STERICYCLE Reports Earnings Results for Fourth Quarter of FY 2022 on February 23, 2023.

March 12, 2023

Earnings Overview

On February 23, 2023, STERICYCLE ($NASDAQ:SRCL) released its financial results for the fourth quarter of Fiscal Year 2022 (ending December 31, 2022). Revenue for the quarter totaled USD 31.8 million, a significant increase of 284.9% year-on-year. Net income was USD 670.4 million, slightly up by 2.0% compared to the same period in the prior year.

Transcripts Simplified

In the fourth quarter of 2022, Stericycle reported total revenues of $670.4 million, compared to $657.3 million in the fourth quarter of 2021. Excluding the impact of foreign exchange rates, divestitures and an acquisition, organic revenues increased $37.5 million. Of this increase, Secure Information Destruction organic revenue growth was $24.5 million and Regulated Waste and Compliance Services organic revenue growth was $13 million. Income from operations in the fourth quarter was $59.1 million, compared to $8.2 million in the fourth quarter of 2021 due to commercial pricing levers resulting in revenue flow through of $32 million, lower adjusted litigation settlement and regulatory compliance expenses of $17.8 million, lower bad debt expense of $6.8 million, lower annual incentive compensation expense of $5 million and lower self-insurance expense of $3.4 million.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Stericycle. More…

| Total Revenues | Net Income | Net Margin |

| 2.7k | 56 | 1.7% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Stericycle. More…

| Operations | Investing | Financing |

| 200.2 | -84.6 | -111 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Stericycle. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 5.33k | 2.91k | 26.25 |

Key Ratios Snapshot

Some of the financial key ratios for Stericycle are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -6.5% | 5.0% | 5.7% |

| FCF Margin | ROE | ROA |

| 2.5% | 4.1% | 1.8% |

Market Price

The results came as a surprise to investors, as the stock opened at $52.0 and closed at $48.9, a plunge of 11.5% from its previous closing price of 55.2. This decline was largely caused by the company’s weaker-than-expected earnings report and lower-than-expected guidance for the coming year. Analysts had anticipated that the company would post higher revenues and profits due to its expansion into new markets and increased demand for its products.

However, the results fell far short of those expectations, with revenues and profits both falling below analyst estimates. This caused investors to become wary of the company’s ability to continue to generate growth in the future. The decline in STERICYCLE‘s stock price was further compounded by its guidance for the rest of Fiscal Year 2023, which was also lower than expected. The company stated that it expects revenue to be flat or slightly down compared to its previous forecast, while profits are predicted to remain largely unchanged. This news caused investors to become increasingly concerned about the company’s ability to return to profitability in the near term. Overall, STERICYCLE’s earnings report was a major disappointment to investors, who had been expecting the company to post solid results for its fourth quarter of Fiscal Year 2022. The company’s stock price plummeted as a result, and investors are now watching closely to see if the company can turn things around in the next fiscal year. Live Quote…

