VEEVA SYSTEMS Reports Record Fourth Quarter Financial Results for FY2023

March 20, 2023

Earnings Overview

VEEVA SYSTEMS ($NYSE:VEEV) announced their financial results for the fourth quarter of FY2023 on January 31 2023. Total revenue for the quarter ending March 1 2023 was USD 188.5 million, an impressive 94.2% increase from the same period the previous year. Net income also saw a 16.0% year-over-year increase to USD 563.4 million.

Share Price

VEEVA SYSTEMS opened the day at $166.9 and closed at $166.1, up by 0.3% from the prior closing price of 165.7. VEEVA SYSTEMS’ strong performance is attributed to strong demand in their cloud and subscription businesses, particularly in their Veeva CRM and Vault products. The company also saw a strong contribution from their other products such as Veeva Commercial Cloud, which is designed to help customers manage their commercial operations, and Veeva Network, which helps customers manage their data and content. With these impressive results, VEEVA SYSTEMS continues to demonstrate its commitment to growth, innovation and customer satisfaction. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Veeva Systems. More…

| Total Revenues | Net Income | Net Margin |

| 2.16k | 487.71 | 22.6% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Veeva Systems. More…

| Operations | Investing | Financing |

| 780.47 | -1.01k | -19.38 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Veeva Systems. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 4.8k | 1.09k | 21.97 |

Key Ratios Snapshot

Some of the financial key ratios for Veeva Systems are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 25.0% | 17.1% | 21.3% |

