TH INTERNATIONAL Reports Record First Quarter Earnings for Fiscal Year 2023

June 3, 2023

🌥️Earnings Overview

On May 31, 2023, TH INTERNATIONAL ($NASDAQ:THCH) revealed its fiscal year 2023 first quarter earnings results, ending on March 31, 2023, showing total revenue of CNY 336.5 million – a 49.8% increase from the same period in the prior year. However, net income was reported to be CNY -174.9 million, compared to CNY -150.6 million in the previous year.

Share Price

Despite a strong start to the trading day, with TH INTERNATIONAL stock opening at $2.9, the share value had plunged by 11.4% by the end of the day, closing at $2.6. This was a significant drop from the last closing price of $3.0. The company attributed this downturn in their stock value to a greater-than-anticipated delay in a major project that was scheduled to be completed in the first quarter. The company cited a lack of material resources as the primary cause for this delay.

Though the overall profits for the quarter were still positive, investors were concerned about the company’s ability to meet deadlines and execute projects on time in the future. This demonstrates that the company’s business model remains strong and that it is weathering market volatility well. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Th International. More…

| Total Revenues | Net Income | Net Margin |

| 1.12k | -766.91 | -51.1% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Th International. More…

| Operations | Investing | Financing |

| -253.23 | -530.67 | 926.45 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Th International. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 2.68k | 2.58k | 0.66 |

Key Ratios Snapshot

Some of the financial key ratios for Th International are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 160.4% | – | -66.9% |

