Waste Management, on Track for Impressive FY2023 Earnings: Brokers

January 30, 2023

Trending News ☀️

Waste Management ($NYSE:WM), Inc. (WM) is a leading provider of waste collection, transfer, disposal, recycling, and energy-related services in North America. With its impressive portfolio of services, WM has been on track for impressive FY2023 earnings and is anticipated by brokers to exceed its previously set goals. The company has been increasing its presence in the waste industry by implementing innovative solutions to provide better customer service, such as digitizing its services for customers to access their accounts online. WM is also expanding its recycling efforts and offering more sustainable solutions for businesses and individuals. By leveraging its network of waste management facilities, WM is able to offer customers comprehensive solutions to their waste management needs.

WM’s dedication to providing quality services and solutions have been reflected in its financial results. Brokers are expecting WM to report impressive earnings in FY2023, with some forecasting a 10% increase in revenue from the previous year. In addition to its impressive financial performance, WM has also seen an increase in its stock price over the last year. As such, WM is well-positioned to have another successful fiscal year, and brokers are expecting it to deliver impressive earnings in FY2023.

Market Price

Waste Management, Inc. has been making headlines lately, but not for the best of reasons. Despite the heated media coverage, the company shows no signs of slowing down and is on track to have impressive earnings in FY2023. On Friday, WASTE MANAGEMENT stock opened at $150.7 and closed at $152.1, up by 1.0% from last closing price of 150.5. This marks a great start to the year and suggests that the company is off to a promising financial outlook. Waste Management has been taking several steps to ensure that they remain competitive in their industry and are able to capitalize on the opportunities that arise. They have invested heavily in research and development to develop new technologies and processes that will help them manage waste more efficiently and effectively.

Additionally, they have implemented a number of programs to reduce their environmental impact, including recycling initiatives and green energy solutions. The company has also taken an active role in advocating for sustainable practices within their industry. They have worked closely with governments and organizations worldwide to ensure that their waste management strategies are as efficient as possible and in line with global regulations. These efforts have allowed Waste Management to stay ahead of the curve when it comes to tackling the challenges posed by waste management. Overall, Waste Management is looking at a bright future in FY2023. With their commitment to better waste management practices, their investments in research and development, and their proactive stance on environmental sustainability, the company is well-positioned to capitalize on the potential growth opportunities in the industry. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Waste Management. More…

| Total Revenues | Net Income | Net Margin |

| 19.44k | 2.25k | 11.6% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Waste Management. More…

| Operations | Investing | Financing |

| 4.48k | -2.82k | -1.6k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Waste Management. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 29.84k | 22.83k | 17.08 |

Key Ratios Snapshot

Some of the financial key ratios for Waste Management are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 8.0% | 6.2% | 16.8% |

