Steel Dynamics Reports Q4 FY2022 Earnings: Total Revenue Down 42.2% Year-Over-Year.

February 7, 2023

Earnings report

STEEL DYNAMICS ($NASDAQ:STLD), one of the largest steel producers in the United States, announced its Q4 FY2022 earnings results on January 26, 2023. The company reported total revenue of USD 0.6 billion, a decrease of 42.2% compared to the same period in the previous year. Net income reported was USD 4.8 billion, which was a 9.0% decrease compared to the same period in the previous year. STEEL DYNAMICS is a leading steel producer and metals recycler in the US. The company produces a wide range of steel products, including flat rolled steel, structural steel, and merchant bar products and services. It also offers a variety of recycling services for ferrous and non-ferrous scrap. The financial results for Q4 FY2022 indicate that the company was heavily impacted by the global pandemic and its effects on the steel industry. The decrease in revenue was primarily due to lower average selling prices and significantly lower volumes across all product segments. The decrease in net income was largely attributed to higher costs associated with raw materials, energy, and freight. The company has taken a number of steps in order to mitigate the impact of the pandemic on its operations. This includes cost-reduction initiatives, such as workforce reductions, and other operational restructuring measures.

In addition, the company has implemented several strategic initiatives to increase efficiency, reduce costs, and strengthen its balance sheet. Despite the difficult environment, STEEL DYNAMICS reported strong financial performance for the fourth quarter of FY2022. The company managed to reduce its costs and improve its operational efficiency while maintaining its market share. Going forward, the company is optimistic that it will be able to further reduce costs and improve its profitability in order to take advantage of emerging opportunities in the steel market.

Market Price

Steel Dynamics reported their fourth quarter fiscal year 2022 earnings on Thursday, with total revenue down 42.2% year-over-year. The company’s stock opened at $113.1 and closed at $121.4, representing a 10.0% increase from their last closing price of $110.4. Despite this, the company was able to report higher gross margins across all segments, with the exception of its steel fabrication segment, which saw a slight decrease due to higher costs. This is a positive sign for the company, as it positions them well for future growth despite the current challenging economic environment.

Overall, Steel Dynamics reported mixed results for their fourth quarter fiscal year 2022 earnings, with total revenue down but net income increasing on the back of cost reduction efforts and higher gross margins. With their improved financial position, the company looks well-positioned to weather any further economic uncertainty and capitalize on potential opportunities going forward. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Steel Dynamics. More…

| Total Revenues | Net Income | Net Margin |

| 22.26k | 3.86k | 17.4% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Steel Dynamics. More…

| Operations | Investing | Financing |

| 4.46k | -1.88k | -2.2k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Steel Dynamics. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 14.16k | 6.06k | 45.15 |

Key Ratios Snapshot

Some of the financial key ratios for Steel Dynamics are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 28.6% | 72.8% | 23.0% |

