Waste Management Stock Fair Value – WASTE MANAGEMENT Reports Record Q2 Earnings for Fiscal Year 2023

July 27, 2023

🌧️Earnings Overview

For the second quarter of the fiscal year 2023 (ending June 30, 2023), WASTE MANAGEMENT ($NYSE:WM) reported a total revenue of USD 5119.0 million, a 1.8% increase compared to the same quarter of the previous year. Net income for the quarter was USD 615.0 million, representing a 4.8% year-over-year increase.

Share Price

On Tuesday, WASTE MANAGEMENT reported record earnings for the second quarter of fiscal year 2023, with their stock opening at $171.6 and closing at $171.8. The Q2 earnings report from WASTE MANAGEMENT indicates that the company has seen strong growth in a variety of areas, including residential waste collection, recycling, and hazardous waste disposal. The company has also seen success in their continued investments in new technologies, such as advanced waste sorting systems and digital fleet management tools. Looking to the future, WASTE MANAGEMENT plans to continue investing in technology to improve services and maximize efficiency.

These recent financial results demonstrate that WASTE MANAGEMENT is well-positioned to continue its success well into the future. With new investments in technology and continued focus on customer satisfaction, the company is poised to remain a leader in the waste management industry for years to come. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Waste Management. More…

| Total Revenues | Net Income | Net Margin |

| 20.02k | 2.29k | 11.6% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Waste Management. More…

| Operations | Investing | Financing |

| 4.3k | -3.3k | -1.73k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Waste Management. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 31.61k | 24.69k | 16.98 |

Key Ratios Snapshot

Some of the financial key ratios for Waste Management are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 9.9% | 10.8% | 17.1% |

| FCF Margin | ROE | ROA |

| 7.5% | 31.2% | 6.8% |

Analysis – Waste Management Stock Fair Value

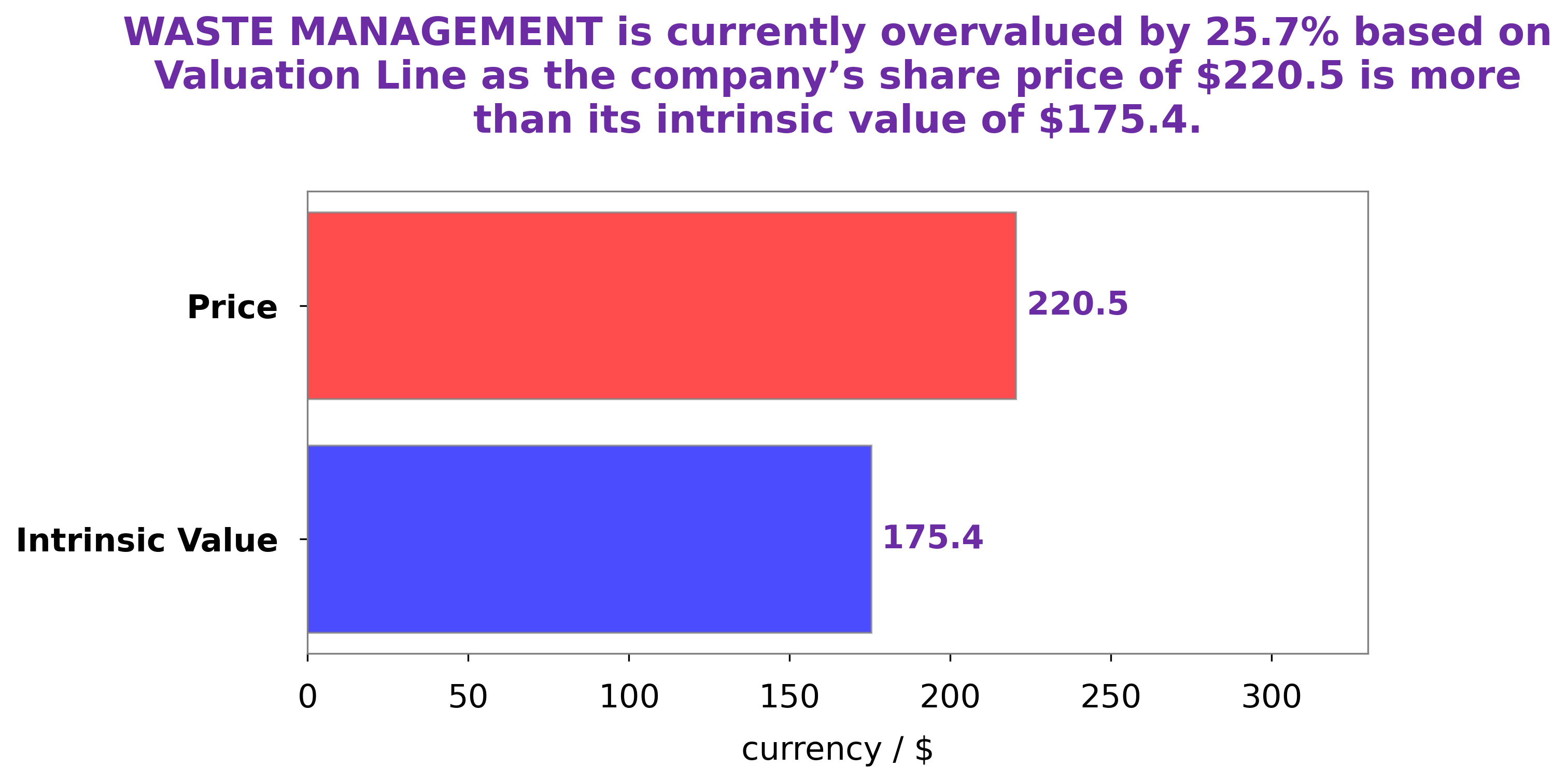

At GoodWhale, we recently conducted an analysis of WASTE MANAGEMENT‘s wellbeing. Our findings revealed that the intrinsic value of WASTE MANAGEMENT share is around $166.6, which we calculated using our proprietary Valuation Line. We hope that our analysis can help investors make informed decisions about their investments. More…

Peers

It has many competitors, including Republic Services Inc, Waste Connections Inc, and Macau Capital Investments Inc.

– Republic Services Inc ($NYSE:RSG)

Republic Services is an American trash and recycling company. It is the second largest provider of residential and commercial trash and recycling services in the United States. The company’s revenue for 2020 was $9.75 billion. The company’s ROE for 2020 was 13.97%.

– Waste Connections Inc ($NYSE:WCN)

Waste Connections Inc is a provider of waste management services in North America. The company has a market cap of 34.1B as of 2022 and a return on equity of 9.38%. Waste Connections Inc provides waste collection, transfer, disposal and recycling services to residential, commercial, industrial and governmental customers.

Summary

Investors may find Waste Management’s second quarter of 2023 to be of interest due to their positive revenue growth and increasing net income. Total revenue for the quarter was up 1.8% year-over-year, while net income rose 4.8%. These figures indicate positive performance and suggest that Waste Management may be a good investment opportunity and worth considering as part of an investor’s portfolio. It is important to remember, however, to research the company more thoroughly before investing.

Recent Posts