TimkenSteel Co. Shares Gap Up After Strong Earnings Report

May 9, 2023

Trending News ☀️

TIMKENSTEEL ($NYSE:TMST): TimkenSteel Corporation is an Ohio-based steel production and manufacturing company. On Friday morning, TimkenSteel Co. shares experienced a sharp increase in their market value after the company released their quarterly financial report. The report exceeded expectations, showing higher than expected sales and profits. As a result of this report, TimkenSteel Co.’s share price surged at the opening of the market on Friday.

This sudden spike created a “gap up” in the trading, which is when the stock price opens above the previous day’s closing rate. Investors were quick to jump on the news, sending TimkenSteel Co.’s stock up more than 10% by the end of the day. The company’s strong earnings report has investors optimistic about the future performance of TimkenSteel Co., and its stock is expected to continue to rise in the coming weeks.

Earnings

TIMKENSTEEL CORPORATION has seen significant progress over the past three years, with a total revenue increase from 273.6M USD to 323.5M USD in FY2023 Q1 as of March 31 2023. This represents a 8.1% decrease in total revenue and a 61.2% decrease in net income. The release of the earning report for FY2023 Q1 prompted investors to react positively, causing a gap up in the company’s stock. The market’s enthusiasm for TIMKENSTEEL CORPORATION’s performance suggests the company is well-positioned for continued growth in the future.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Timkensteel Corporation. More…

| Total Revenues | Net Income | Net Margin |

| 1.3k | 42.4 | 3.0% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Timkensteel Corporation. More…

| Operations | Investing | Financing |

| 131 | -24.3 | -119.3 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Timkensteel Corporation. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.14k | 443.9 | 15.71 |

Key Ratios Snapshot

Some of the financial key ratios for Timkensteel Corporation are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 5.8% | 178.9% | 6.1% |

| FCF Margin | ROE | ROA |

| 7.7% | 7.2% | 4.3% |

Stock Price

Monday proved to be a great day for TIMKENSTEEL CORPORATION shareholders, as its stock opened at $17.6 and closed at the same price, up 1.6% from last closing price of 17.3. These impressive results have increased investor confidence in the company and driven the stock price up. Live Quote…

