Taylor Morrison Home Reports Fourth Quarter Earnings Results for FY2022

March 31, 2023

Earnings Overview

On February 15 2023, Taylor Morrison Home ($NYSE:TMHC) announced its financial results for the fourth quarter of FY2022, ending December 31 2022. The revenue was USD 275.3 million, a rise of 1.0% compared to the same quarter the previous year, while net income totaled USD 2492.1 million, representing a decrease of 0.5% compared to the same quarter the year before.

Transcripts Simplified

Taylor Morrison has a large backlog of homes sold in 2022, which provide a strong margin profile. They also have a good margin from their vintage land bank. In addition, they have seen operational enhancements and simplification such as reducing options by over 50%, plans by over 20%, and Canvas initiative, plus favorable lumber tailwinds into 2023.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for TMHC. More…

| Total Revenues | Net Income | Net Margin |

| 8.22k | 1.05k | 12.7% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for TMHC. More…

| Operations | Investing | Financing |

| 1.11k | -14.88 | -1.2k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for TMHC. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 8.47k | 3.82k | 42.88 |

Key Ratios Snapshot

Some of the financial key ratios for TMHC are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 20.0% | 63.1% | 17.6% |

| FCF Margin | ROE | ROA |

| 13.1% | 20.1% | 10.7% |

Stock Price

The company’s stock opened at $35.7 and closed at $36.6, up by 1.8% from the prior closing price of 36.0. This marks an impressive performance for the quarter that was mainly fueled by improved demand for their housing units, as well as their aggressive cost cutting strategies in order to remain competitive. Taylor Morrison Home has been focusing on providing quality, affordable housing to its customers while continuing to innovate and improve its services. Throughout the quarter, they have successfully launched a number of initiatives aimed at modernizing and improving their operations, such as an online home buying platform and an app that allows customers to easily search for and customize homes. The company has also undertaken several initiatives to reduce costs, such as sourcing materials from local suppliers and implementing an optimized supply chain process.

These efforts have enabled them to remain competitive in the marketplace while continuing to provide quality housing solutions to their customers. Overall, Taylor Morrison Home ended the quarter on a positive note with their earnings report. They were able to leverage their cost cutting strategies and innovations in order to remain competitive, which ultimately drove the stock price up by 1.8%. Live Quote…

