VERIZON COMMUNICATIONS Reports Record Earnings for Q4 2022

February 2, 2023

Earnings report

On January 24, 2023, VERIZON COMMUNICATIONS ($NYSE:VZ) reported record earnings results for their fourth quarter of fiscal year 2022. It is one of the leading providers of wireless, internet, and digital services in the US. On December 31, 2022, VERIZON COMMUNICATIONS reported total revenue of USD 6.6 billion, a 42.7% increase from the same period a year prior. Net income was USD 35.2 billion, a 3.5% increase from the same time in 2021. The company attributed this success to growth in its mobile and internet customers, as well as an increase in its customer base.

Additionally, VERIZON COMMUNICATIONS reported an increase in customer satisfaction, with customer service ratings being at an all-time high. The company attributed its success to its commitment to innovation and customer service. Additionally, VERIZON COMMUNICATIONS has been rolling out new services for its customers, such as unlimited data plans and more comprehensive customer service options. The company has attributed this success to its commitment to innovation and customer service, and it looks forward to continuing this trend into the future.

Market Price

The company opened the day at $38.7 and closed at $40.4, up by 2.0% from the prior closing price of 39.6. This was the highest close for VERIZON COMMUNICATIONS since early 2021. The success of VERIZON COMMUNICATIONS was due to strong revenue growth from its wireless and wireline segments. This was primarily due to higher wireless margins and cost savings from the company’s cost reduction initiatives.

Overall, the strong earnings report from VERIZON COMMUNICATIONS sent its stock prices up on Tuesday and investors are optimistic about the company’s future prospects. With strong revenue growth from both its wireless and wireline segments, and cost savings from cost reduction initiatives, VERIZON COMMUNICATIONS is well-positioned for continued success in the coming quarters. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Verizon Communications. More…

| Total Revenues | Net Income | Net Margin |

| 136.84k | 21.26k | 15.5% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Verizon Communications. More…

| Operations | Investing | Financing |

| 37.14k | -28.66k | -8.53k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Verizon Communications. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 379.68k | 287.22k | 20.83 |

Key Ratios Snapshot

Some of the financial key ratios for Verizon Communications are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 1.2% | -0.0% | 23.3% |

