WBD Intrinsic Value Calculation – Warner Bros. Launches Discovery Platform for Global Audiences

November 25, 2023

🌥️Earnings Overview

On November 8th 2023, WARNER BROS. DISCOVERY ($NASDAQ:WBD) released its financial results for the third quarter of FY2023, with total revenue of USD 9979.0 million, a 1.6% increase from the same period in the prior year. Net income was reported at USD -417.0 million, a decrease of -2308.0 million compared to the same quarter of the previous year.

Share Price

On Wednesday, Warner Bros. Discovery, a new online platform, was officially launched to provide audiences around the world with access to a wealth of content. The platform is backed by Warner Bros.’ expansive library of classic movies and television shows, as well as original programming and exclusive titles from its many subsidiaries.

However, the opening of the platform did not appear to impress investors, as its stock opened at $10.2 and ended the day at $9.4, a plunge of 19.0% from its last closing price of 11.6. Despite this sharp decline, Warner Bros. remains confident that Discovery will be a success, given the immense potential of its content library to reach global audiences. The platform will also feature interactive elements such as gaming and interactive content, including virtual reality experiences and original programming that will debut later in the year. Warner Bros. is hoping that these interactive aspects will help to engage viewers and keep them coming back for more. In order to take full advantage of Discovery’s global reach, Warner Bros. has also launched a number of marketing initiatives to support the platform’s launch. These include promotional campaigns on social media networks as well as partnerships with key online streaming services. By leveraging its expansive library of classic films and television shows, along with interactive elements and promotional campaigns, Warner Bros. is hoping that its Discovery platform will become the premier destination for global audiences in the months ahead. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for WBD. More…

| Total Revenues | Net Income | Net Margin |

| 42.05k | -4.83k | -7.2% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for WBD. More…

| Operations | Investing | Financing |

| 6.75k | -1.24k | -5.58k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for WBD. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 123.75k | 77.61k | 18.36 |

Key Ratios Snapshot

Some of the financial key ratios for WBD are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 58.0% | -8.8% | -8.4% |

