SOLAREDGE TECHNOLOGIES Reports Earnings Results for Fourth Quarter of 2022 Fiscal Year

April 4, 2023

Earnings Overview

On February 13, 2023, SOLAREDGE TECHNOLOGIES ($NASDAQ:SEDG) reported financial results for the fourth quarter of the 2022 fiscal year, which ended on December 31, 2022. Meanwhile, net income increased by 61.4% to USD 890.7 million.

Transcripts Simplified

SolarEdge Technologies reported record quarterly revenues of $890.7 million for the fourth quarter, a 6% increase compared to the prior quarter and a 61% increase compared to the same quarter last year. Solar revenues, which include the sales of residential batteries, increased 6% compared to the prior quarter and 66% compared to the same quarter last year. Revenues from the United States increased 21% compared to the last quarter and 19% compared to the same quarter last year, representing 36% of our solar revenues. Solar revenues from Europe decreased 1% compared to the prior quarter but increased 145% compared to the same quarter last year, representing 57% of our solar revenues.

Rest of the World solar revenues decreased 5% compared to the prior quarter but increased 12% compared to the same quarter last year, representing 7% of our total solar revenues. Two noteworthy items impacting GAAP financials were addressed this quarter: an intangible assets write-off of $107.4 million related to an acquisition, and an eligibility for reduced corporate tax of 6% on income derived from technological products in Israel. The impact on actual taxes was minimal, but the impact on deferred tax assets in Israel was significant as they will now be able to be utilized at a lower corporate tax rate.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Solaredge Technologies. More…

| Total Revenues | Net Income | Net Margin |

| 3.11k | 93.78 | 3.0% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Solaredge Technologies. More…

| Operations | Investing | Financing |

| 31.28 | -417.04 | 654.61 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Solaredge Technologies. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 4.27k | 2.09k | 38.77 |

Key Ratios Snapshot

Some of the financial key ratios for Solaredge Technologies are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 29.7% | -4.4% | 6.0% |

| FCF Margin | ROE | ROA |

| -4.4% | 5.5% | 2.7% |

Stock Price

The company’s stock opened at $303.7 and closed at $310.7, up by 3.3% from its previous closing price of $300.7. The increase in the stock price followed the announcement of the quarterly earnings results. These positive results in terms of revenue and operating income drove the stock price higher.

The strong quarterly earnings results of SOLAREDGE TECHNOLOGIES have shown that the company is well positioned to continue to grow and expand its presence in the renewable energy industry. With the increasing demand for solar power, SOLAREDGE TECHNOLOGIES looks set to benefit from this trend and continue to perform strongly in the future. Live Quote…

