TUTOR PERINI Reports 416.8% Year-on-Year Decrease in Q4 FY2022 Revenue

March 18, 2023

Earnings Overview

TUTOR PERINI ($NYSE:TPC) reported total revenue of USD -92.9 million for the fourth quarter of FY2022 ending December 31 2022, a 416.8% year-on-year decrease. Net income for the same time period was USD 906.6 million, 12.6% lower than in the same period of the previous year. These results were announced on March 15 2023.

Transcripts Simplified

At this time all participants are in a listen-only mode. Later, we will conduct a question-and-answer session and instructions will follow at that time. As a reminder, this conference is being recorded. I would now like to turn the conference over to Mr. Mark P. Tutor, Chairman, President and Chief Executive Officer. Please go ahead, sir. Thank you, operator.

On the call with me today is our Chief Financial Officer, Stuart Schmuck. This increase was driven by strong execution on our projects, as well as favorable performance on our civil infrastructure projects. Looking forward, we remain focused on continuing to execute on our large and important projects and are optimistic that our strong backlog positions us well for continued success in the future. We look forward to providing additional updates on today’s earnings call and thank you for your interest in Tutor Perini Corporation. Operator, you may now open the call for questions.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Tutor Perini. More…

| Total Revenues | Net Income | Net Margin |

| 3.79k | -210.01 | -5.5% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Tutor Perini. More…

| Operations | Investing | Financing |

| 206.97 | -65.64 | -78.9 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Tutor Perini. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 4.54k | 3.1k | 28.14 |

Key Ratios Snapshot

Some of the financial key ratios for Tutor Perini are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -5.2% | 5.7% | -5.3% |

| FCF Margin | ROE | ROA |

| 3.9% | -8.4% | -2.7% |

Stock Price

On Wednesday, TUTOR PERINI, a leading construction and civil engineering company, reported an alarming 416.8% year-on-year decrease in its fourth quarter fiscal year 2022 revenue. This news sent the company’s stock prices plummeting–opening at $7.2 and closing at the same figure, down by 3.8% from its previous closing price of $7.4. It is expected that the company’s prospects will remain poor for the upcoming fiscal year, with revenues estimated to stay low due to the pandemic’s lingering effects on the construction industry. TUTOR PERINI’s stock performance will likely remain volatile and unstable in the near future due to its reduced revenues and weak outlook. Live Quote…