| FCF Margin | ROE | ROA |

| 12.7% | -4.9% | -1.8% |

Analysis – WBD Intrinsic Value Calculation

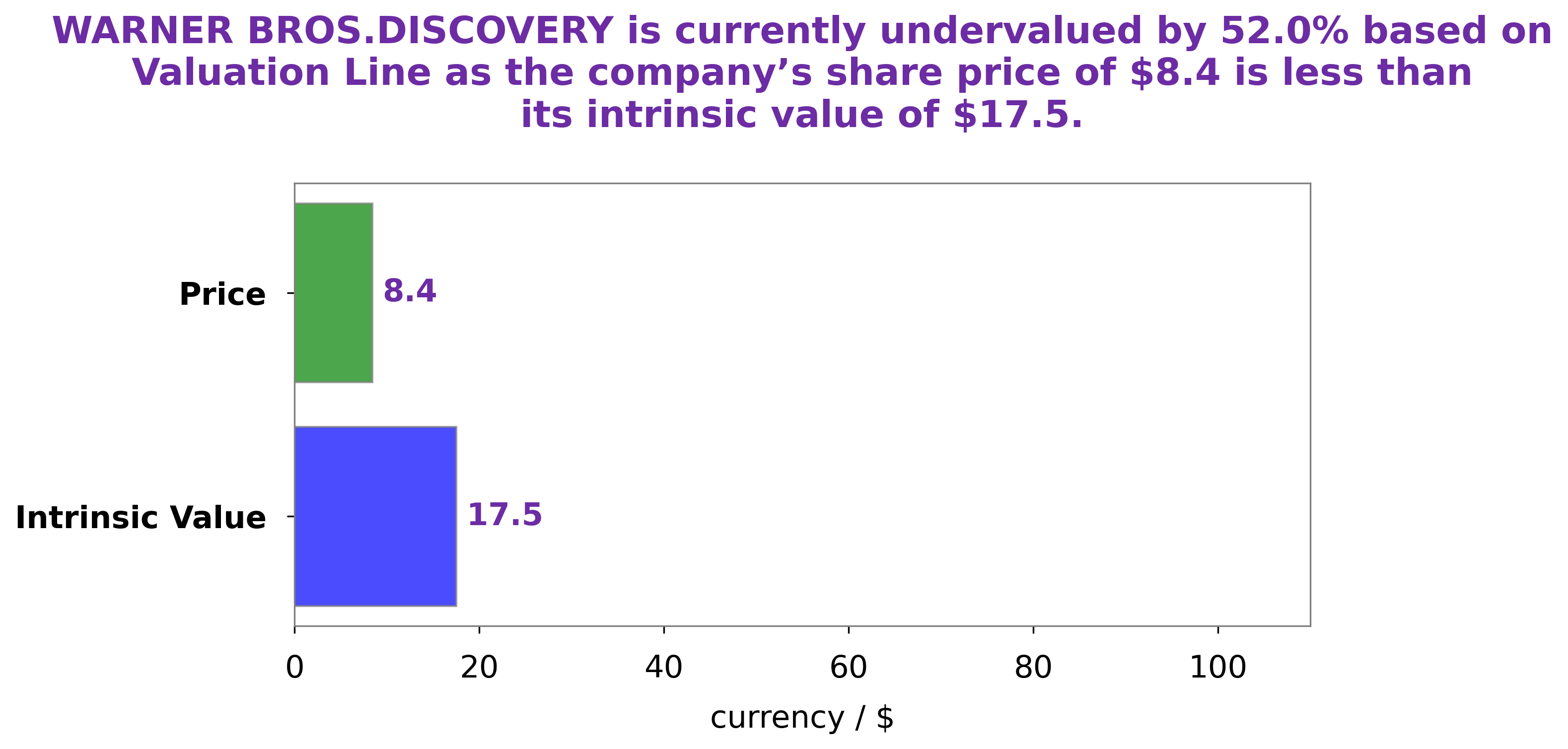

At GoodWhale, we conducted an analysis of WARNER BROS. DISCOVERY’s financials and came up with a fair value of $19.7 for each share. This was determined by our proprietary Valuation Line. In comparison, the current trading price of the stock is at $9.4 which is undervalued by 52.4%. This shows potential for significant return on investment for those who are able to purchase the stock at its current, undervalued rate. More…

Peers

The entertainment industry is currently undergoing a period of intense competition, with Warner Bros. Discovery Inc. emerging as a major player. The company’s competitors include The Walt Disney Co, Netflix Inc, AT&T Inc, and a host of other smaller firms. Warner Bros. Discovery Inc has been able to differentiate itself from its competitors through its focus on quality content and innovative marketing strategies.

– The Walt Disney Co ($NYSE:DIS)

Disney’s market cap is 179.53B as of 2022 and its ROE is 4.53%. The company is a leading entertainment and media conglomerate with businesses in film, television, theme parks, consumer products, and interactive media. Disney is also a major provider of family-friendly content across its various networks and platforms.

– Netflix Inc ($NASDAQ:NFLX)

Netflix, Inc. is an American over-the-top content platform and production company headquartered in Los Gatos, California. The company was founded in 1997 by Reed Hastings and Marc Randolph in Scotts Valley, California. It specializes in and provides streaming media, video-on-demand online, and DVD by mail. In 2013, Netflix expanded into film and television production, as well as online distribution.

As of 2022, Netflix’s market cap is 107.11B and its ROE is 22.38%. Netflix has been a driving force in the shift from traditional television viewing to online streaming. The company has invested heavily in original content, which has helped it grow its subscriber base and become one of the most popular streaming platforms.

– AT&T Inc ($NYSE:T)

AT&T Inc. is an American multinational conglomerate holding company headquartered at Whitacre Tower in Downtown Dallas, Texas. It is the world’s largest telecommunications company, the second largest provider of mobile telephone services, and the largest provider of fixed telephone services in the United States through AT&T Communications. Since June 14, 2018, it also became the parent company of mass media conglomerate WarnerMedia, making it the world’s largest entertainment company in terms of revenue. As of 2019, AT&T is ranked #9 on the Fortune 500 rankings of the largest United States corporations by total revenue.

AT&T Inc. has a market cap of 111.17B as of 2022. AT&T Inc.’s Return on Equity for the quarter that ended in Mar. 2021 was 12.91%.

Summary

WARNER BROS. DISCOVERY released its financial results for the third quarter of FY2023, with total revenue reaching USD 9979.0 million, a slight growth of 1.6%.

However, reported net income for the same period declined significantly, down by -2308.0 million from last year. Consequently, stock price of WARNER BROS. DISCOVERY moved downward on the same day. Investors may consider the company’s current financial performance before making an investment decision. They should pay attention to the company’s growth potential and its ability to drive revenue and increase profits in the long run.

Recent Posts