| FCF Margin | ROE | ROA |

| 10.2% | 28.8% | 6.8% |

VI Analysis

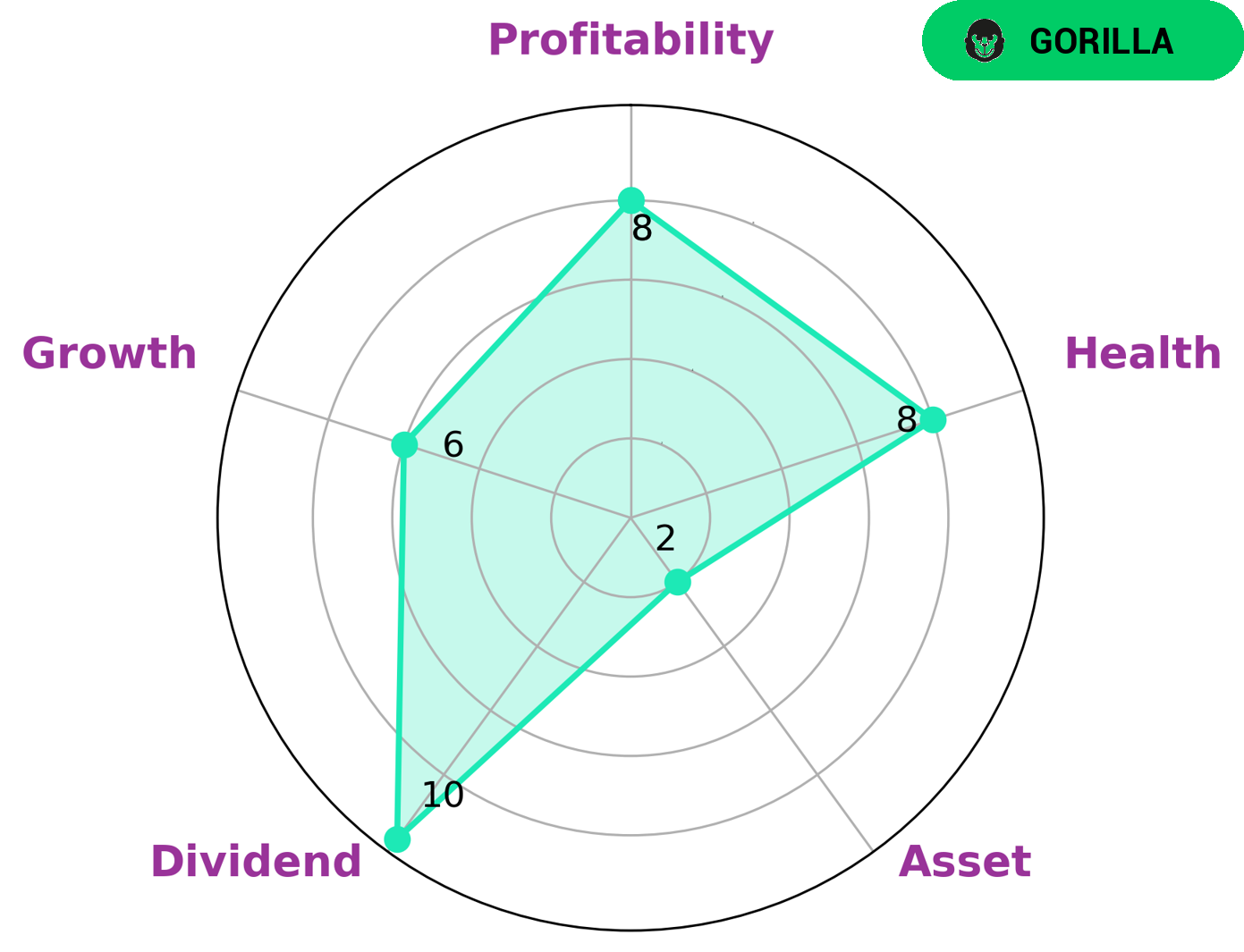

Fundamental analysis is a great tool for evaluating a company’s long-term potential. The VI app simplifies this process by providing an overview of a company’s fundamentals in the form of a star chart. According to the VI star chart, Waste Management has a high health score of 8/10 in terms of cashflows and debt, indicating that the company is capable of paying off its debt and funding future operations. In addition, it is strong in dividends and profitability, medium in growth and weak in assets. Waste Management is classified as a ‘gorilla’ company, which is one that has achieved stable and high revenue or earning growth due to its strong competitive advantage. Investors interested in such companies may be looking for strong dividends, steady earnings growth, and/or a low risk of default. For investors looking for a long-term investment, Waste Management may be a great option due to its strong fundamentals and competitive advantages. More…

VI Peers

It has many competitors, including Republic Services Inc, Waste Connections Inc, and Macau Capital Investments Inc.

– Republic Services Inc ($NYSE:RSG)

Republic Services is an American trash and recycling company. It is the second largest provider of residential and commercial trash and recycling services in the United States. The company’s revenue for 2020 was $9.75 billion. The company’s ROE for 2020 was 13.97%.

– Waste Connections Inc ($NYSE:WCN)

Waste Connections Inc is a provider of waste management services in North America. The company has a market cap of 34.1B as of 2022 and a return on equity of 9.38%. Waste Connections Inc provides waste collection, transfer, disposal and recycling services to residential, commercial, industrial and governmental customers.

Summary

Investing in Waste Management, Inc. (WMI) is looking to be a profitable venture for fiscal year 2023. Analysts are reporting positive earnings prospects for the company, with their current financial performance indicating a strong return on investment. Despite the current negative media coverage surrounding the company, investors are still encouraged to consider WMI as a potential investment opportunity. WMI has a stable track record of success, with consistent growth in revenue and profits for the past few years.

Additionally, their long-term strategy appears to be well-positioned for future success. With their financials in order and a promising outlook ahead, WMI looks to be a viable option for investors looking to gain a greater return on their investment.

Recent Posts