SUMINOE TEXTILE Reports Third Quarter Earnings Results for FY2023.

April 18, 2023

Earnings Overview

On April 13 2023, SUMINOE TEXTILE ($TSE:3501) announced its financial results for the third quarter of FY2023, which ended on February 28 2023. They revealed a 101.8% rise in their total revenue to JPY 7.0 million, and a 14.7% growth in net income to JPY 23430.0 million.

Price History

The company’s stock opened at JP¥2154.0 and closed at 2107.0, down 1.7% from its prior closing price of 2143.0. This marks the first quarterly earnings report of the fiscal year, and investors are eager to see how the company is faring amidst the pandemic-induced economic downturn. The company has taken various cost-cutting measures to cope with the challenging business environment and has seen improved performance in their core operations, such as textiles and apparel.

Additionally, the company’s management has highlighted the importance of product quality and customer service as key priorities in order to maintain their competitive edge in the market. SUMINOE TEXTILE is optimistic about its outlook for the upcoming quarters of FY2023. The company is looking to build on their current momentum and plans to introduce new products and services to capitalize on the slowly recovering market conditions. They have also stated that they will continue to monitor the market closely and adjust their strategies accordingly in order to ensure long-term success. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Suminoe Textile. More…

| Total Revenues | Net Income | Net Margin |

| 90.79k | -61 | -0.3% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Suminoe Textile. More…

| Operations | Investing | Financing |

| 1.12k | -1.19k | -2.07k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Suminoe Textile. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 88.67k | 55.27k | 4.43k |

Key Ratios Snapshot

Some of the financial key ratios for Suminoe Textile are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -1.8% | -40.0% | 1.8% |

