SMART GLOBAL Reports Strong Fiscal Year 2023 Q2 Earnings Results for April 4

April 14, 2023

Earnings Overview

On April 4, 2023, SMART GLOBAL ($NASDAQ:SGH) released its fiscal year 2023 Q2 earnings results. Total revenue was reported at USD -27.2 million, a 1206.5% decrease from the same quarter in the preceding year. Net income was USD 429.2 million, representing a 4.5% decrease compared to the previous year.

Transcripts Simplified

At this time, all participants are in a listen-only mode. Later, we will conduct a question-and-answer session and instructions will be given at that time. Operator Instructions As a reminder, this conference is being recorded. I’d now like to turn the conference over to Brett Maas, Managing Partner at Hayden IR. Please go ahead. Brett Maas Thank you and good afternoon. Joining us on today’s call are Paul Melaschenko, Chief Executive Officer; and John Kispert, Chief Financial Officer of Smart Global Holdings. Following remarks by management, we will open the call to questions. Before we begin our formal remarks, I would like to remind everyone that during the course of this call, Smart Global’s management may make certain forward-looking statements concerning the company’s performance and operations. These forward-looking statements are subject to a number of risks and uncertainties as described in the company’s public filings with the SEC and in today’s press release issued by the company. The company undertakes no obligation to revise or update any forward-looking statements contained herein, except as required by law. I will now turn the call over to Paul Melaschenko, Chief Executive Officer of Smart Global Holdings. Paul? Paul Melaschenko Thanks, Brett, and thanks to everyone joining us on today’s call. I’m very pleased with our second quarter performance. We delivered strong top and bottom line results as we continue to benefit from strength in our computing components business and an improving environment for our memory business. This was driven primarily by growth in our computing components business, which more than doubled year-over-year due to strong demand from both original equipment manufacturers and contract manufacturers. This was partially offset by declines in our memory business due to softness in the consumer market and softer than expected demand for enterprise server memory products.

This was driven primarily by an increase in non-GAAP gross profit and improved non-GAAP operating margins driven by higher average selling prices and cost efficiencies in our computing components business. In summary, this was a strong quarter for Smart Global with strong revenue growth, improved profitability, and continued balance sheet strength. We remain confident in our long-term growth prospects and look forward to updating you on our progress in future quarters. With that, I’d like to turn the call over to John Kispert, Chief Financial Officer of Smart Global Holdings. John? John Kispert Thanks Paul and good afternoon everyone. This was partially offset by declines in our memory business due to softness in the consumer market and softer than expected demand for enterprise server memory products. Finally please note that all financial outlooks constitute forward looking statements based on current expectations that are subject to risks and uncertainties that could cause actual results to differ materially from expectations. The company does not undertake any obligation to update any forward looking statements as a result of new information or future events or developments except as may be required by law . With that I’ll turn it back over to Paul . Paul Melaschenko Thanks John . In summary we are very pleased with our second quarter results . We delivered strong top line growth an improved profitability . We remain confident in our long term growth prospects and look forward to updating you on our progress in future quarters . Thank you for joining us today . Operator , could we now have the first question please .

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Smart Global. More…

| Total Revenues | Net Income | Net Margin |

| 1.79k | 21.84 | 3.0% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Smart Global. More…

| Operations | Investing | Financing |

| 84.17 | -255.13 | 178.5 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Smart Global. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.64k | 1.31k | 7.14 |

Key Ratios Snapshot

Some of the financial key ratios for Smart Global are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 19.3% | 49.7% | 3.3% |

| FCF Margin | ROE | ROA |

| 2.3% | 10.9% | 2.2% |

Price History

The company’s shares opened at $16.8 and closed at $16.5, down 1.5% from its previous closing price of $16.8. This was partially driven by the elevated demand for their products and services due to increased technological advancements in the remote working environment. The company’s CEO, Robert Anderson, commented on the results stating “We are thrilled with our Q2 performance and our strong financial position as we continue to provide innovative products and services that meet our customer’s needs in this new digital economy.” SMART GLOBAL has continued to invest heavily in research and development of new products and services that have become increasingly popular during this pandemic period. They are confident that these investments will fuel their growth for the remainder of the fiscal year and beyond.

Overall, SMART GLOBAL’s Q2 earnings results were very impressive and bode well for the company’s future performance. Investors should continue to monitor developments in the company and remain vigilant of their stock price movements. Live Quote…

