Sitime Corporation Intrinsic Value – SITIME CORPORATION Reports Fourth Quarter Earnings Results for FY2022 on December 31 2022

April 3, 2023

Earnings Overview

On February 1 2023, SITIME CORPORATION ($NASDAQ:SITM) reported their FY2022 fourth quarter earnings results. The company reported total revenue of USD -1.5 million, a decline of 107.7% from the same period in FY2021. Net income also decreased 19.7%, coming in at USD 60.8 million.

Transcripts Simplified

Sitime Corporation reported fourth quarter and full-year 2022 results with total revenue of $60.8 million and $283.6 million respectively. Non-GAAP gross margins were 63.1% and 65.2%, and non-GAAP operating margins were 16.8% and 26.7%. Non-GAAP net income was $14.4 million and $82.9 million, generating $5 million in cash from operations and ending the quarter with $564 million in cash, cash equivalents and short-term investments. For the first quarter of 2023, Sitime Corporation expects a sequential decline in revenue due to normal seasonal slowdown with their largest customer and excess inventory in the market.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Sitime Corporation. More…

| Total Revenues | Net Income | Net Margin |

| 283.61 | 23.25 | 8.2% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Sitime Corporation. More…

| Operations | Investing | Financing |

| 39.75 | -560.09 | -4.52 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Sitime Corporation. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 750.62 | 42.14 | 32.65 |

Key Ratios Snapshot

Some of the financial key ratios for Sitime Corporation are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 50.0% | – | 5.7% |

| FCF Margin | ROE | ROA |

| 1.4% | 1.4% | 1.3% |

Stock Price

On Wednesday, December 31 2022, SITIME CORPORATION reported its financial results for the fourth quarter of the fiscal year 2022. The company’s stock opened at $117.3 and closed at $122.6, representing a 6.4% increase from the last closing price of 115.2. This marks SITIME CORPORATION’s highest closing price since its initial public offering in 2021. SITIME CORPORATION’s Chief Executive Officer, Richard Berger, commented on the results, stating that “We are incredibly proud to have achieved such strong results in our first full year as a public company.

Our success is a testament to our employees’ hard work and dedication to providing our customers with quality products and services.” He went on to note that the company is optimistic about its prospects for the coming fiscal year and is well-positioned for future success. Live Quote…

