TimkenSteel Co. Earnings Estimated to Increase in 2023 According to KeyCorp Analysts

March 20, 2023

Trending News ☀️

TIMKENSTEEL ($NYSE:TMST): Analysts from KeyCorp recently released an updated report that is predicting increased earnings for TimkenSteel Co in the coming year. This is a significant jump from estimates made at the start of the year, where analysts had initially projected a 10 percent increase in earnings. The overall market outlook for the steel industry appears to be improving, and KeyCorp has taken this into consideration when making their projections. They highlighted the strong demand for steel products across various sectors, including automotive, energy and aerospace.

Additionally, the analysts noted the continued investments made by TimkenSteel Co in process and technological advancements, which are expected to help the company remain competitive. Additionally, TimkenSteel Co’s recent strategic partnership with a global steel supplier has also been seen as a positive development for the company. The partnership will create further opportunities for TimkenSteel Co to expand its presence in global markets, allowing it to capture new markets and increase its revenues. Overall, these positive developments have led to an optimistic outlook for TimkenSteel Co’s future. If their current trajectory continues, the company can expect to see increased earnings in 2023 according to KeyCorp analysts.

Share Price

On Friday, the stock opened at $16.3 and closed at $15.7, a decrease of 4.3% from the prior closing price of $16.4. This news has caused the stock to take a hit, but analysts remain optimistic that the company will be able to rebound in the coming year. With strong cost-cutting efforts, innovative product development, and continued focus on customer satisfaction, TimkenSteel Corporation appears well positioned to see increased earnings in 2023. The company’s dedication to growth and profitability makes it an attractive investment for those looking for a strong return on their money. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Timkensteel Corporation. More…

| Total Revenues | Net Income | Net Margin |

| 1.33k | 65.1 | 5.5% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Timkensteel Corporation. More…

| Operations | Investing | Financing |

| 134.5 | -21.7 | -114.6 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Timkensteel Corporation. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.08k | 395.5 | 15.57 |

Key Ratios Snapshot

Some of the financial key ratios for Timkensteel Corporation are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 3.2% | 178.9% | 7.6% |