| FCF Margin | ROE | ROA |

| 7.6% | 22.3% | 5.2% |

Analysis

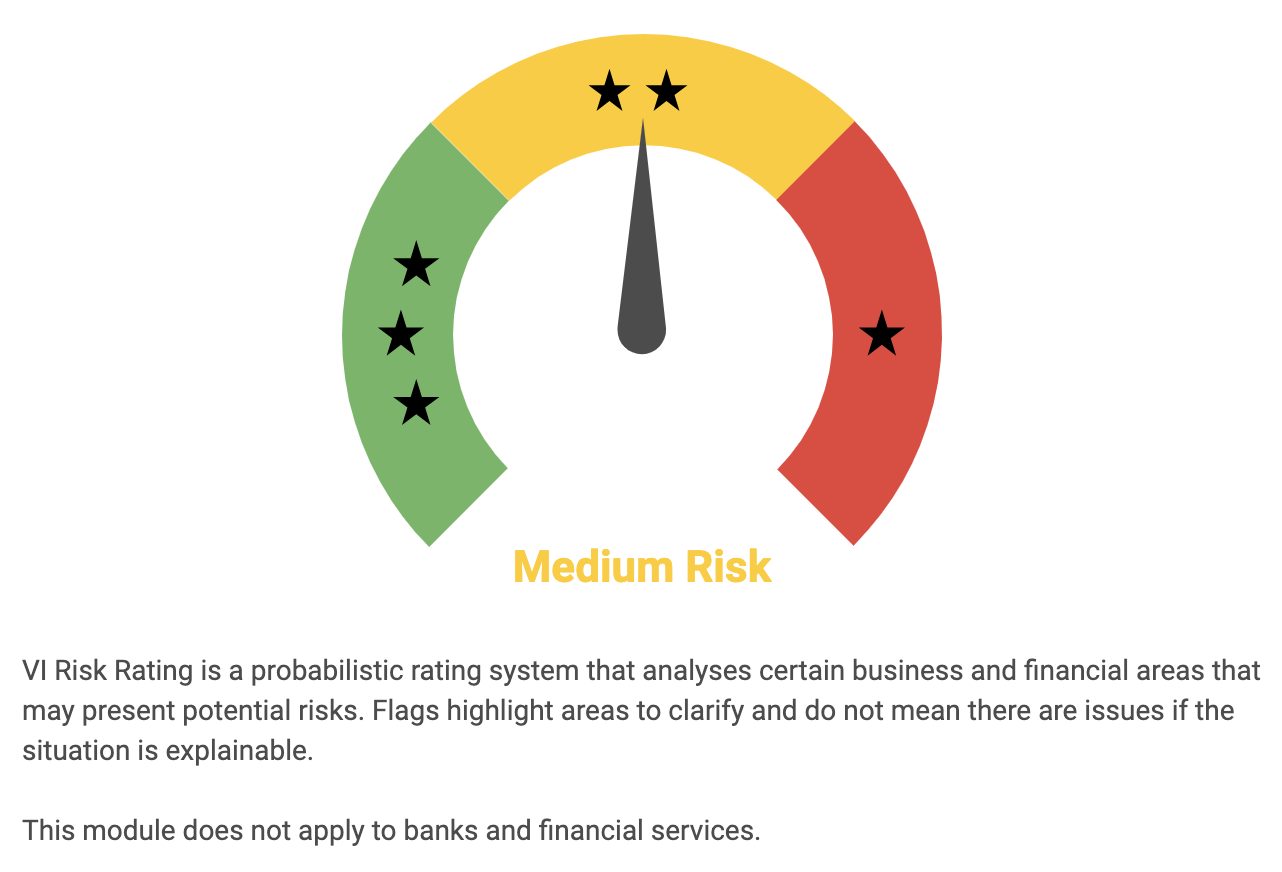

GoodWhale has conducted an analysis of VERIZON COMMUNICATIONS‘s wellbeing, determining it to be a medium risk investment on both financial and business aspects. This classification is based on the Risk Rating system developed by GoodWhale, which takes into account various metrics such as financial stability, business operations, and growth potential. GoodWhale has also identified three risk warnings in the income sheet, balance sheet, and cashflow statement of VERIZON COMMUNICATIONS. These warnings are an indication of potential issues in the company’s financial health and need to be closely monitored. To access these risk warnings and further data about VERIZON COMMUNICATIONS, one must become a registered user of GoodWhale. GoodWhale’s Risk Rating system offers an efficient way for investors to assess the relative safety of their investments. The system provides an objective overview of a company’s financial and business standing, giving investors a better understanding of the risks associated with their investments. More…

Peers

Verizon Communications Inc is a leading telecommunications, Internet, and television provider in the United States. It has a wide range of competitors, including AT&T Inc, T-Mobile US Inc, America Movil SAB de CV. Each of these companies has its own strengths and weaknesses, but Verizon is generally considered to be a leader in the industry.

– AT&T Inc ($NYSE:T)

AT&T Inc. is an American multinational conglomerate holding company headquartered at Whitacre Tower in Downtown Dallas, Texas. It is the world’s largest telecommunications company, the second largest provider of mobile telephone services, and the largest provider of fixed telephone services in the United States through AT&T Communications. Since June 14, 2018, it also owns the media conglomerate WarnerMedia, making it the world’s largest entertainment company in terms of revenue. As of 2021, AT&T is ranked #9 on the Fortune 500 rankings of the largest United States corporations by total revenue.

AT&T Inc. has a market cap of 110.74B as of 2022 and a Return on Equity of 12.91%. AT&T is the world’s largest telecommunications company and the second largest provider of mobile telephone services. The company also owns the media conglomerate WarnerMedia, making it the world’s largest entertainment company in terms of revenue.

– T-Mobile US Inc ($NASDAQ:TMUS)

T-Mobile US, Inc., together with its subsidiaries, provides mobile communications services in the United States, Puerto Rico, and the U.S. Virgin Islands. The company offers voice, messaging, and data services to approximately 79 million customers as of the end of 2019. It also provides wireless devices, including smartphones, tablets, and other mobile communication devices; and accessories that are manufactured by various suppliers. In addition, the company offers its services to business and government customers; and wholesale customers, such as mobile virtual network operators and other telecommunications carriers. T-Mobile US, Inc. was founded in 1994 and is headquartered in Bellevue, Washington.

– America Movil SAB de CV ($OTCPK:AMXVF)

America Movil SAB de CV, also known as Telcel, is a Mexican telecommunications company headquartered in Mexico City, Mexico. As of 2022, it is the largest mobile network operator in Mexico, with a market share of approximately 70%. Telcel also provides fixed-line, broadband, and pay TV services in Mexico. The company was founded in 1972 and is a subsidiary of America Movil.

Summary

Verizon Communications has been a reliable stock for investors, with strong fourth quarter results in 2022. Total revenue for the quarter rose 42.7% year-over-year to $6.6 billion, and net income was $35.2 billion, a 3.5% increase from the previous year. This has been a consistent trend for Verizon, with strong revenue and income growth over the last few years. Investors can expect a steady stream of dividends and share buybacks, as the company continues to invest in improving its services.

In addition, the company has been expanding its customer base and product portfolio, which should provide additional growth opportunities in the future. Overall, Verizon Communications has been a reliable stock for investors and should continue to be a strong investment in the coming years.

Recent Posts