| FCF Margin | ROE | ROA |

| 16.0% | 39.7% | 22.6% |

Analysis

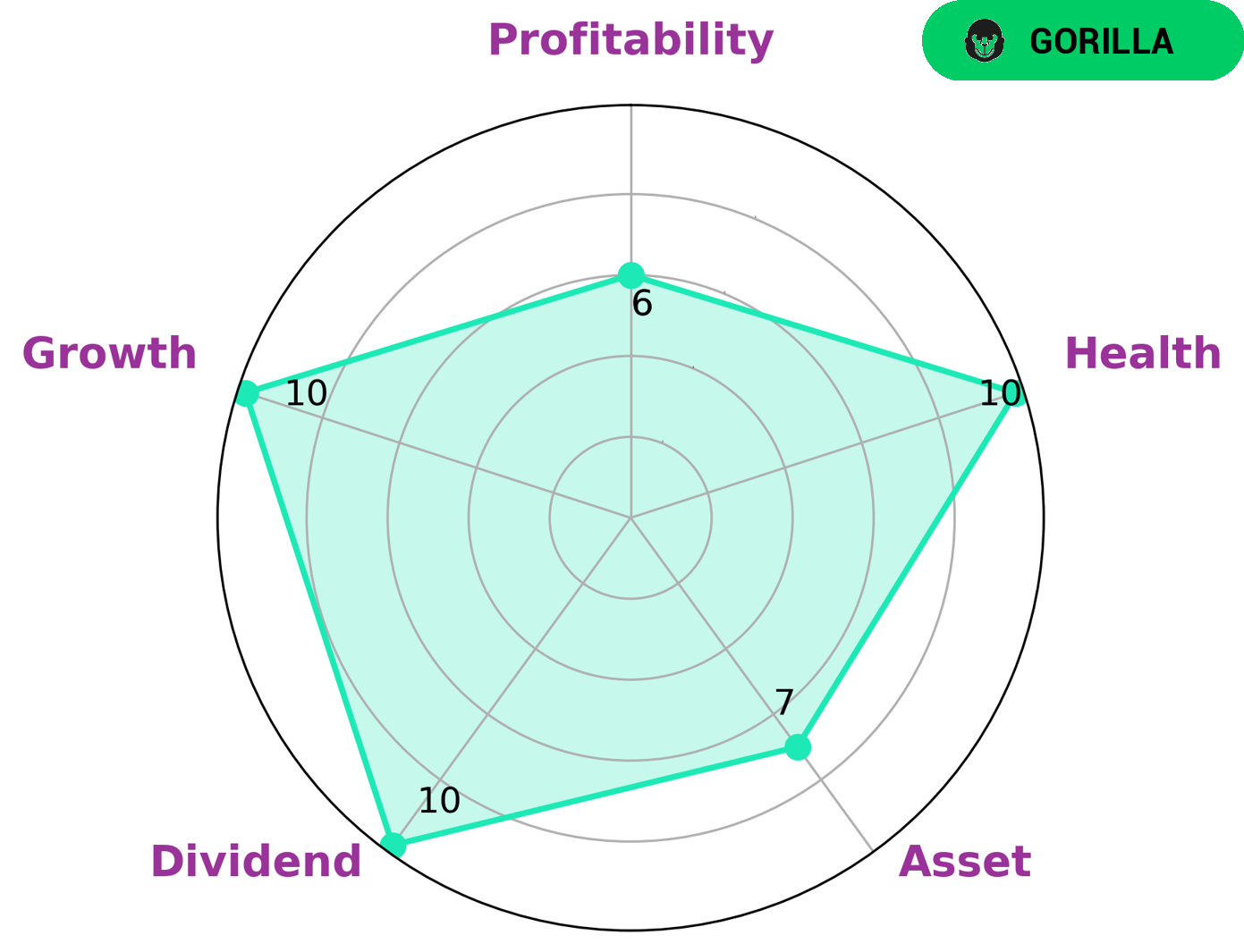

Investors looking for a company with a strong competitive advantage should look no further than STEEL DYNAMICS. According to the Star Chart, STEEL DYNAMICS is classified as a ‘gorilla’, a type of company that has achieved stable and high revenue or earnings growth over time. With a health score of 10/10 according to GoodWhale, STEEL DYNAMICS is well-positioned to sustain future operations even in times of crisis. Moreover, STEEL DYNAMICS has a strong rating for its asset, dividend, and growth score and a medium rating for its profitability score. This makes STEEL DYNAMICS an attractive investment for those seeking a high-growth stock. It also makes it a good choice for long-term investors looking for stability, as the company has demonstrated that it can maintain its high revenue or earnings growth over the long-term. Additionally, the company’s strong financials means that investors can trust in its ability to perform well in the future. Overall, STEEL DYNAMICS is an excellent stock to consider for investors looking for both short-term and long-term gains. With its high ratings in both asset, dividend, growth, and profitability, investors can be sure that they are making a smart investment. The company’s strong financials also provide reassurance that it can handle times of crisis and continue to grow in the future. More…

Peers

The steel industry is extremely competitive, with Steel Dynamics Inc. facing stiff competition from BCH JSC, KG Dongbusteel, Kalyani Steels Ltd, and other companies. Steel Dynamics Inc. has remained a strong competitor by investing in new technologies and expanding its production capabilities. The company has also been able to keep its costs low by utilizing its large scale and efficient operations.

– BCH JSC ($HNX:BCA)

Dongbu Steel is one of the largest steel manufacturers in South Korea. The company has a market cap of 895.02B as of 2022 and a return on equity of 17.61%. Dongbu Steel produces a wide range of steel products including hot and cold rolled steel, galvanized steel, stainless steel, and more. The company also has a large presence in the global market, with plants and offices in countries such as the United States, China, and India.

– KG Dongbusteel ($KOSE:016380)

Kalyani Steels Ltd is an Indian steel company with a market cap of 13.05 billion as of 2022. The company has a return on equity of 11.27%. The company produces a range of steel products including rebars, wire rods, and merchant products. The company has a strong presence in the Indian market and is expanding its operations in the international market.

Summary

Investing in Steel Dynamics can be a great way to capitalize on the company’s long-term growth potential. Despite a significant decrease in total revenue and net income in the fourth quarter of FY2022 compared to the same period in the previous year, Steel Dynamics’ stock price moved up the same day. This could indicate an investor sentiment that the company’s long-term prospects remain strong. Furthermore, the company has consistently increased its earnings per share and operating margin over the past several years, indicating a strong cost-containment strategy.

Steel Dynamics’ strong financial position and liquidity is another positive indicator for potential investors. In summary, Steel Dynamics is well positioned to continue growing, and investing in its stock is a great way to capitalize on this potential. Its strong financial position, increasing earnings per share, and history of dividend distributions make it an attractive option for those looking to diversify their portfolio.

Recent Posts