UGI CORPORATION Reports Fourth Quarter Earnings Results for FY2022 on February 2 2023

March 20, 2023

Earnings Overview

On February 2 2023, UGI CORPORATION ($NYSE:UGI) released its financial results for the fourth quarter of FY2022, revealing a total revenue of -954.0 million USD, representing a decrease of 491.0% year-over-year. In contrast, net income rose to 2759.0 million USD, indicating a 42.7% growth compared to the same period in the prior year.

Transcripts Simplified

UGI Corporation reported adjusted diluted earnings per share of $1.14 this quarter, compared to $0.93 in the prior fiscal first quarter. This increase is due to stronger performance in the Global LPG and natural gas businesses, driven by effective margin management and strong expense control efforts.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Ugi Corporation. More…

| Total Revenues | Net Income | Net Margin |

| 10.19k | 216 | 2.8% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Ugi Corporation. More…

| Operations | Investing | Financing |

| 1.07k | -1.13k | 263 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Ugi Corporation. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 17.13k | 11.94k | 28.94 |

Key Ratios Snapshot

Some of the financial key ratios for Ugi Corporation are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 12.7% | -4.8% | 5.4% |

| FCF Margin | ROE | ROA |

| 2.4% | 6.1% | 2.0% |

Stock Price

The company showed great performance as its stock opened at $40.9 and closed at $42.6, a rise of 5.3% from the prior closing price of $40.5. This strong performance has been attributed to the investments and cost-cutting measures that have been implemented since the beginning of the fiscal year.

In addition, the company has seen its revenues increase significantly, due to the growing demand for its products and services in the market. The company has also been expanding its customer base and continues to invest in research and development to stay competitive in the global market. The company’s management team is confident that this trend of success will continue through the coming year and beyond. The report has been well-received by analysts and investors alike, with many confident that this strong performance will lead to larger profits for UGI CORPORATION in the near future. As a result, the stock price is expected to increase further in the coming months. Furthermore, the company is looking to make further investments in order to maintain its competitive edge in a ever-evolving industry. Overall, UGI CORPORATION has made a strong start to FY2022 and is poised for continued success in the future. With its strong financial position, the company is looking to maintain its current momentum and create more profits for shareholders in the long run. Live Quote…