Analysis

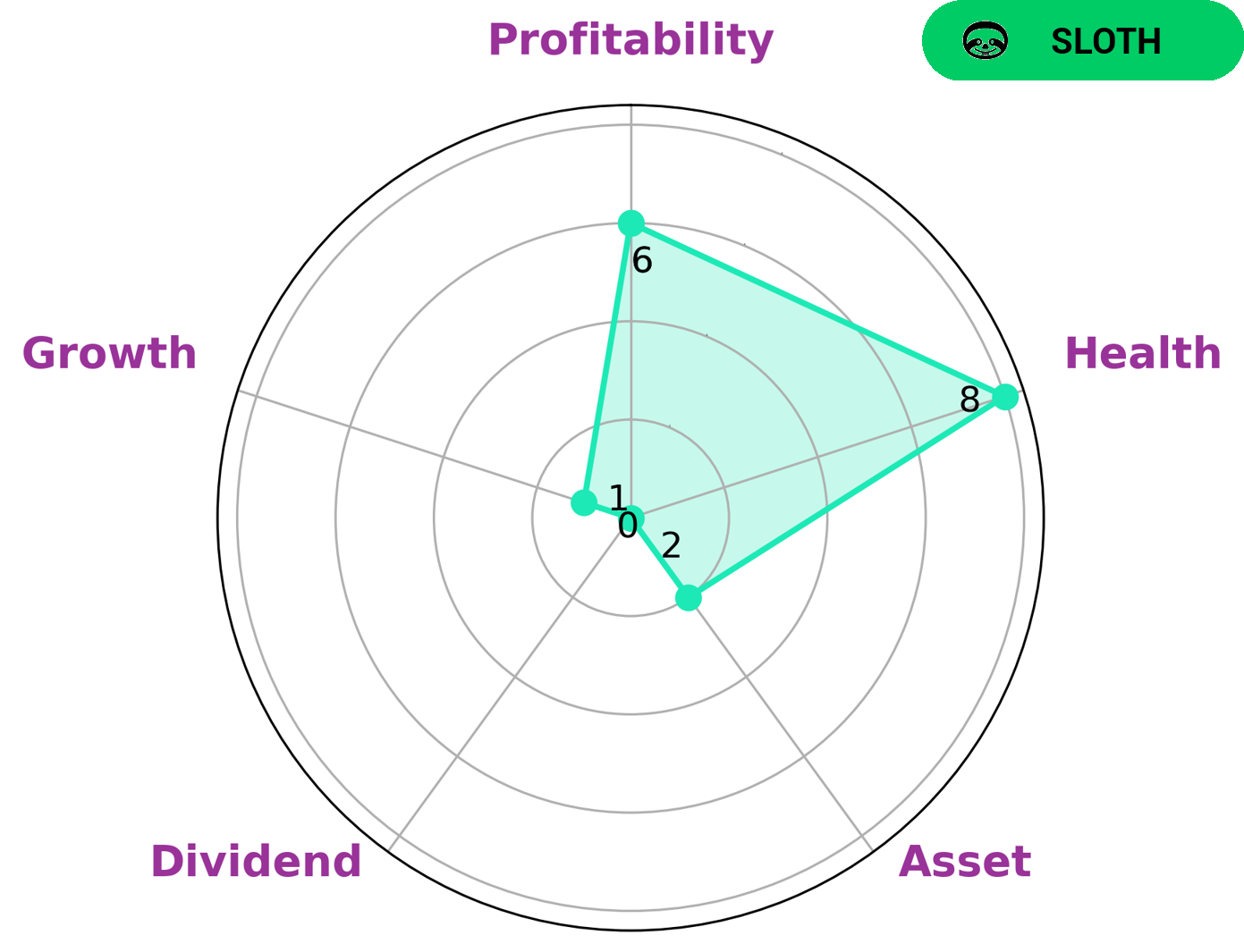

As GoodWhale, we evaluated the wellbeing of STERICYCLE and classified it as ‘sloth’ according to the Star Chart. This means that STERICYCLE has achieved revenue or earnings growth slower than the overall economy. Although STERICYCLE may not be the most attractive company for investors looking for rapid growth, its high health score of 8/10 indicates that it is capable of riding out any crisis without the risk of bankruptcy. Our analysis of STERICYCLE reveals that it is strong in cash flows and debt, medium in profitability and weak in assets, dividends, and growth. Because of this mix of strengths and weaknesses, STERICYCLE may be attractive to investors who are looking for a relatively safe investment with moderate returns. More…

Peers

Its competitors are Sunny Friend Environmental Technology Co, Waste Connections Inc, Waste Management Inc.

– Sunny Friend Environmental Technology Co ($TWSE:8341)

Sunny Friend Environmental Technology Co is a company that specializes in environmental technology. They have a market cap of 14.83B as of 2022 and a ROE of 25.67%. The company does research and development in the field of environmental technology in order to help preserve the environment.

– Waste Connections Inc ($NYSE:WCN)

Waste Connections Inc is a publicly traded company that provides waste management and environmental services in the United States, Canada, and Mexico. The company has a market capitalization of $33.42 billion as of April 2021 and a return on equity of 9.38%. Waste Connections Inc is the third largest waste management company in North America by revenue. The company’s main services include residential, commercial, and industrial waste collection; landfill operations; and recycling and resource recovery.

– Waste Management Inc ($NYSE:WM)

Waste Management Inc is a leading provider of comprehensive waste management services in North America. The company’s operations include solid waste collection, transfer, disposal, and recycling. Waste Management serves residential, commercial, industrial, and municipal customers in the United States and Canada.

Waste Management has a market capitalization of $63.71 billion as of 2022 and a return on equity of 28.78%. The company’s strong financial performance is driven by its diversified business model, which provides a stable stream of revenue and earnings. Waste Management’s diversified operations also provide a buffer against economic cycles. The company’s strong market position and financial stability have allowed it to weather the COVID-19 pandemic relatively well.

Summary

STERICYCLE reported strong financial results for the fourth quarter of FY 2022, with total revenues increasing 284.9% year-over-year and net income up 2.0%. However, the stock price dropped the same day, indicating that investors may be cautious about the company’s long-term prospects. Analysts will need to look more closely at the financials to better understand the reasons behind the stock market reaction. Looking ahead, investors should monitor trends in revenue growth and profitability to get a better understanding of STERICYCLE’s financial performance.

Recent Posts