SOFTBANK CORP Reports Third Quarter Fiscal Year 2023 Earnings Results on December 31 2022

March 29, 2023

Earnings Overview

SOFTBANK CORP ($BER:3AG0) announced their earnings results for the third quarter of the fiscal year 2023, ending on February 9 2023, on December 31 2022. Total revenue increased by 141.6% from the same period last year, reaching JPY 274.4 billion, while net income grew 6.0% to JPY 1536.9 billion.

Stock Price

The stock opened at €10.8 and closed at the same price, indicating a steady market performance. This increase was mainly attributed to higher international sales and the successful launch of new products. Sales in North America and Europe both showed positive growth as well.

Overall, investors seem pleased with SOFTBANK CORP’s financial performance, and the stock price has been relatively stable since their earnings announcement. The company is expected to continue to grow in the coming quarters as they look to capitalize on new opportunities. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Softbank Corp. More…

| Total Revenues | Net Income | Net Margin |

| 5.86M | 604.44k | 10.8% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Softbank Corp. More…

| Operations | Investing | Financing |

| 1.23M | -51.85k | -598.23k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Softbank Corp. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 14.7M | 11.04M | 466.64 |

Key Ratios Snapshot

Some of the financial key ratios for Softbank Corp are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 14.5% | 13.9% | 18.8% |

| FCF Margin | ROE | ROA |

| 10.9% | 34.2% | 4.7% |

Analysis

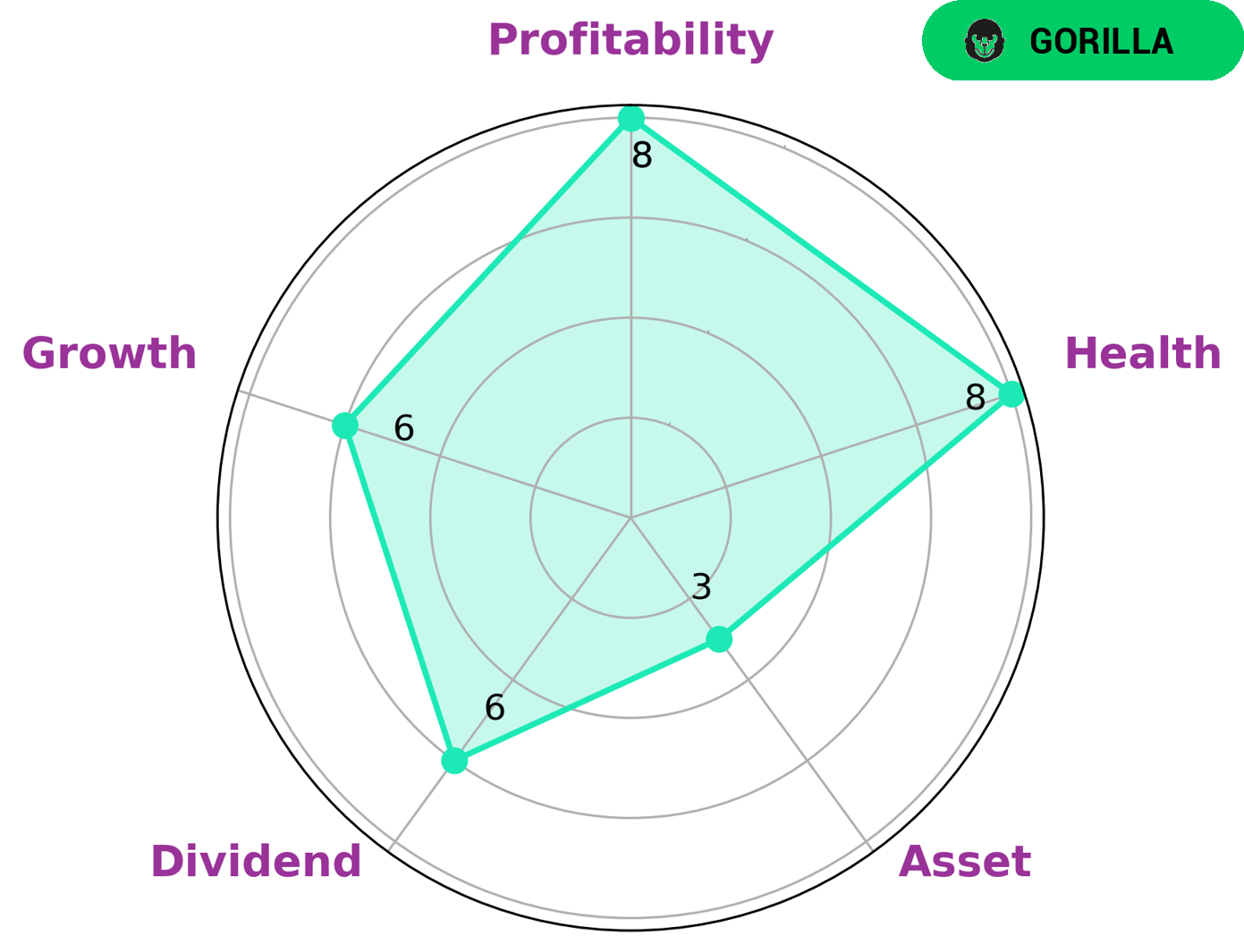

At GoodWhale, we have conducted an analysis of SOFTBANK CORP‘s financials. After reviewing our findings, we have classified them as a ‘gorilla’, indicating they achieved consistent and strong revenue/earnings growth due to their competitive advantages. We believe that investors interested in such a strong company should consider SOFTBANK CORP. When it comes to SOFTBANK CORP’s health score, we have given them an impressive 8/10 score based on their cash flows and debt. This means that the company is well equipped to weather any financial storms that may come its way without the risk of bankruptcy. Finally, we have concluded that SOFTBANK CORP is strong in terms of profitability, medium in terms of dividends, growth, and weak in terms of assets. These factors should be taken into account when considering investing in such a company. More…

Summary

SoftBank Corp has seen impressive growth in the third quarter of FY2023, with total revenue increasing by 141.6% year-over-year and net income increasing by 6.0%. This is a positive sign for investors, indicating that the company is able to generate strong profits and growth despite challenging market conditions. Investors may consider investing in SoftBank Corp given its strong performance and the potential for continued growth in the future. The company could continue to be an attractive investment opportunity in the long term.

Recent Posts