Analysis

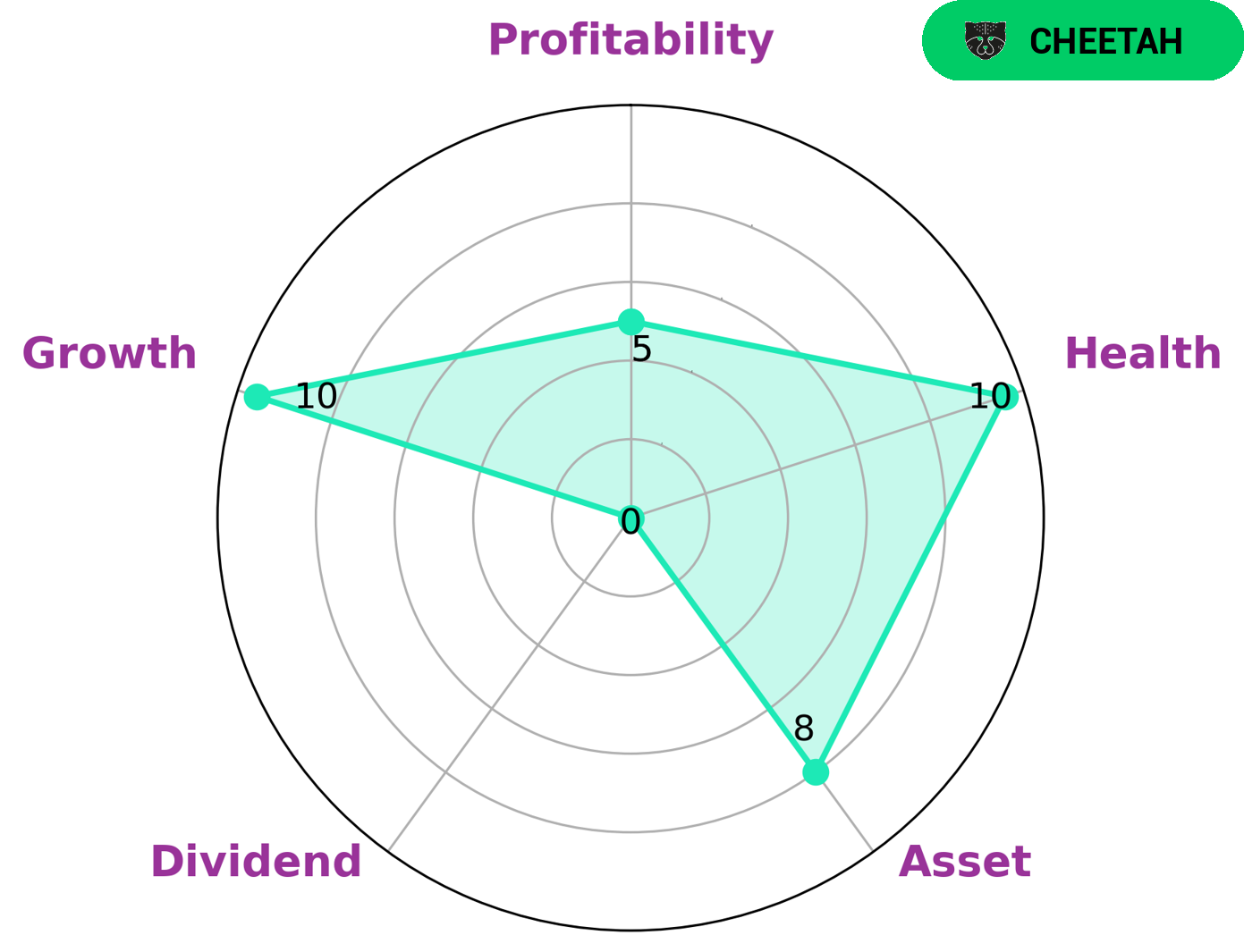

GoodWhale has conducted an analysis of TAYLOR MORRISON HOME’s financials and our Star Chart reveals that TAYLOR MORRISON HOME is strong in assets, growth, and medium in profitability, while weak in dividend. With a high health score of 10/10 with regard to its cashflows and debt, TAYLOR MORRISON HOME is a safe bet and can ride out any crisis without bankruptcy risk. Based on our analysis, we have also classified TAYLOR MORRISON HOME as a ‘cheetah’ – a company that has achieved high revenue or earnings growth but is considered less stable due to lower profitability. Therefore, investors looking for high-growth companies with potentially higher returns or risk-averse investors looking for stability may be interested in this type of company. More…

Peers

The homebuilding industry is highly competitive, with many large and small companies vying for market share. Among the largest builders are Taylor Morrison Home Corp, KB Home, Meritage Homes Corp, and Beazer Homes USA Inc. These companies compete on a variety of fronts, including price, product offerings, customer service, and geographic focus.

– KB Home ($NYSE:KBH)

KB Home is a homebuilding company that was founded in 1957. The company has a market cap of $2.46 billion and a return on equity of 18.25%. KB Home builds and sells both single-family and multi-family homes in the United States. The company has operations in 35 markets across nine states.

– Meritage Homes Corp ($NYSE:MTH)

Meritage Homes is a homebuilding company that was founded in 1985 and is headquartered in Scottsdale, Arizona. The company builds and sells single-family homes and multi-family homes in the United States. As of 2022, the company has a market cap of 2.65 billion and a return on equity of 22.62%. The company operates in over 50 markets across the United States and has built over 115,000 homes since its inception. Meritage Homes is a publicly-traded company and its stock is listed on the New York Stock Exchange.

– Beazer Homes USA Inc ($NYSE:BZH)

Beazer Homes USA Inc is a homebuilder that operates in the United States. The company has a market capitalization of $345.59 million and a return on equity of 15.8%. Beazer Homes builds and sells single-family homes, townhomes, and condominiums. The company operates in Arizona, California, Colorado, Delaware, Florida, Georgia, Indiana, Maryland, Nevada, North Carolina, South Carolina, Tennessee, Texas, and Virginia.

Summary

Taylor Morrison Home reported fourth quarter results for the fiscal year 2022 on February 15 2023. Revenue increased slightly year-over-year by 1.0%, however net income decreased by 0.5%. This could indicate that the company is potentially facing increased expenses in running the business, or that its investments in the market are not returning positive results. Investors should further analyze trends in the company’s performance over time to assess whether its growth is sustainable, and evaluate its balance sheet to determine whether it is a good investment.

Recent Posts