TORO COMPANY Reports Record Q1 Earnings for FY2023

March 11, 2023

Earnings Overview

TORO COMPANY ($NYSE:TTC) announced its financial results for the three months ended January 31 2023 on March 9 2023. The company reported total revenue of USD 106.9 million, which represented a 53.7% increase from the same period of FY2022. Additionally, its net income increased 23.2% on a year-over-year basis, amounting to USD 1148.8 million.

Transcripts Simplified

Q1 Earnings Transcript Chairman and CEO: Good morning and welcome to Toro Company‘s first quarter earnings call. We have had a great start to the year and are pleased to report strong financial performance in the first quarter. Our improved profitability is a testament to our efforts to drive efficiency and maximize profitability. This growth was driven by strong demand in Europe and Asia, as well as increased market share in the Middle East.

We are confident in the strength of our balance sheet and our ability to continue to execute on our long-term strategy. Thank you for your time today, and we look forward to providing updates on our progress.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Toro Company. More…

| Total Revenues | Net Income | Net Margin |

| 4.73k | 480.69 | 10.2% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Toro Company. More…

| Operations | Investing | Financing |

| 318.37 | -156.83 | -176.67 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Toro Company. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 3.65k | 2.21k | 13.8 |

Key Ratios Snapshot

Some of the financial key ratios for Toro Company are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 12.7% | 21.5% | 13.5% |

| FCF Margin | ROE | ROA |

| 3.3% | 28.6% | 10.9% |

Share Price

On Thursday, TORO COMPANY reported record Q1 earnings for the fiscal year 2023, with their stock opening at $113.7 and closing at $115.9, representing an impressive increase of 2.3% from its previous closing price of 113.3. This marked TORO COMPANY’s highest quarterly profits to date, driven by strong growth in sales and a solid increase in customer demand for their products and services. TORO COMPANY attributed their success in the first quarter to the company’s increased focus on expanding their customer base by leveraging innovative digital technologies and marketing strategies. TORO COMPANY also reported significant improvement in their operational efficiency and cost-cutting measures, resulting in higher profits margins.

Furthermore, the company also benefited from a favorable macroeconomic environment, which enabled them to capitalize on numerous growth opportunities. Overall, TORO COMPANY’s strong performance in the first quarter of FY2023 is a testament to the company’s commitment to excellence, and the results further illustrate their ability to execute successful strategies and capitalize on favorable market conditions. With the Q1 earnings already surpassing analysts’ expectations, TORO COMPANY is well positioned to continue posting strong results in the coming quarters as well. Live Quote…

