VALARIS LIMITED Reports Q2 FY2023 Earnings Results on June 30, 2023

August 5, 2023

🌧️Earnings Overview

On June 30 2023, VALARIS LIMITED ($NYSE:VAL) reported their second quarter FY2023 earnings results. Total revenue had increased by 0.5% compared to the prior year, amounting to USD 415.2 million. In contrast, their net income had decreased from USD 111.6 million to -29.4 million.

Share Price

On Wednesday, June 30th, 2023, VALARIS LIMITED reported its second quarter (Q2) earnings results for the fiscal year 2023. The company’s stock opened at $74.6 per share and closed at $75.0, down 1.3% from its previous closing price of $75.9. Despite the losses, VALARIS LIMITED’s management remained optimistic about its future prospects, citing its strong asset base and focus on cost-efficiency as the primary reasons for their confidence.

Furthermore, the company revealed plans to invest heavily in research and development of new technologies to further improve their competitive edge in the industry. Overall, VALARIS LIMITED’s Q2 FY2023 earnings results were mixed but its management remains confident about its outlook for the future despite the current market conditions. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Valaris Limited. More…

| Total Revenues | Net Income | Net Margin |

| 1.72k | 120.8 | 14.7% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Valaris Limited. More…

| Operations | Investing | Financing |

| 364.2 | -161.8 | 26.2 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Valaris Limited. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 3.09k | 1.82k | 17.85 |

Key Ratios Snapshot

Some of the financial key ratios for Valaris Limited are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -7.9% | – | 11.7% |