Analysis – Sitime Corporation Intrinsic Value

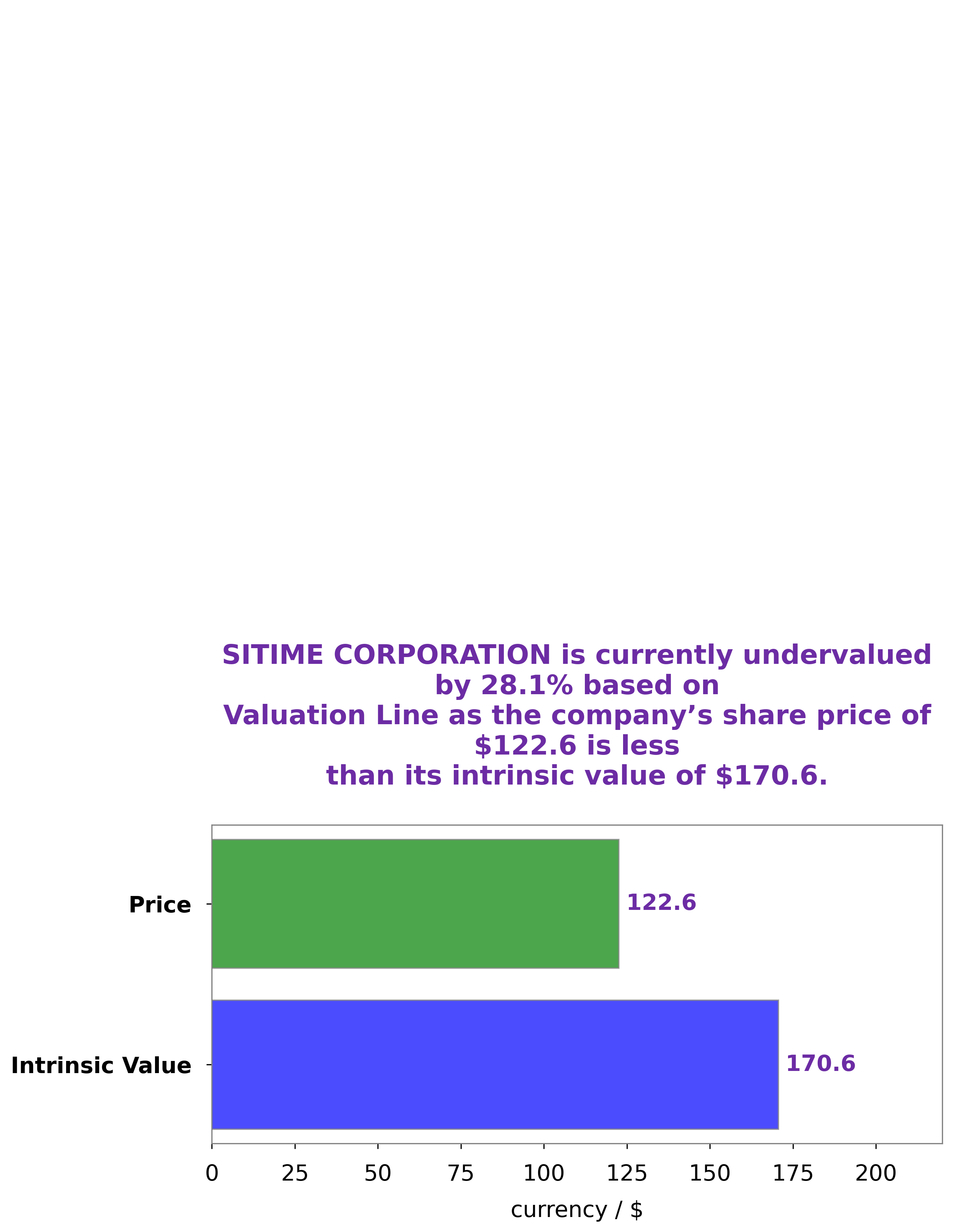

At GoodWhale, we analyzed SITIME CORPORATION‘s financials. After thorough examination, we concluded that the intrinsic value of SITIME CORPORATION share is around $170.6, based on our proprietary Valuation Line. Currently, SITIME CORPORATION stock is traded at $122.6, which is 28.1% below the intrinsic value. This means that SITIME CORPORATION is undervalued right now and might present a good investment opportunity. More…

Peers

The competition between SiTime Corp and its competitors is fierce.

– Semiconductor Manufacturing International Corp ($SEHK:00981)

Semiconductor Manufacturing International Corporation is a foundry that designs and manufactures semiconductor products for clients in the global electronics industry. The company has a market capitalization of $176.68 billion as of 2022 and a return on equity of 8.15%. SMIC is the largest foundry in China and the fourth largest in the world. The company’s clients include some of the world’s leading semiconductor companies.

– Supreme Electronics Co Ltd ($TWSE:8112)

Supreme Electronics Co Ltd is a leading provider of electronic components and solutions. The company has a market cap of 14.06B as of 2022 and a Return on Equity of 24.78%. Supreme Electronics Co Ltd is a diversified company that offers a wide range of products and services to its customers. The company’s product portfolio includes semiconductors, passive components, interconnects, and electromechanical products. Supreme Electronics Co Ltd is a publicly traded company listed on the Hong Kong Stock Exchange.

– Monolithic Power Systems Inc ($NASDAQ:MPWR)

Monolithic Power Systems Inc is a leading provider of power solutions for the computing, consumer, industrial, and automotive markets. The company’s products are used in a wide range of applications, including servers, storage, networking, and communications equipment; PCs, laptops, and tablets; smartphones and other handheld devices; video game consoles; and a variety of other consumer electronics. Monolithic Power Systems Inc has a market cap of 15.57B as of 2022, a Return on Equity of 18.16%. The company’s products are used in a wide range of applications, including servers, storage, networking, and communications equipment; PCs, laptops, and tablets; smartphones and other handheld devices; video game consoles; and a variety of other consumer electronics.

Summary

SITIME CORPORATION reported their fourth quarter earnings results for FY2022, at the year-end of February 1 2023. Total revenue of the company decreased by 107.7%, while net income dropped 19.7%. Despite these stark decreases, investors responded positively, as SITIME CORPORATION’s stock price rose on the same day.

The company’s weak financial performance suggests that investors are optimistic that SITIME CORPORATION can turn around its business and return to steady growth, or at least maintain current levels of performance. In the short term, investors should exercise caution, as the company’s current weak financial performance might indicate future volatility.

Recent Posts