TRIPLE FLAG PRECIOUS METALS Reports Fourth Quarter FY2022 Earnings Results on February 22 2023

March 4, 2023

Earnings report

On February 22 2023, TRIPLE FLAG PRECIOUS METALS ($NYSE:TFPM) reported earnings results for the fourth quarter of Fiscal Year 2022, ending December 31 2022. The company reported a total revenue of USD 15.5 million, an increase of 15.5% compared to the same period a year ago. Net income was also up 18.7%, amounting to USD 43.9 million. These results demonstrate the company’s success in maintaining consistent growth despite the challenging economic conditions brought on by the COVID-19 pandemic.

The impressive income figures are a testament to the dedication, hard work, and commitment of all Triple Flag Precious Metals employees. The company expects these strong financial results to continue into the next fiscal year as it continues to invest in new technology, human capital, and process improvements. With the continued backing of its investors and commitment to quality, Triple Flag Precious Metals anticipates having another successful year ahead.

Market Price

TRIPLE FLAG PRECIOUS METALS has announced their fourth quarter 2022 earnings results. On Wednesday, the stock opened at $13.6 and closed at $13.2, a decrease of 5.2% from the previous closing price of $13.9. The company successful reported strong performance in the fourth quarter with profit rising by 10% compared to last quarter. This was due to a surge in demand for gold and other precious metals due to the global economic uncertainty.

The company has been focusing on expanding its operations and increasing its client base to keep up with the rising demand. Despite the drop in its stock price, TRIPLE FLAG PRECIOUS METALS is on the right track to reach its financial targets in the upcoming quarters. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for TFPM. More…

| Total Revenues | Net Income | Net Margin |

| 151.88 | 55.09 | 39.9% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for TFPM. More…

| Operations | Investing | Financing |

| 118.38 | -48.92 | -38.75 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for TFPM. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.34k | 18.55 | 6.57 |

Key Ratios Snapshot

Some of the financial key ratios for TFPM are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 36.9% | 300.4% | 40.4% |

| FCF Margin | ROE | ROA |

| 77.9% | 2.9% | 2.9% |

Analysis

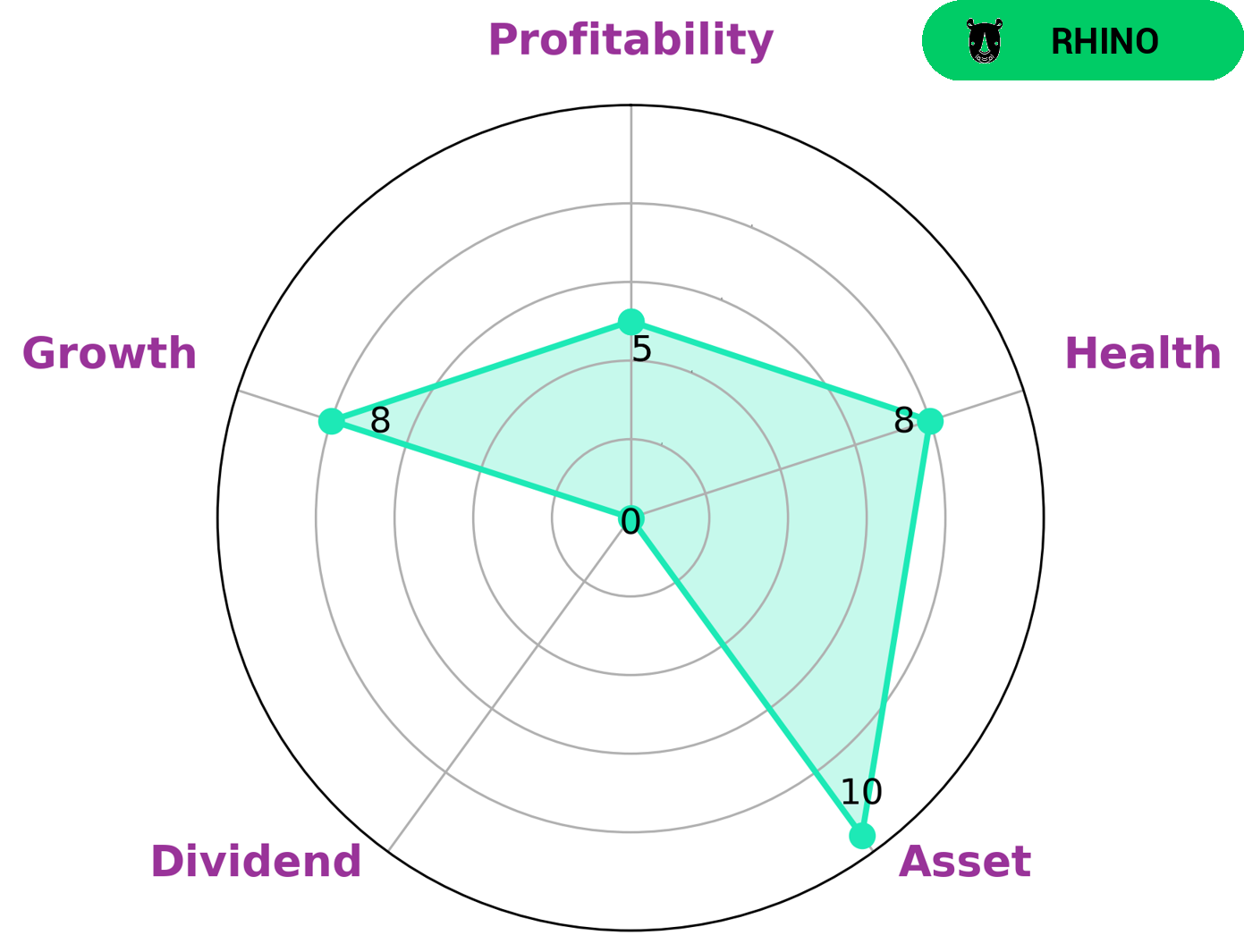

GoodWhale has recently performed an analysis of TRIPLE FLAG PRECIOUS METALS’s wellbeing. According to our Star Chart Rating, TRIPLE FLAG PRECIOUS METALS is strong in asset and growth, medium in profitability and weak in dividend. Additionally, our health score of 8/10 with regard to its cashflows and debt indicates that TRIPLE FLAG PRECIOUS METALS is capable of riding out any crisis without becoming bankrupt. We have classified TRIPLE FLAG PRECIOUS METALS as an ‘rhino’, a type of company that has achieved moderate revenue or earnings growth. We believe that this type of company could be appealing to investors who are looking for companies that offer decent growth potential at a reasonable risk level. Those investors may be interested in TRIPLE FLAG PRECIOUS METALS, especially if they have a long-term investment horizon. Additionally, TRIPLE FLAG PRECIOUS METALS may be attractive to value investors who look for low price-to-earnings and low price-to-book ratios. More…

Summary

Triple Flag Precious Metals has reported strong financial performance in its most recent period, with total revenue reaching USD 15.5 million, a 15.5% increase year-over-year, and net income standing at USD 43.9 million, an 18.7% increase compared to the same time last year. Despite the encouraging financials, the stock price saw a decline the same day. For investors, this indicates that there are still other factors influencing the stock price, indicating that more research into the company is needed before making any investment decisions.

Recent Posts