Trican Well Service Reports Q1 Earnings for FY2023, Ending March 31 2023

May 27, 2023

Earnings Overview

On May 11, 2023, TRICAN WELL SERVICE ($TSX:TCW) released its financial report for the first quarter of FY2023, which ended on March 31, 2023. With total revenue of CAD 297.0 million, a 35.7% increase year-over-year, and net income of CAD 46.0 million, the company saw a remarkable growth compared to the 13.3 million net income of the previous year.

Market Price

On Thursday, Trican Well Service reported its earnings for the first quarter of the fiscal year 2023 which ended on March 31st, 2023. The stock opened at CA$3.0 and after a day of volatile trade, it eventually closed at CA$2.9, down by 2.6% from its previous closing price of CA$3.0. The company has been plagued by a turbulent couple of months and had to face the effects of the pandemic which has impacted their operations significantly.

However, the company has managed to make efficient use of technology and digitalization to minimize the impacts of the virus while still providing services that are of high quality. Trican Well Service also reported that they have made use of cost control strategies to reduce expenses and focus on preserving cash flows. The company is expecting to see improved cash flows in the coming quarters and is confident that their cost control strategies will help them weather this storm. The management team at Trican Well Service is optimistic about their growth prospects and is looking forward to the coming year with confidence. They are continuing to make strategic investments in technology and digitalization to ensure that they remain competitive in the market and continue to provide quality services to their customers. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for TCW. More…

| Total Revenues | Net Income | Net Margin |

| 944.42 | 111.91 | 12.0% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for TCW. More…

| Operations | Investing | Financing |

| 172.68 | -80.2 | -71.3 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for TCW. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 713.31 | 203.09 | 2.2 |

Key Ratios Snapshot

Some of the financial key ratios for TCW are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 17.0% | 7.5% | 16.3% |