Analysis

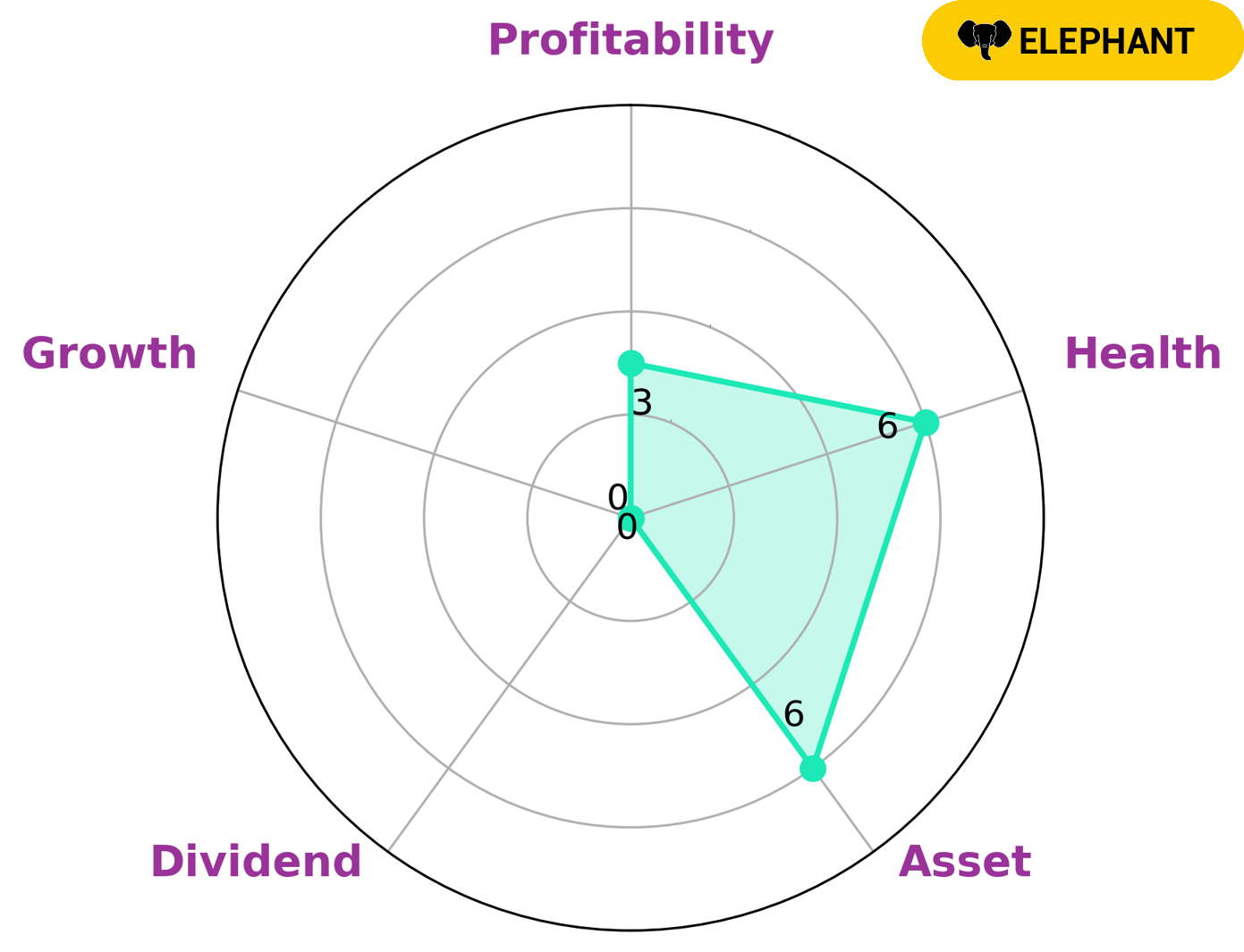

After analyzing TUTOR PERINI‘s fundamentals, GoodWhale has determined that the company has an intermediate health score of 6/10, taking into consideration its cashflows and debt. TUTOR PERINI is classified as an ‘elephant’, which is a type of company with a high level of assets after deducting liabilities. Investors who may be interested in such a company are those who are looking for stability and want to ensure that the company has the ability to sustain future operations in times of crisis. TUTOR PERINI is strong in medium asset and weak in dividend, growth, and profitability. Therefore, investors should take these factors into account when considering any investments. More…

Peers

In the construction industry, Tutor Perini Corp competes with Coteccons Construction Joint Stock Company, Limbach Holdings Inc, and TA Corp Ltd. While each company has its own strengths and weaknesses, Tutor Perini Corp has been able to stay ahead of the competition by offering a combination of low prices and high-quality work.

– Coteccons Construction Joint Stock Company ($HOSE:CTD)

Coteccons Construction Joint Stock Company is a Vietnam-based company engaged in the construction sector. The Company’s main businesses include general contracting, investment, design and construction of civil, industrial, infrastructure and commercial works, as well as real estate trading and development. As of December 31, 2011, the Company had a workforce of approximately 25,000 employees.

– Limbach Holdings Inc ($NASDAQ:LMB)

Limbach Holdings Inc is a publicly traded company with a market capitalization of $83.16 million as of 2022. The company has a return on equity of 10.16%. Limbach Holdings Inc is engaged in the design, engineering, construction, and service of HVAC and mechanical, electrical, and plumbing systems for the commercial, industrial, and institutional markets.

– TA Corp Ltd ($SGX:PA3)

Euronet Worldwide Inc. is a leading provider of electronic payments and transaction processing solutions. The company offers a comprehensive suite of products and services for consumer and business-to-business transactions, including electronic funds transfer, point-of-sale, ATM, money transfer, prepaid processing, card issuing and merchant acquiring. Euronet serves financial institutions, retailers, service providers and individual consumers in over 160 countries.

Euronet’s market cap is $35.75 million, and its ROE is -1.46%. The company offers a wide range of products and services for consumer and business-to-business transactions. It has a strong presence in over 160 countries.

Summary

Tutor Perini Corporation reported total revenue of -$92.9 million for the fourth quarter of FY2022, ending December 31st 2022. This represented a 416.8% decrease from the same period in the previous year. Net income for the same period was $906.6 million, a 12.6% decrease year-on-year. On March 15th 2023, the stock price of Tutor Perini Corporation dropped, reflecting investor sentiment towards the company’s performance.

Despite the lower net income, investors remain optimistic about the potential of Tutor Perini Corporation due to its diversified portfolio of projects and unique customer base. As such, investors are advised to perform their own due diligence and research before investing in Tutor Perini Corporation.

Recent Posts