| FCF Margin | ROE | ROA |

| -52.4% | -449.4% | -17.5% |

Analysis

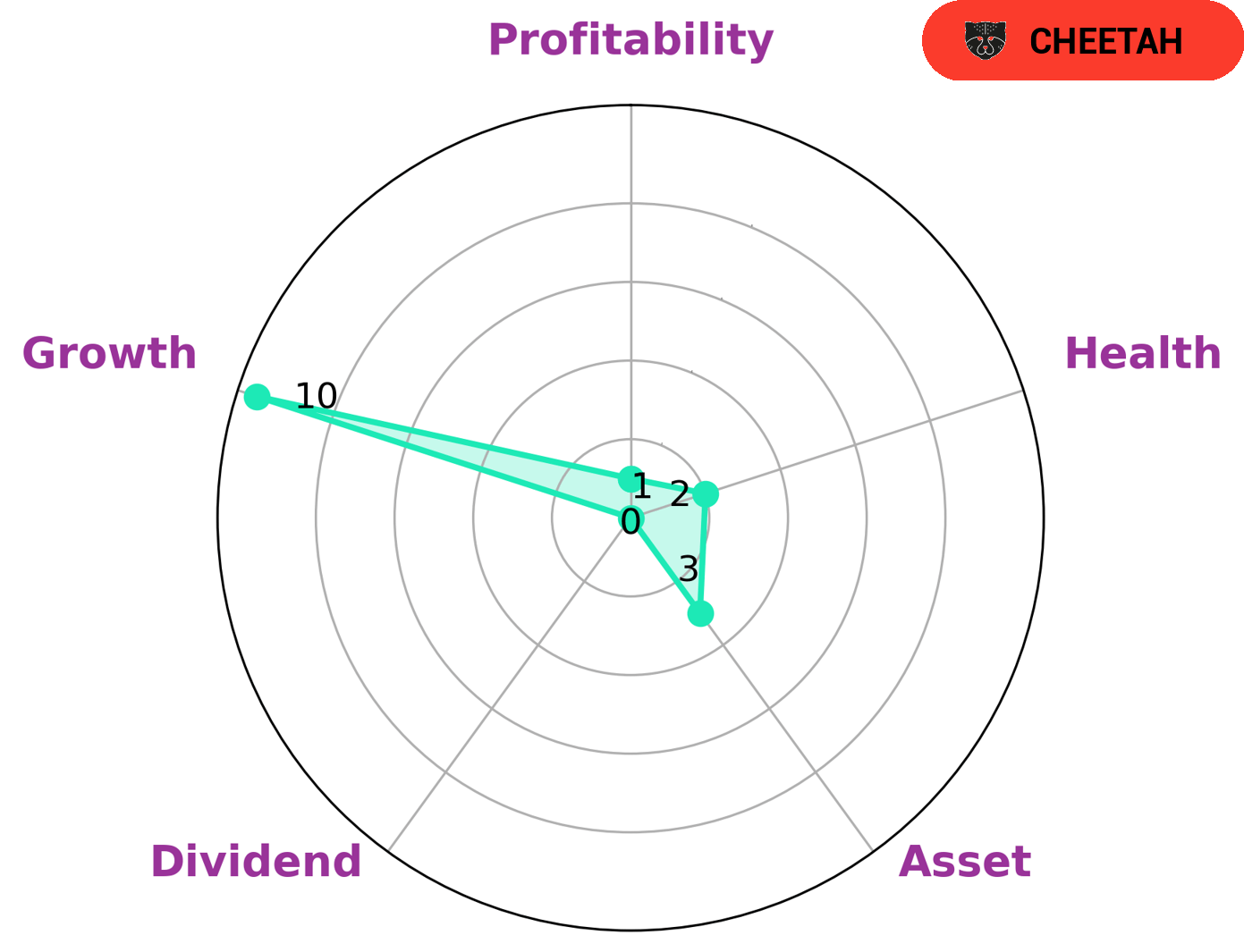

At GoodWhale, we recently conducted an analysis of TH INTERNATIONAL‘s wellbeing. Our Star Chart revealed that TH INTERNATIONAL had a low health score of 2/10 considering its cashflows and debt. This indicates that this company is less likely to safely ride out any crisis without the risk of bankruptcy. Upon further investigation, we determined that TH INTERNATIONAL is classified as a ‘cheetah’ company. This means that it has achieved high revenue or earnings growth but is considered less stable due to lower profitability. For these reasons, TH INTERNATIONAL may be attractive to certain investors. It is strong in terms of growth, however it is weak in terms of assets, dividends, and profitability. Investors who are willing to take on higher risk in exchange for potential rewards may find this company to be a good fit. More…

Peers

The competition between TH International Ltd and its competitors, Restaurant Brands International Inc, Yum China Holdings Inc and Starbucks Corp, is fierce as these four companies strive to gain the competitive edge in the global market. Each company is leveraging their brand recognition and offerings to draw in customers and establish a foothold in their respective markets. The competition has heated up in recent years as new products are released and each company strives to be the best in the business.

– Restaurant Brands International Inc ($TSX:QSR)

Restaurant Brands International Inc is a global restaurant company that owns, operates, and franchises some of the world’s most iconic food and beverage brands. As of 2023, the company has a market cap of 27.61 billion dollars and a Return on Equity (ROE) of 48.76%, reflecting its successful strategies and strong financial performance. Market cap is the total market value of a company’s outstanding shares, while the ROE is an indicator of the efficiency with which a company is using its assets to generate profits. A high ROE indicates that the company is using its assets to generate higher returns, which can be beneficial for shareholders. Restaurant Brands International Inc’s large market cap and impressive ROE suggest that it has a very successful business model and financial situation.

– Yum China Holdings Inc ($NYSE:YUMC)

Yum China Holdings Inc is a multinational fast food company specializing in quick service restaurant brands. As of 2023, Yum China has a market capitalization of 26.16 billion USD, making it one of the largest restaurant companies in the world. Yum China also has a Return on Equity of 6.38%, suggesting that the company is able to generate returns on investments made through equity financing. This strong financial performance indicates that the company is able to deliver good returns to its shareholders.

– Starbucks Corp ($NASDAQ:SBUX)

Starbucks Corp is a global coffee company and coffeehouse chain. It is the largest coffeehouse chain in the world, operating over 30,000 stores in more than 70 countries. As of 2023, Starbucks has a massive market cap of 120.31B. This market cap reflects the company’s success in providing high-quality products and services to customers around the world. Despite its impressive market cap, the company has seen a negative return on equity (ROE) of -34.53%, which is an indicator that the company’s investments have not been as successful as hoped.

Summary

TH INTERNATIONAL recently announced its first quarter financial results for the fiscal year 2023, which showed total revenue of CNY 336.5 million, a 49.8% increase from the same period last year. Unfortunately, the net income for the same quarter fell to CNY -174.9 million, down from the previous year’s CNY -150.6 million. This led to a downward movement in stock prices on May 31, 2023. Investors should approach TH INTERNATIONAL with caution as this may be a sign of further losses to come in the future.

However, given that the company’s revenue has grown significantly, there could also be opportunities for potential growth. Investors should assess the company’s financial performance and future prospects before investing in TH INTERNATIONAL.

Recent Posts