| FCF Margin | ROE | ROA |

| 7.5% | 18.9% | 13.5% |

Analysis

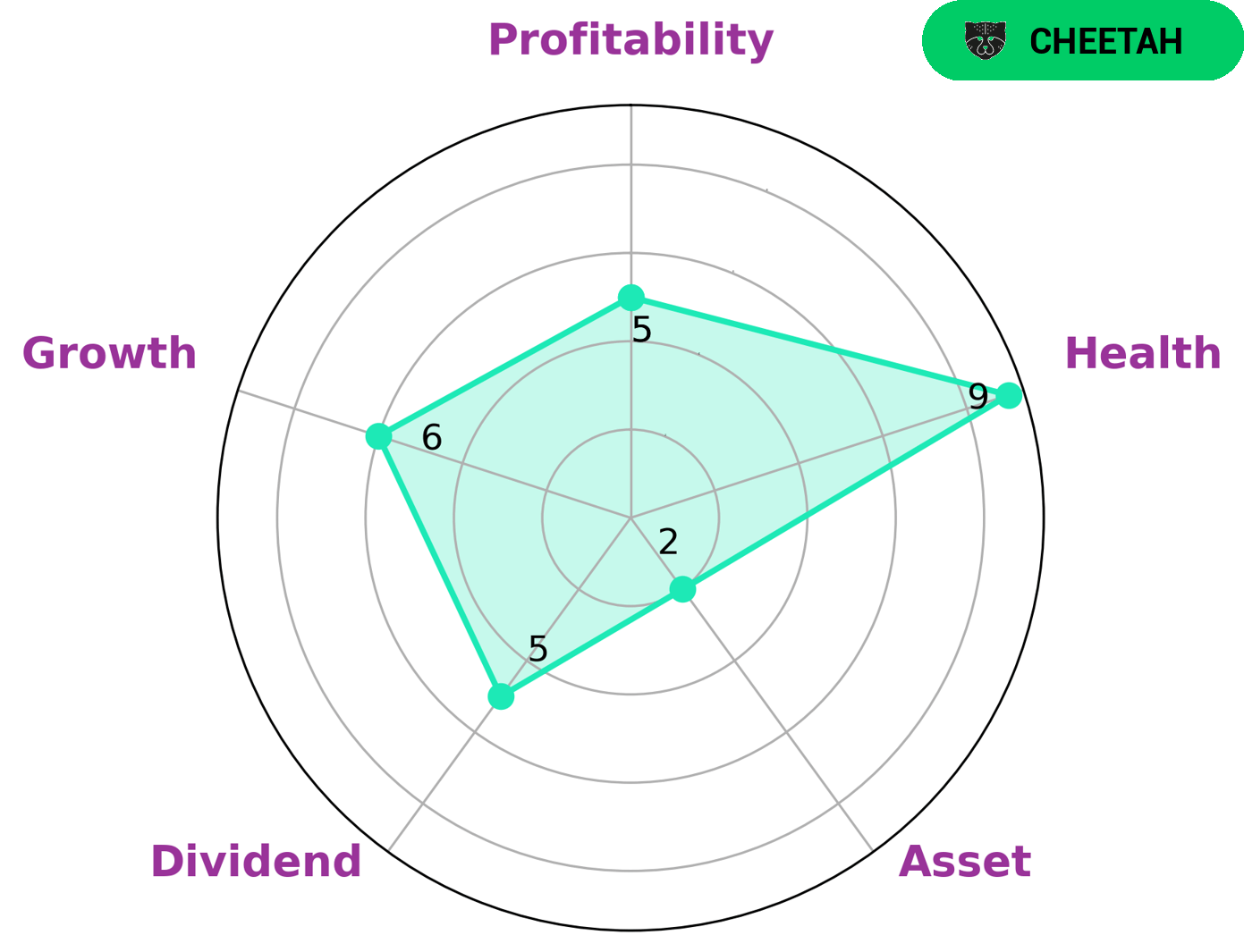

At GoodWhale we analyzed the fundamentals of TRICAN WELL SERVICE. Based on our Star Chart, TRICAN WELL SERVICE is strong in dividend, medium in growth, and weak in profitability and assets. We classified TRICAN WELL SERVICE as a ‘cheetah’, which is a type of company that has achieved high revenue or earnings growth but is considered less stable due to lower profitability. Investors who are interested in high-growth stocks may be intrigued by TRICAN WELL SERVICE’s classification as a cheetah. The company has a high health score of 9/10 with regard to its cashflows and debt, indicating that it is capable to pay off debt and fund future operations. We suggest that investors do their due diligence and assess their risk profile before investing in such companies. More…

Peers

In the oil and gas industry, Trican Well Service Ltd competes with Essential Energy Services Ltd, Nine Energy Service Inc, and Zhejiang Renzhi Co Ltd. All four companies provide services that are essential to the industry, including drilling, completion, and production services. While all four companies are similar in many ways, they each have their own unique strengths and weaknesses that give them a competitive advantage or disadvantage in the market.

– Essential Energy Services Ltd ($TSX:ESN)

Essential Energy Services Ltd is a Canadian oilfield services company that provides a range of services to the oil and gas industry, including drilling, completions, and production services. The company has a market cap of 49.43M as of 2022 and a Return on Equity of -4.38%. The company’s products and services are used in the exploration, development, and production of oil and natural gas. Essential Energy Services Ltd operates in Canada, the United States, and Australia.

– Nine Energy Service Inc ($NYSE:NINE)

Nine Energy Service Inc is a publicly traded oilfield services company headquartered in Houston, Texas. The company provides completion, production, and intervention services to the upstream oil and gas industry with a focus on North America shale plays. Its services include hydraulic fracturing, coiled tubing, cased hole wireline, and other well completion and intervention services.

The company has a market cap of 141.43M as of 2022. Its return on equity (ROE) is 10.99%.

Nine Energy Service Inc is a leading provider of completion, production, and intervention services to the upstream oil and gas industry with a focus on North America shale plays. The company’s services include hydraulic fracturing, coiled tubing, cased hole wireline, and other well completion and intervention services.

Nine Energy Service Inc has a market cap of 141.43M as of 2022, a Return on Equity of 10.99%.

– Zhejiang Renzhi Co Ltd ($SZSE:002629)

Zhejiang Renzhi Co Ltd is a Chinese company that manufactures and sells building materials. The company has a market cap of 1.79B as of 2022 and a return on equity of -551.14%. The company’s products include cement, concrete, bricks, and tiles.

Summary

Trican Well Service reported impressive first quarter earnings for the fiscal year 2023, with total revenue increasing by 35.7% and net income more than tripling from the previous year. Investors should be encouraged by the company’s strong performance, and the sector outlook appears positive with strong momentum in North America. Furthermore, Trican has made strategic moves to capitalize on the changing market conditions, such as expanding its fleet of transportation units and continuing its focus on operational efficiency and cost control. With these factors in mind, Trican looks like a promising investment opportunity for investors.

Recent Posts