Analysis

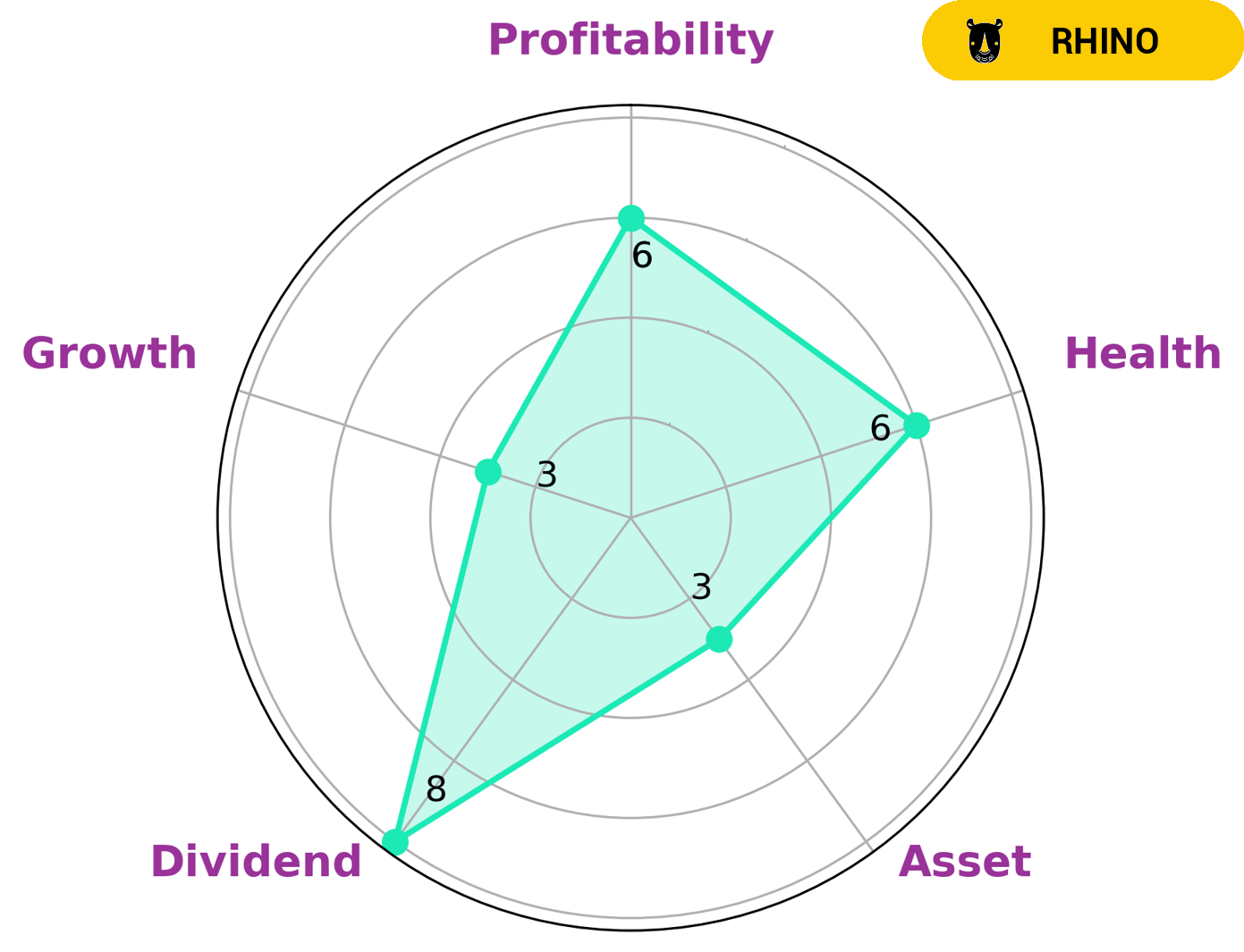

GoodWhale has conducted an analysis of UGI CORPORATION‘s financials in order to determine what type of investors might be interested in such a company. According to our Star Chart, UGI CORPORATION is classified as a ‘rhino’, which we conclude to be companies that have achieved moderate revenue or earnings growth. Additionally, we have found UGI CORPORATION to have an intermediate health score of 6/10 with regard to its cashflows and debt, suggesting that the company might be able to safely ride out any crisis without the risk of bankruptcy. Our evaluation also showed that UGI CORPORATION is strong in dividend, medium in profitability and weak in asset and growth. Taking all of this into consideration, we believe that UGI CORPORATION is a moderately viable investment for investors looking for slow and steady growth. More…

Peers

UGI Corp competes with Chesapeake Utilities Corp, SSE PLC, and Spire Inc in the energy sector. All four companies are engaged in the business of providing energy services, including natural gas, electricity, and propane. All four companies have a presence in the United States, with UGI Corp and Chesapeake Utilities Corp having their headquarters in the US. SSE PLC is headquartered in the UK, while Spire Inc is headquartered in Missouri, US.

– Chesapeake Utilities Corp ($NYSE:CPK)

The company’s market cap is 2.17B as of 2022 and its ROE is 10.92%. The company is a diversified energy delivery company that provides natural gas and electricity to customers in Delaware, Maryland, and Virginia. The company also provides propane gas service in Maryland and Delaware.

– SSE PLC ($LSE:SSE)

SSE PLC is a Scottish electricity company that is headquartered in Perth. The company has a market cap of 16.48B as of 2022 and a Return on Equity of 29.62%. SSE PLC is involved in the generation, transmission, distribution and supply of electricity. The company also has a retail division which supplies gas and electricity to customers in the UK.

– Spire Inc ($NYSE:SR)

Spire Inc. is a publicly traded energy services holding company based in St. Louis, Missouri. The Company, through its subsidiaries, engages in the purchase, sale, and transportation of natural gas in the United States. It operates through two segments: Gas Utility and Gas Marketing. The Gas Utility segment provides retail natural gas service to approximately 547,200 residential, commercial, and industrial customers in Missouri, Alabama, and Mississippi. The Gas Marketing segment purchases, sells, and transports natural gas to electric utilities, local distribution companies, interstate pipelines, producers, and other market participants.

Summary

UGI Corporation‘s fourth quarter earnings report for FY2022 showed a significant decrease in total revenue, with a 491.0% drop year over year. Despite this, the company was still able to report an increase in net income of 42.7% compared to the same quarter of the previous year. The stock price reacted positively to the news, moving up on the same day.

For investors, UGI Corporation appears to be a strong investment opportunity, despite the decrease in revenue. The increase in net income indicates strong profitability and suggests that the company is well-positioned to continue to generate returns in the future.

Recent Posts