| FCF Margin | ROE | ROA |

| 36.2% | 8.0% | 6.0% |

Analysis

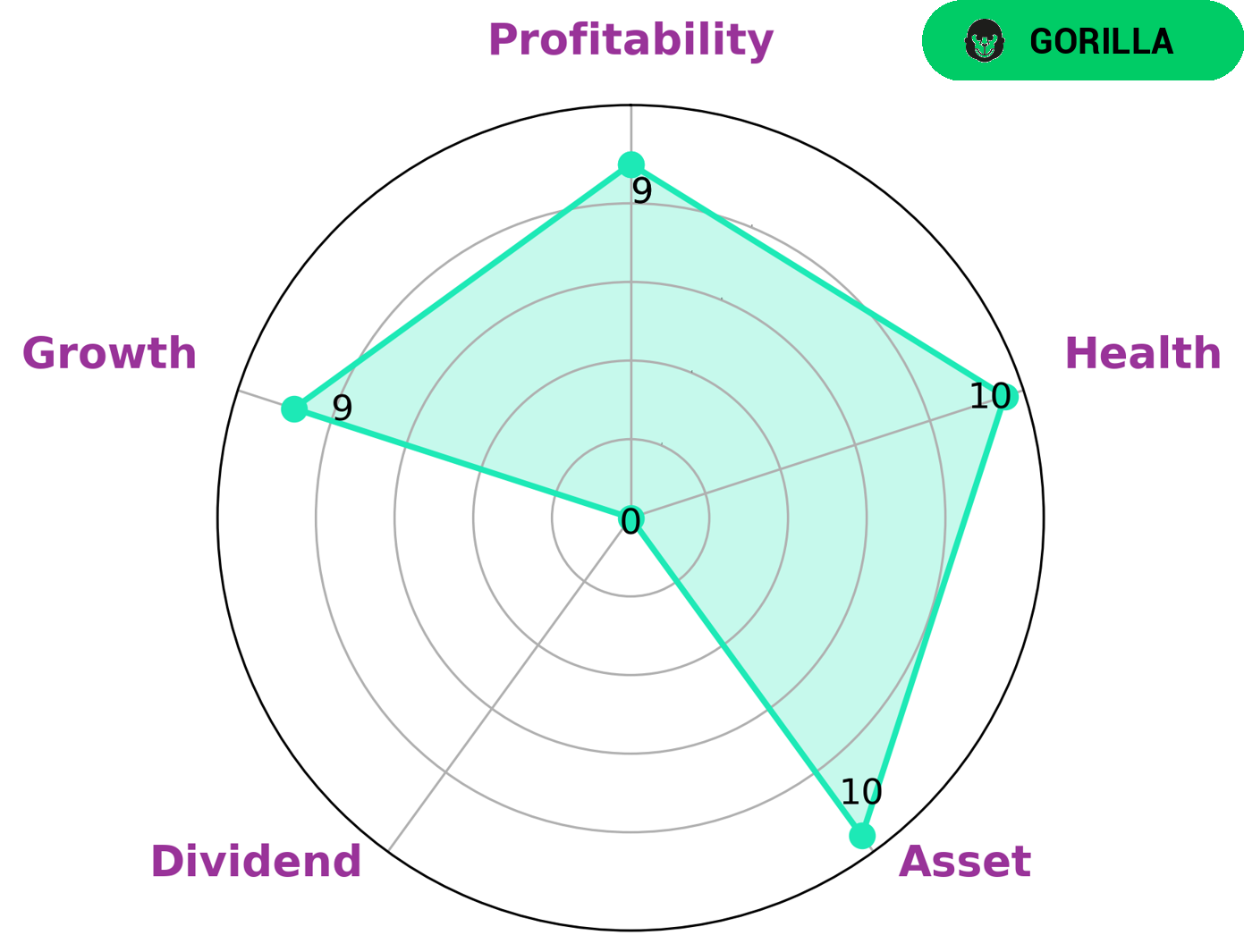

We at GoodWhale have conducted an analysis of VEEVA SYSTEMS‘s financials and based on the Star Chart, they are classified as a ‘gorilla’, a type of company that has achieved stable and high revenue or earning growth due to its strong competitive advantage. This makes them an attractive investment opportunity for investors who are looking for steady growth or companies with strong competitive advantage. VEEVA SYSTEMS currently has a high health score of 10/10 with regard to its cashflows and debt, which indicates that the company is capable of sustaining future operations even in times of crisis. Furthermore, VEEVA SYSTEMS is strong in asset, growth, and profitability but weak in dividend, which could mean that the company may not be generating enough revenue to pay out dividends to shareholders. This could be a good opportunity for investors who are looking to expand the company’s revenue streams and make it more attractive to potential shareholders. More…

Peers

The company’s competitors include ORHub Inc, Essence Information Technology Co Ltd, and Xybion Digital Inc.

– ORHub Inc ($OTCPK:ORHB)

CrowdStrike Holdings, Inc. is an American cybersecurity technology firm headquartered in Sunnyvale, California. It provides endpoint security, threat intelligence, and cyber attack response services. The company was founded in 2011 by George Kurtz and Dmitri Alperovitch.

– Essence Information Technology Co Ltd ($SHSE:688555)

Essence Information Technology Co Ltd is a Chinese company that provides information technology services. It has a market cap of 1.01B as of 2022 and a Return on Equity of -2.84%. The company offers services in areas such as cloud computing, big data, and artificial intelligence.

– Xybion Digital Inc ($TSXV:XYBN)

Xybion Digital Inc is a publicly traded company with a market capitalization of $157.07 million as of 2022. The company has a negative return on equity of 12.47% and is involved in the digital media industry. Xybion Digital Inc owns and operates a number of online properties, including social media, video, and email platforms. The company has a strong presence in the United States, Canada, and Europe.

Summary

VEEVA SYSTEMS has reported strong financial results for the fourth quarter of FY2023, ending March 1 2023. Total revenues increased 94.2% year-over-year to USD 188.5 million and net income rose 16.0% to USD 563.4 million. This impressive growth in revenues and profits signifies a bright future for VEEVA SYSTEMS and it is an attractive investment opportunity for investors. The company is expected to continue its growth trajectory and provide shareholders with robust returns.

Recent Posts