Analysis

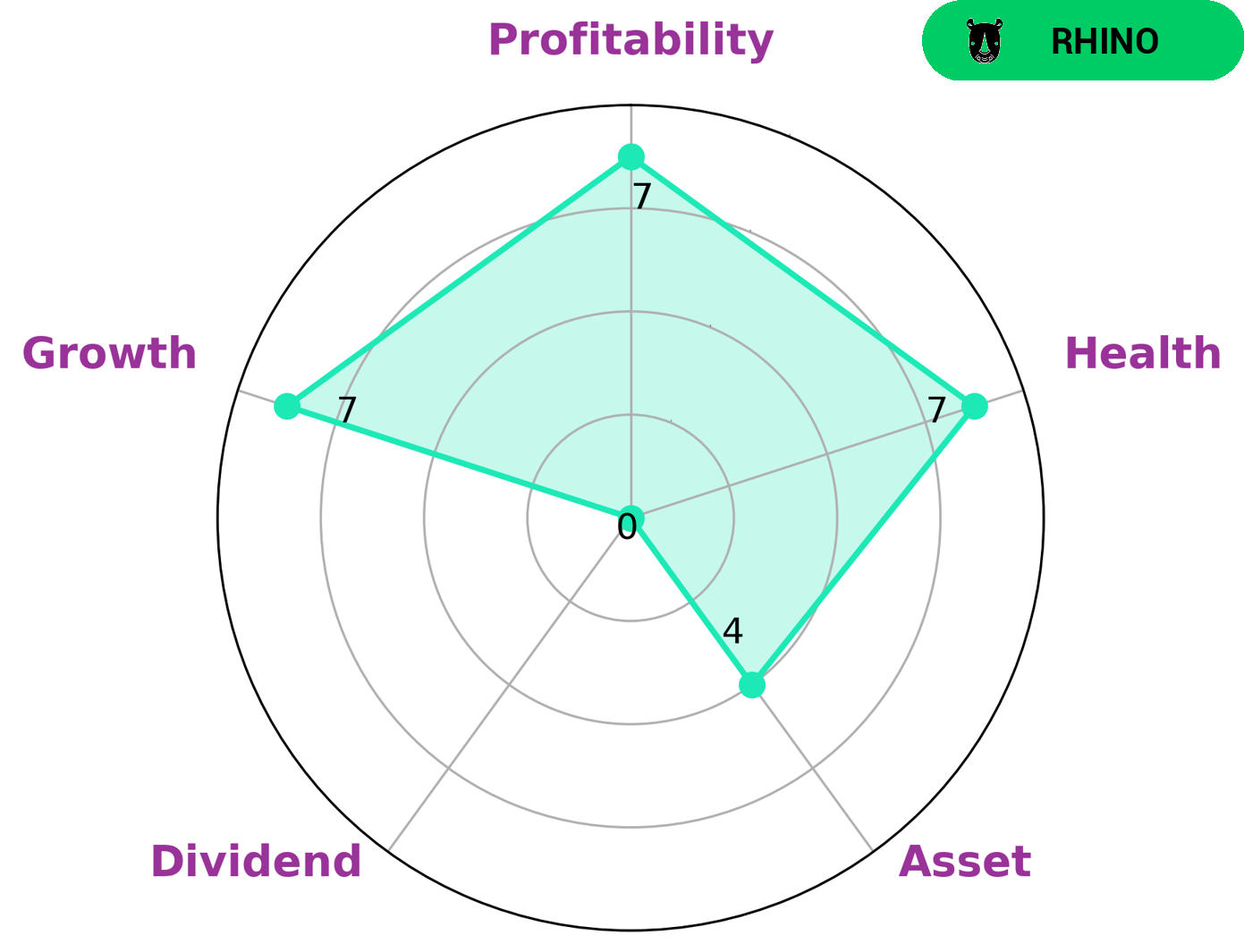

GoodWhale’s analysis of SMART GLOBAL‘s wellbeing shows that the company is classified as ‘rhino’, a type of company that has achieved moderate revenue or earnings growth. Upon further examination of the star chart, we can see that SMART GLOBAL is strong in growth, profitability, and medium in asset and weak in dividend. Additionally, SMART GLOBAL has a high health score of 7/10 considering its cashflows and debt, which indicates the company is capable to sustain future operations in times of crisis. Considering all the factors mentioned above, investors who seek moderate growth and a strong financial standing may be interested in SMART GLOBAL. Furthermore, those looking for consistent dividends should look elsewhere. More…

Peers

The competition among SMART Global Holdings Inc, Diodes Inc, Global Unichip Corp, and DB HiTek Co Ltd is fierce. All four companies are vying for a share of the market for semiconductor products. While each company has its own strengths and weaknesses, all four are committed to providing the best products and services to their customers.

– Diodes Inc ($NASDAQ:DIOD)

Diodes Inc is a leading manufacturer of semiconductor products. Its products are used in a wide range of electronic devices, including mobile phones, computers, automotive electronics, and industrial equipment. The company has a market cap of 3.14B as of 2022 and a Return on Equity of 22.49%. Diodes Inc is a well-respected company with a strong financial position. It is a leader in its industry and its products are in high demand. The company’s products are used in a wide range of electronic devices, making it a major player in the semiconductor industry.

– Global Unichip Corp ($TWSE:3443)

Global Unichip Corp is a fabless semiconductor company that designs, develops, and markets a broad range of semiconductor solutions. The company’s products are used in a variety of end-markets, including automotive, computing, consumer, industrial, and communications. Global Unichip’s market cap is $59.84B as of 2022, and its return on equity is 28.78%. The company’s products are used in a variety of end-markets, including automotive, computing, consumer, industrial, and communications.

– DB HiTek Co Ltd ($KOSE:000990)

Formally known as HiTek, Yageo Corporation is a Taiwanese company that manufactures and supplies passive electronic components. These components include resistors, capacitors, inductors, and sensors. Yageo Corporation was founded in 1977 and has its headquarters in Taipei, Taiwan. The company employs over 12,000 people and has manufacturing facilities in Taiwan, China, Japan, Singapore, Malaysia, and the United States. Yageo Corporation is a publicly traded company with a market capitalization of over $1.8 trillion as of 2022. The company has a return on equity of 33.11%. Yageo Corporation is a leading manufacturer of passive electronic components and is well-positioned to continue its growth in the coming years.

Summary

SMART GLOBAL‘s fiscal year 2023 Q2 earnings report revealed a large decrease in total revenue of 1206.5%. Although net income decreased as well, it was not as drastic, decreasing only by 4.5%. Investors should note that this quarter’s results demonstrate a large financial downturn for the company, and may indicate further declines in the future. A thorough analysis of the company’s financials is recommended in order to make a well-informed decision on whether to invest in the company.

Recent Posts