| FCF Margin | ROE | ROA |

| 7.5% | 9.3% | 4.1% |

Analysis

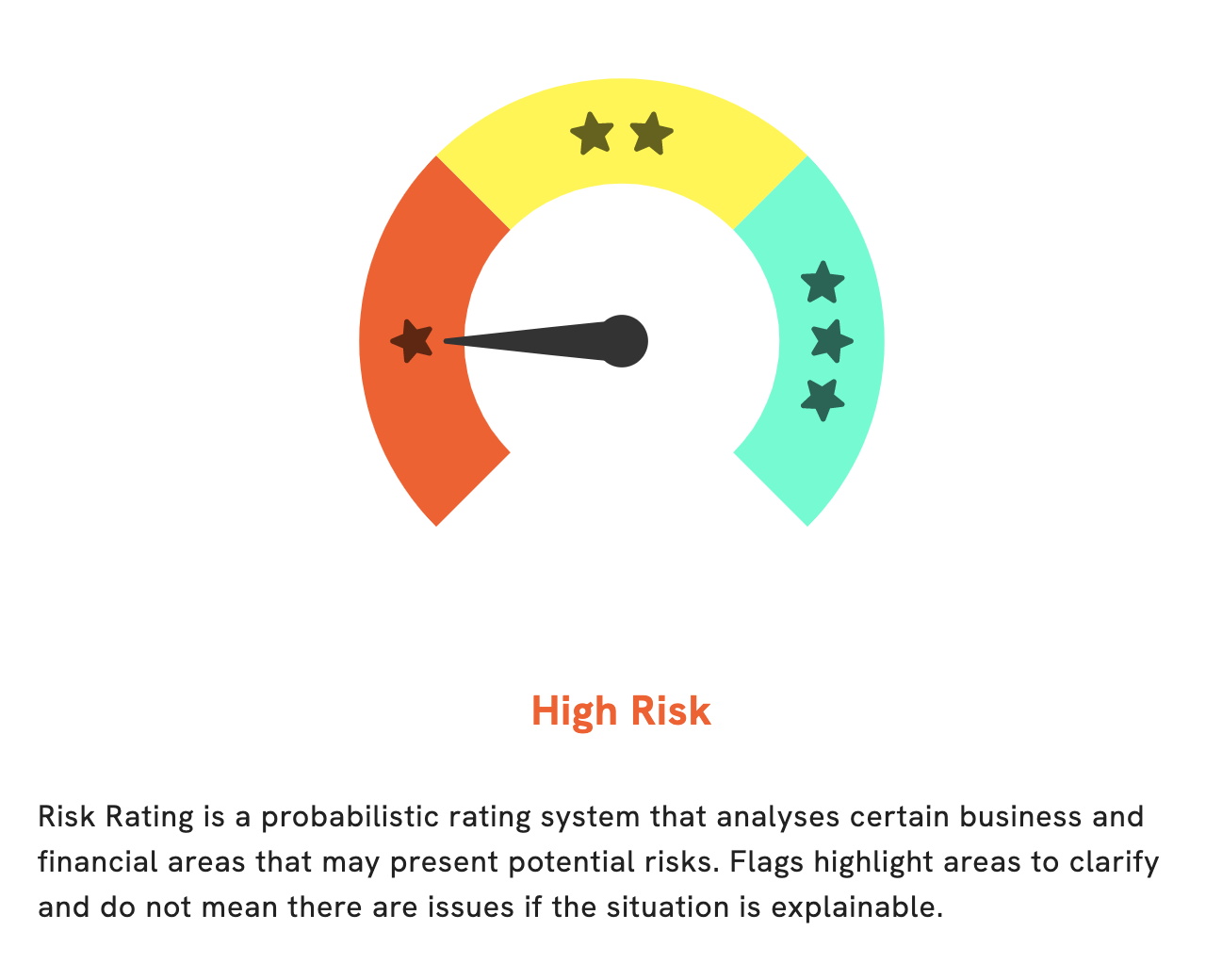

At GoodWhale, we conducted an analysis of VALARIS LIMITED‘s finances and found that it is a high risk investment in terms of financial and business aspects, according to our Risk Rating. We have detected 2 risk warnings in the income sheet and cash flow statement of VALARIS LIMITED. To access this information and to take advantage of our other services, we invite you to become a registered user with GoodWhale. With this, you can receive personalized recommendations for better investing decisions and access more detailed analysis reports about companies. Join us today and benefit from our extensive expertise and resources. More…

Peers

Valaris Ltd. is an offshore drilling contractor that provides drilling and related services to the oil and gas industry. The company operates a fleet of offshore drilling rigs and is headquartered in London, the United Kingdom. Select Energy Services Inc, Transocean Ltd, and Tetra Technologies Inc are all competitors of Valaris Ltd.

– Select Energy Services Inc ($NYSE:WTTR)

As of 2022, Select Energy Services Inc has a market cap of 988.86M and a Return on Equity of 2.29%. The company provides oilfield services and products to exploration and production companies in the United States and Canada. Select Energy Services Inc was founded in 2007 and is headquartered in Houston, Texas.

– Transocean Ltd ($NYSE:RIG)

Transocean Ltd is a Swiss-based international provider of offshore contract drilling services for oil and gas wells. The company has a market cap of 3.11B as of 2022 and a Return on Equity of -0.26%. Transocean’s primary business is offshore contract drilling, and it is one of the largest providers of offshore contract drilling services in the world. The company’s fleet consists of 63 rigs, including 27 ultra-deepwater rigs, 30 deepwater rigs and six high-specification jackups.

– Tetra Technologies Inc ($NYSE:TTI)

Tetra Technologies Inc is a North American oil and gas services company. They provide services to both onshore and offshore oil and gas projects. Their services include drilling, completion, and production services. They also have a presence in the oilfield chemicals market.

Summary

Overall, VALARIS LIMITED reported a slight increase in revenue of 0.5% in the second quarter of FY2023 compared to the same period of the year before. However, their net income took a negative turn, falling from USD 111.6 million to USD -29.4 million. Investors should be weary of this performance and track these metrics closely in order to gain an accurate understanding of the company’s financial performance. Additionally, they should consider the company’s current and future strategies and take into account factors such as market trends and competitive landscape before investing.

Recent Posts