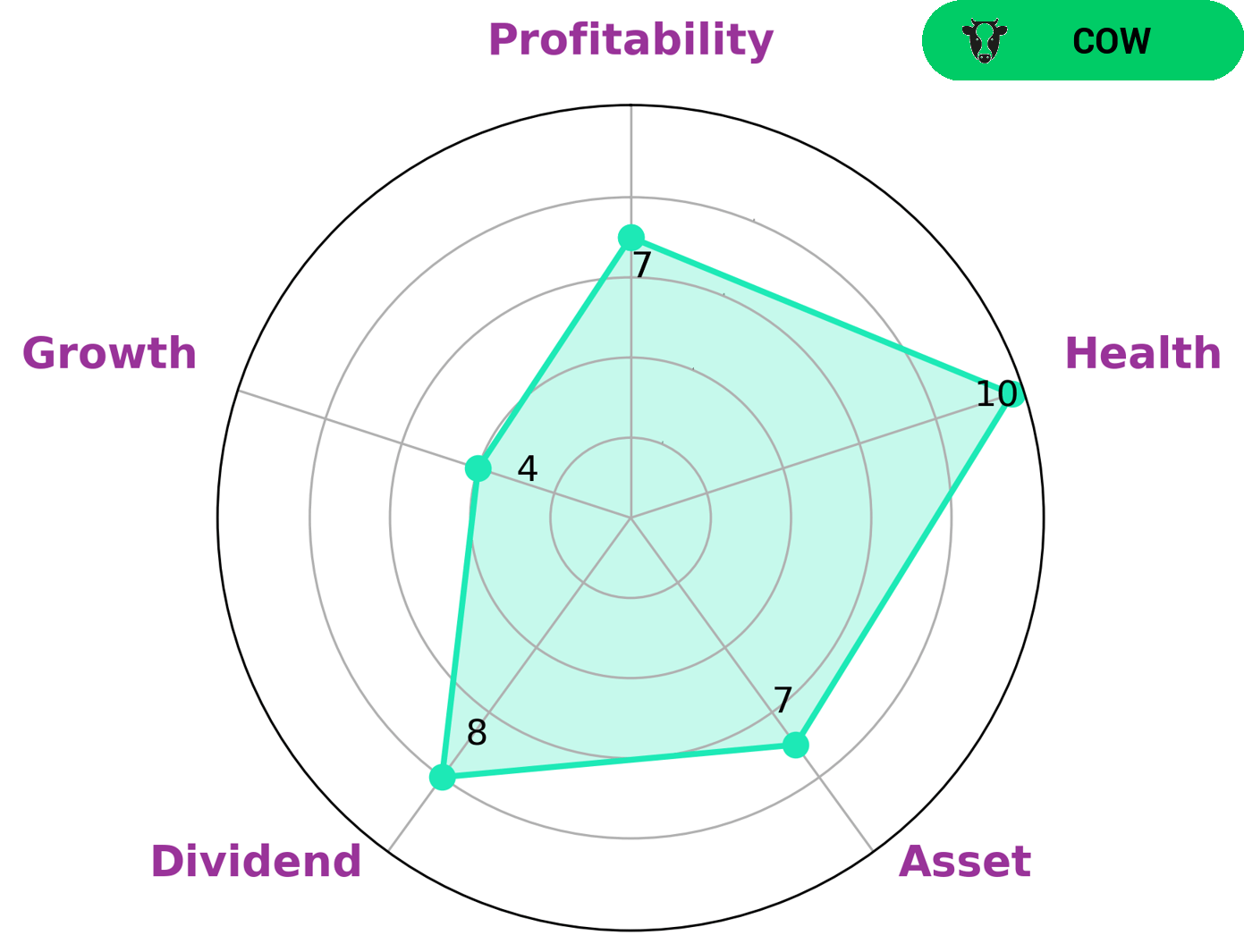

At GoodWhale, we conducted a wellbeing analysis of STEVEN MADDEN. Our star chart revealed that the company had a high health score of 10 out of 10, indicating that its cashflows and debt were in good stead and could sustain operations during times of crisis. We classified STEVEN MADDEN as a ‘cow’ company, meaning that it had a consistent and sustainable track record of paying dividends. This type of company is likely to be of interest to investors looking for stable returns. Besides having a high health score, STEVEN MADDEN also exhibited strong performance in terms of asset, dividend, and profitability. Its growth was classified as medium according to our analysis. More…

Peers

The competition in the footwear industry is fierce with many companies vying for market share. Steven Madden Ltd, a leading designer and marketer of fashion footwear for women, faces stiff competition from the likes of Puma SE, Deckers Outdoor Corp, and Tod’s SpA. While each company has its own unique marketing strategy, they all share one common goal: to be the top dog in the footwear industry.

– Puma SE ($OTCPK:PUMSY)

Puma SE is a German multinational corporation that designs and manufactures athletic and casual footwear, apparel, and accessories. As of 2022, Puma SE has a market cap of 6.97B and a Return on Equity of 17.11%. Founded in 1948, Puma SE is the third largest sportswear manufacturer in the world. The company’s products are sold in over 120 countries worldwide.

– Deckers Outdoor Corp ($NYSE:DECK)

Deckers Outdoor Corporation is an American footwear company based in Goleta, California. The company was founded in 1973 by Douglas Tompkins and owns several brands including UGG, Teva, and Sanuk. As of 2022, the company had a market capitalization of $9.2 billion and a return on equity of 23.76%. The company’s products are sold in over 170 countries and its brands are some of the most recognizable in the world.

– Tod’s SpA ($OTCPK:TODGF)

Tod’s SpA is an Italian luxury goods company specializing in leather shoes, handbags, luggage, and other accessories. The company was founded in 1920 by Filippo della Valle and is headquartered in Rome, Italy. As of 2022, Tod’s SpA had a market capitalization of 1.03 billion euros and a return on equity of 2.64%.

Summary

Investment analysts at Wedbush recently released their earnings predictions for Steven Madden, Ltd. (STEVEN MADDEN) for the second quarter of 2023. This suggests that STEVEN MADDEN is likely to see a year-over-year decline in earnings in the coming quarter. Investors should carefully consider this new prediction when assessing their portfolios.

Recent Posts