| FCF Margin | ROE | ROA |

| -3.2% | 3.5% | 1.1% |

Analysis

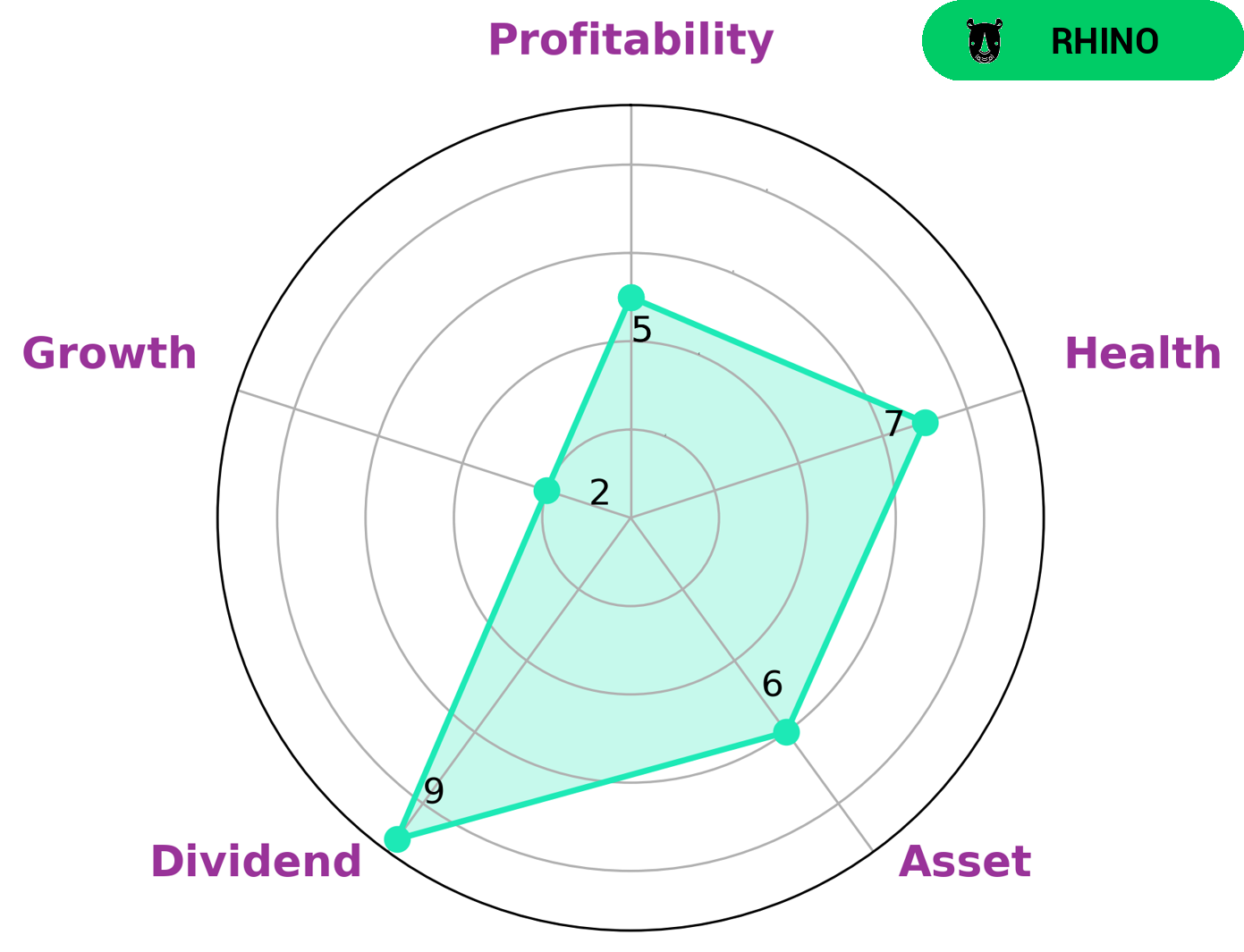

GoodWhale has conducted an analysis of SUMINOE TEXTILE‘s financials, utilizing our Star Chart to evaluate the company’s performance. The Star Chart indicates that SUMINOE TEXTILE is strong in dividend, medium in asset, profitability, and weak in growth. Additionally, SUMINOE TEXTILE has a high health score of 7/10 with regard to its cashflows and debt, indicating that the company is capable of paying off debt and funding future operations. We have classified SUMINOE TEXTILE as ‘rhino’, meaning that the company has achieved moderate revenue or earnings growth. Given its financial performance and health score, SUMINOE TEXTILE may be of interest to investors seeking a company with above-average dividend payouts and relative stability. Additionally, investors seeking companies with moderate growth may be interested in SUMINOE TEXTILE as it presents a lower risk investment opportunity. More…

Peers

The competition between Suminoe Textile Co Ltd and its competitors—Seiren Co Ltd, Linas AB, PT Asia Pacific Investama Tbk—is fierce. All four companies are vying for a share of the global textile market, and each has different strengths and weaknesses that help them differentiate themselves from the competition. Ultimately, the winner will be the company that can provide the best quality products at the most competitive price.

– Seiren Co Ltd ($TSE:3569)

Seiren Co Ltd is a leading Japanese manufacturing company that produces and sells automotive parts, textiles and other industrial products. The company has a market capitalization of 120.78B as of 2023, which gives it a strong presence in the Japanese industrial market. Its Return on Equity of 9.29% demonstrates the company’s ability to generate returns from its investors’ equity. This indicates a strong financial performance, as well as its ability to generate long-term value for shareholders.

– Linas AB ($LTS:0J6H)

Linas AB is a Finnish company that specializes in producing agricultural machinery, energy products, and engineering services. The company has grown significantly since its establishment in the early 1900s, and its current market capitalization is 4.65M as of 2023. Additionally, Linas AB also has a strong Return on Equity (ROE) of 6.86%, indicating that the company is able to generate a significant amount of revenue from its investments. This is a testament to the company’s successful business strategies and sound financial management. As such, Linas AB is a reliable and well-established company with a strong financial position.

– PT Asia Pacific Investama Tbk ($IDX:MYTX)

PT Asia Pacific Investama Tbk (APIN) is an Indonesian investment company headquartered in Jakarta that focuses on investments in the energy, resources, and infrastructure sectors. The company combines its in-depth knowledge of the local markets with a global perspective to achieve a diversified portfolio. As of 2023, APIN has a market capitalization of 550.06 billion and a Return on Equity of -120.56%. This market cap is indicative of the company’s strong performance in the Indonesian markets and signals the potential for future growth. Although the negative ROE is concerning, APIN continues to seek out opportunities to drive returns and support the Indonesian economy.

Summary

SUMINOE TEXTILE recently reported its third quarter earnings for FY2023, showing impressive growth. Total revenue increased by 101.8%, amounting to JPY 7.0 million, while net income rose 14.7% to JPY 23430.0 million. This marks a great return for shareholders as the company continues to expand, and is an indicator of potential future growth. Investors should keep an eye on SUMINOE TEXTILE for further developments as it looks to capitalize on its positive financial performance and continue to build upon its success.

Recent Posts