Analysis

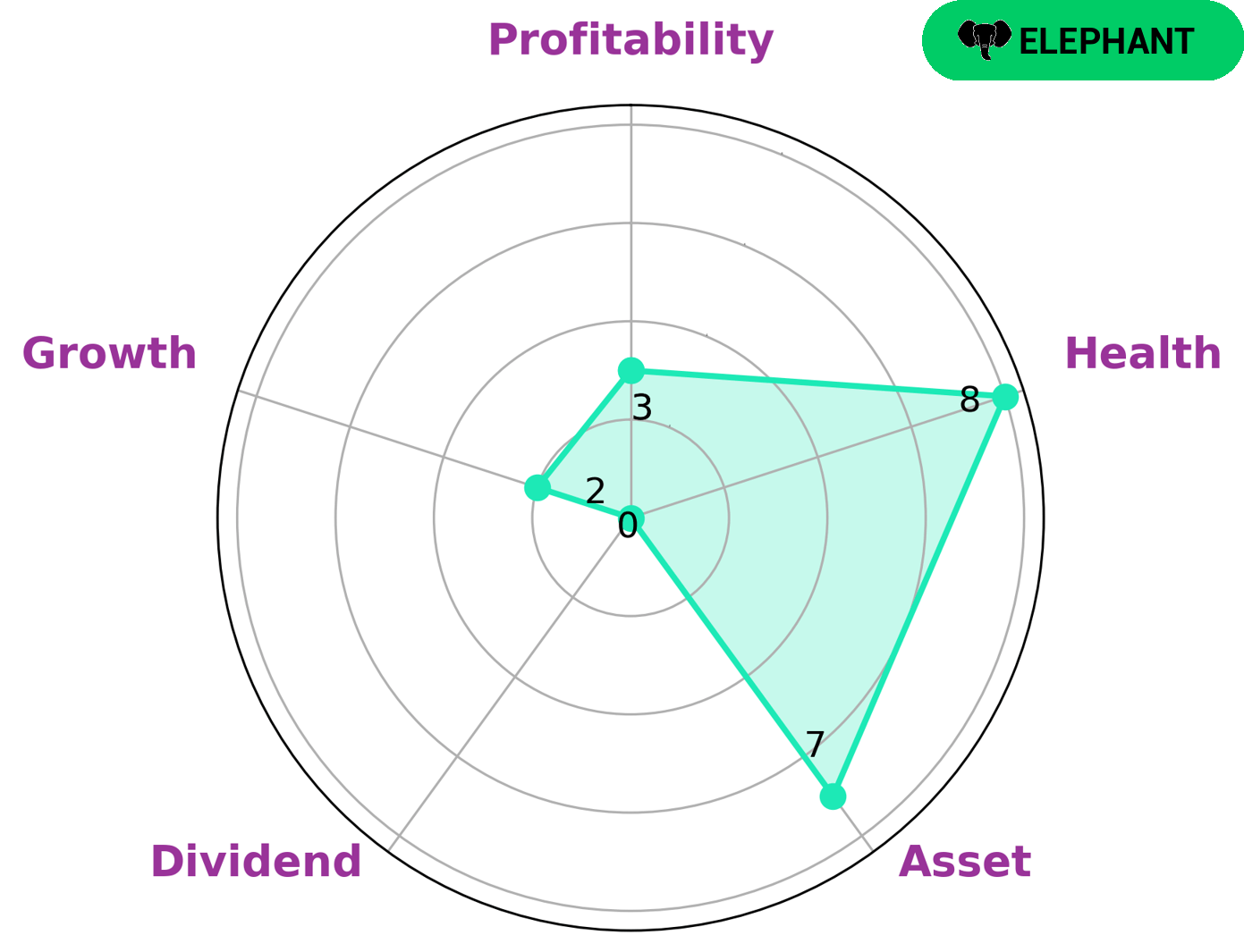

As an investor, you may be interested in analyzing the financials of TIMKENSTEEL CORPORATION. After running our analysis, we have classified TIMKENSTEEL CORPORATION as an ‘elephant’, a type of company which is rich in assets after deducting off liabilities. We have also assigned it a health score of 8/10 considering its cashflows and debt, meaning it is capable to safely ride out any crisis without the risk of bankruptcy. However, it is important to note that while TIMKENSTEEL CORPORATION is strong in asset, the company is weak in dividend, growth, and profitability. Therefore, investors should consider these factors when assessing the potential of this company. More…

Peers

The company produces a variety of steel products, including alloy, carbon, and micro-alloy steels. The company’s competitors include Reliance Steel & Aluminum Co, ISMT Ltd, Jindal Stainless (Hisar) Ltd, and others.

– Reliance Steel & Aluminum Co ($NYSE:RS)

Reliance Steel & Aluminum Co is a publicly traded company with a market cap of 11.39B as of 2022. The company has a Return on Equity of 24.44%. Reliance Steel & Aluminum Co is engaged in the business of processing and selling steel and aluminum products.

– ISMT Ltd ($BSE:532479)

Siemens is a global powerhouse focusing on the areas of electrification, automation, and digitalization. One of the world’s largest producers of energy-efficient, resource-saving technologies, Siemens is a leading supplier of systems for power generation and transmission as well as medical diagnosis. With approximately 372,000 employees in more than 190 countries, Siemens reported worldwide revenue of €83.0 billion in 2020.

– Jindal Stainless (Hisar) Ltd ($BSE:539597)

Jindal Stainless (Hisar) Ltd is an Indian stainless steel company. It has a market cap of Rs. 7,673 crores and a return on equity of 31.59%. The company produces a range of stainless steel products including sheets, coils, and pipes.

Summary

TIMKENSTEEL Corporation is a leading steel manufacturer with a strong performance in the global market. Investors are taking notice as the stock price gapped up before the market opened on Friday following a strong earnings report. Analysts suggest that the company is well positioned to benefit from favorable long-term growth prospects and the strength of its operational performance. TIMKENSTEEL has managed to increase both revenue and profit over the past several years, and its recent earnings report suggests that it is continuing to grow. The company’s balance sheet looks healthy, with a low debt-to-equity ratio and plenty of cash on hand.

Additionally, the stock has a low beta and pays an attractive dividend, making it an attractive investment for those looking for a stable steel stock with upside potential.

Recent Posts