Analysis

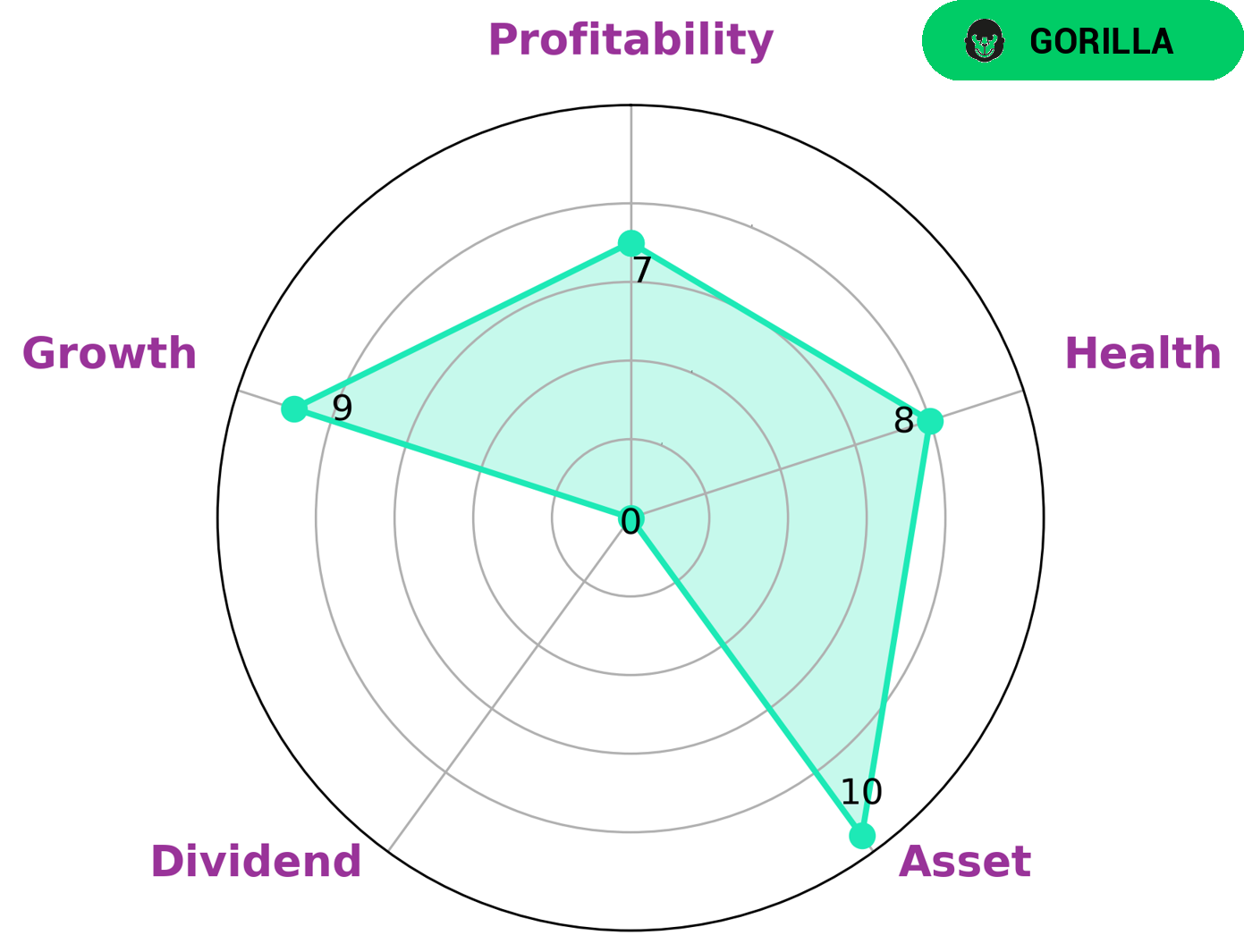

At GoodWhale, we believe that it is essential for investors to understand the fundamentals of SOLAREDGE TECHNOLOGIES before investing. Our Star Chart classifies SOLAREDGE TECHNOLOGIES as a ‘gorilla’, which indicates that it has achieved a stable and high revenue or earning growth due to its strong competitive advantage. This makes SOLAREDGE TECHNOLOGIES an attractive option for investors looking for growth potential. SOLAREDGE TECHNOLOGIES performs strongly on the GoodWhale asset, growth, and profitability metrics. However, it is weak on dividend payouts. In terms of financial health, SOLAREDGE TECHNOLOGIES has a high health score of 8/10 with regards to its cashflows and debt. This suggests that it is capable of riding out any crisis without the risk of bankruptcy. More…

Peers

In the solar energy industry, there is intense competition between SolarEdge Technologies Inc and its main competitors United Renewable Energy Co Ltd, Folkup Development Inc, and Tainergy Tech Co Ltd. All four companies are striving to be the leading provider of solar energy solutions and each has its own unique strengths and weaknesses. SolarEdge Technologies Inc has a strong focus on innovation and has developed several industry-leading products, while United Renewable Energy Co Ltd has a large customer base and a strong financial position. Folkup Development Inc has a strong research and development team, while Tainergy Tech Co Ltd has a large manufacturing capacity.

– United Renewable Energy Co Ltd ($TWSE:3576)

As of 2022, United Renewable Energy Co Ltd has a market cap of 34.73B and a Return on Equity of 2.02%. The company is engaged in the business of developing, manufacturing and marketing of solar photovoltaic products. It also provides engineering, procurement and construction services for solar power projects.

– Folkup Development Inc ($OTCPK:FLDI)

Folkup Development Inc is a publicly traded company with a market capitalization of $49 million as of 2022. The company has a return on equity of 40.0%, indicating that it is a profitable company that is generate shareholder value. Folkup Development Inc is engaged in the business of real estate development and management. The company has a portfolio of properties in the United States and Canada.

– Tainergy Tech Co Ltd ($TWSE:4934)

Tainergy Tech Co Ltd is a Taiwanese company that manufactures lithium batteries and energy storage systems. The company has a market cap of 5.65 billion as of 2022 and a return on equity of -26.54%. Tainergy Tech Co Ltd manufactures lithium batteries and energy storage systems for a variety of applications, including electric vehicles, power tools, and consumer electronics. The company has a strong presence in the Asia-Pacific region and is expanding its operations globally.

Summary

SOLAREDGE TECHNOLOGIES reported its earnings results for the fourth quarter of 2022 on February 13, 2023, showing a 49.1% decrease in total revenue compared to the same quarter of the previous year.

However, the company achieved a 61.4% year-on-year growth in net income amounting to USD 890.7 million. Upon the release of the results, SOLAREDGE TECHNOLOGIES’ stock price moved up on the same day. Investors are optimistic about the company’s performance, as profitability has improved significantly. Therefore, it may be a good time for investors to consider investing in SOLAREDGE TECHNOLOGIES as it shows strong potential for future growth.

Recent Posts