Analysis

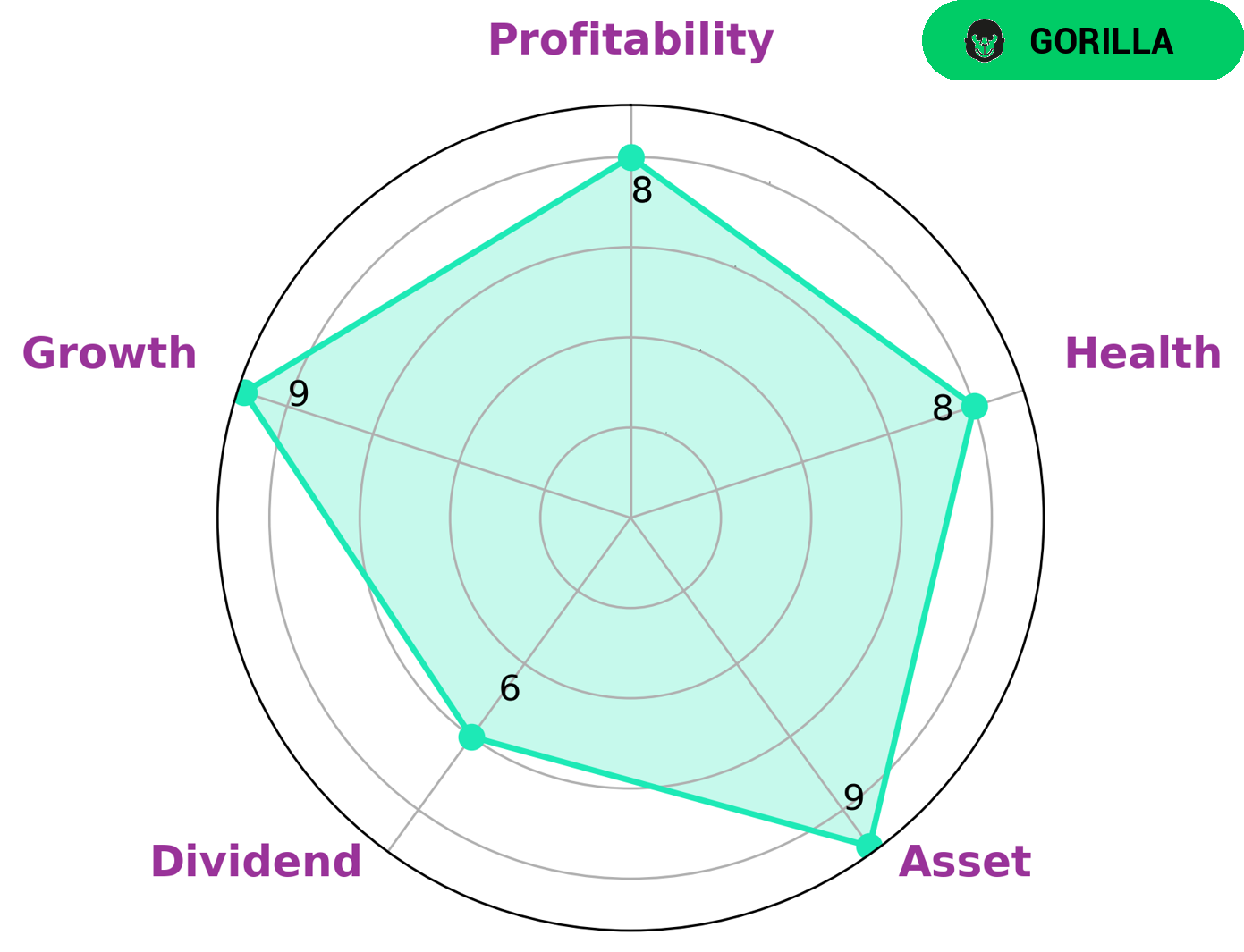

GoodWhale recently conducted an analysis of TORO COMPANY‘s wellbeing. The results of the Star Chart showed that TORO COMPANY has a high health score of 8/10, and is in a good position to pay off debt and fund future operations. The company’s assets, growth, and profitability are all strong, while its dividend is rated as medium. TORO COMPANY is classified as a ‘gorilla’, a type of company that has achieved stable and high revenue or earning growth due to its strong competitive advantage. This type of company may be of interest to a wide variety of investors, from those looking for a solid return on their investments to those who are looking to diversify their portfolio with a stock that has strong upside potential. Additionally, the stability of TORO COMPANY due to its competitive advantage can provide peace of mind to investors who are looking to invest in a reliable stock. More…

Peers

Toro Co is a leading manufacturer of hydraulic elements and systems. Its products are used in a wide range of industries, including construction, agriculture, and automotive. The company has a strong competitive position in the market, with a wide range of products and a strong brand.

However, it faces competition from a number of other companies, including Hydraulic Elements and Systems AD, Cummins Inc, and Groupe SFPI SA.

– Hydraulic Elements and Systems AD ($LTS:0NZ4)

Hydraulic Elements and Systems AD is a leading manufacturer of hydraulic components and systems for a variety of industries. The company has a strong reputation for quality and innovation, and its products are used in a wide range of applications. Hydraulic Elements and Systems AD has a market cap of 113.71M as of 2022, a Return on Equity of 13.72%. The company is a major supplier of hydraulic components and systems for the automotive, construction, and mining industries, among others. Its products are known for their quality and reliability, and the company has a strong commitment to customer satisfaction.

– Cummins Inc ($NYSE:CMI)

Cummins Inc is a global power leader that designs, manufactures, sells and services diesel engines and related technologies, including fuel systems, controls, air handling, filtration, emission solutions and electrical power generation systems. Headquartered in Columbus, Indiana, USA, Cummins employs approximately 62,600 people in about 190 countries and territories.

– Groupe SFPI SA ($LTS:0N9P)

Groupe SFPI is a French holding company that specializes in financial and investment services. The company has a market capitalization of 189.59 million as of 2022 and a return on equity of 12.35%. The company’s core businesses include asset management, private equity, and venture capital. Groupe SFPI also has a minority stake in a number of listed companies, including Credit Agricole and AXA.

Summary

TORO COMPANY had a strong start to FY2023, with total revenue increasing by 53.7% compared to the same period last year. Net income also rose by 23.2%, to USD 1148.8 million. This suggests that the company is well-positioned for growth and could be an attractive investment option for investors.

The company’s robust financial performance signals good potential for further expansion and increased shareholder value. Investors should take advantage of the company’s strong performance and consider investing in TORO COMPANY.

Recent Posts