| FCF Margin | ROE | ROA |

| 8.1% | 8.9% | 5.8% |

Analysis

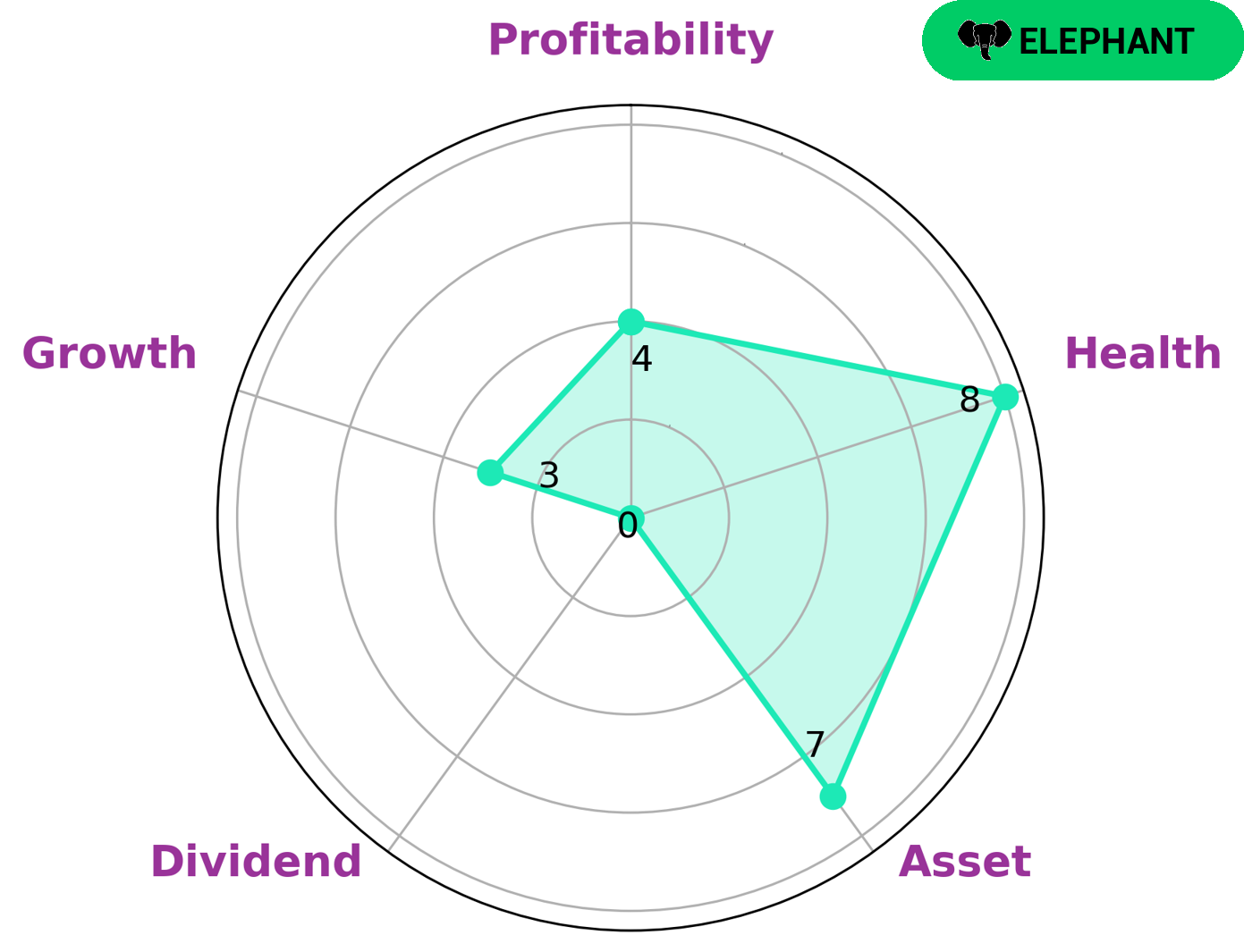

GoodWhale has conducted an analysis of TIMKENSTEEL CORPORATION’s wellbeing and our Star Chart indicates the company has a healthy score of 8/10 when it comes to cashflows and debt, meaning it is capable of riding out short-term market fluctuations without fear of bankruptcy. This makes it an ‘elephant’ type of company – one that is rich in assets after deducting off liabilities. These qualities make TIMKENSTEEL CORPORATION an attractive proposition for investors. It has strong assets, medium profitability and weak dividend growth potential, making it a suitable choice for investors looking for a safe investment with moderate returns. It may also interest value investors who are looking for companies with high potential. Long-term investors may find an attractive opportunity in the company, as its size and financial security offer a degree of stability that other companies may not be able to provide. More…

Peers

The company produces a variety of steel products, including alloy, carbon, and micro-alloy steels. The company’s competitors include Reliance Steel & Aluminum Co, ISMT Ltd, Jindal Stainless (Hisar) Ltd, and others.

– Reliance Steel & Aluminum Co ($NYSE:RS)

Reliance Steel & Aluminum Co is a publicly traded company with a market cap of 11.39B as of 2022. The company has a Return on Equity of 24.44%. Reliance Steel & Aluminum Co is engaged in the business of processing and selling steel and aluminum products.

– ISMT Ltd ($BSE:532479)

Siemens is a global powerhouse focusing on the areas of electrification, automation, and digitalization. One of the world’s largest producers of energy-efficient, resource-saving technologies, Siemens is a leading supplier of systems for power generation and transmission as well as medical diagnosis. With approximately 372,000 employees in more than 190 countries, Siemens reported worldwide revenue of €83.0 billion in 2020.

– Jindal Stainless (Hisar) Ltd ($BSE:539597)

Jindal Stainless (Hisar) Ltd is an Indian stainless steel company. It has a market cap of Rs. 7,673 crores and a return on equity of 31.59%. The company produces a range of stainless steel products including sheets, coils, and pipes.

Summary

KeyCorp analysts recently estimated that TimkenSteel Corporation‘s earnings will increase in 2023.

However, despite the positive outlook, the stock price of the company dropped on the same day. This suggests that investors may have a cautious outlook for the company. The company should focus on developing strategies to improve its operations and increase profitability. It should also look for new opportunities to expand its market share and gain a competitive edge over its rivals. Potential investors should watch for any changes in the company’s performance and keep track of current market conditions to weigh the risk and reward of investing in TimkenSteel Corporation.

Recent Posts