SILVERCORP METALS Reports Third Quarter Fiscal Year 2023 Earnings Results for Period Ending February 10 2023

April 9, 2023

Earnings Overview

SILVERCORP METALS ($TSX:SVM) reported total revenue of USD 11.9 million for the third quarter of fiscal year 2023, which ended on February 10 2023, a 135.6% year-over-year increase. Net income for the quarter was USD 58.6 million, a slight 0.7% decrease from the same period of the prior year. The earnings results were reported on December 31 2022.

Share Price

On Friday, SILVERCORP METALS released its third quarter fiscal year 2023 earnings results for the period ending February 10, 2023. The stock opened at CA$4.2 and closed at CA$4.3, representing an increase of 3.1% from the previous closing price of CA$4.2. The company’s strong balance sheet is a sign of its financial health and provides stability in these uncertain times. With the combination of strong sales, higher profits, and a strong balance sheet, SILVERCORP is well positioned to continue to grow in the future. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Silvercorp Metals. More…

| Total Revenues | Net Income | Net Margin |

| 215.57 | 24.34 | 18.8% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Silvercorp Metals. More…

| Operations | Investing | Financing |

| 94.31 | -106.63 | -7.43 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Silvercorp Metals. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 680.89 | 102.63 | 2.79 |

Key Ratios Snapshot

Some of the financial key ratios for Silvercorp Metals are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 7.2% | -0.2% | 26.3% |

| FCF Margin | ROE | ROA |

| 12.1% | 5.0% | 3.5% |

Analysis

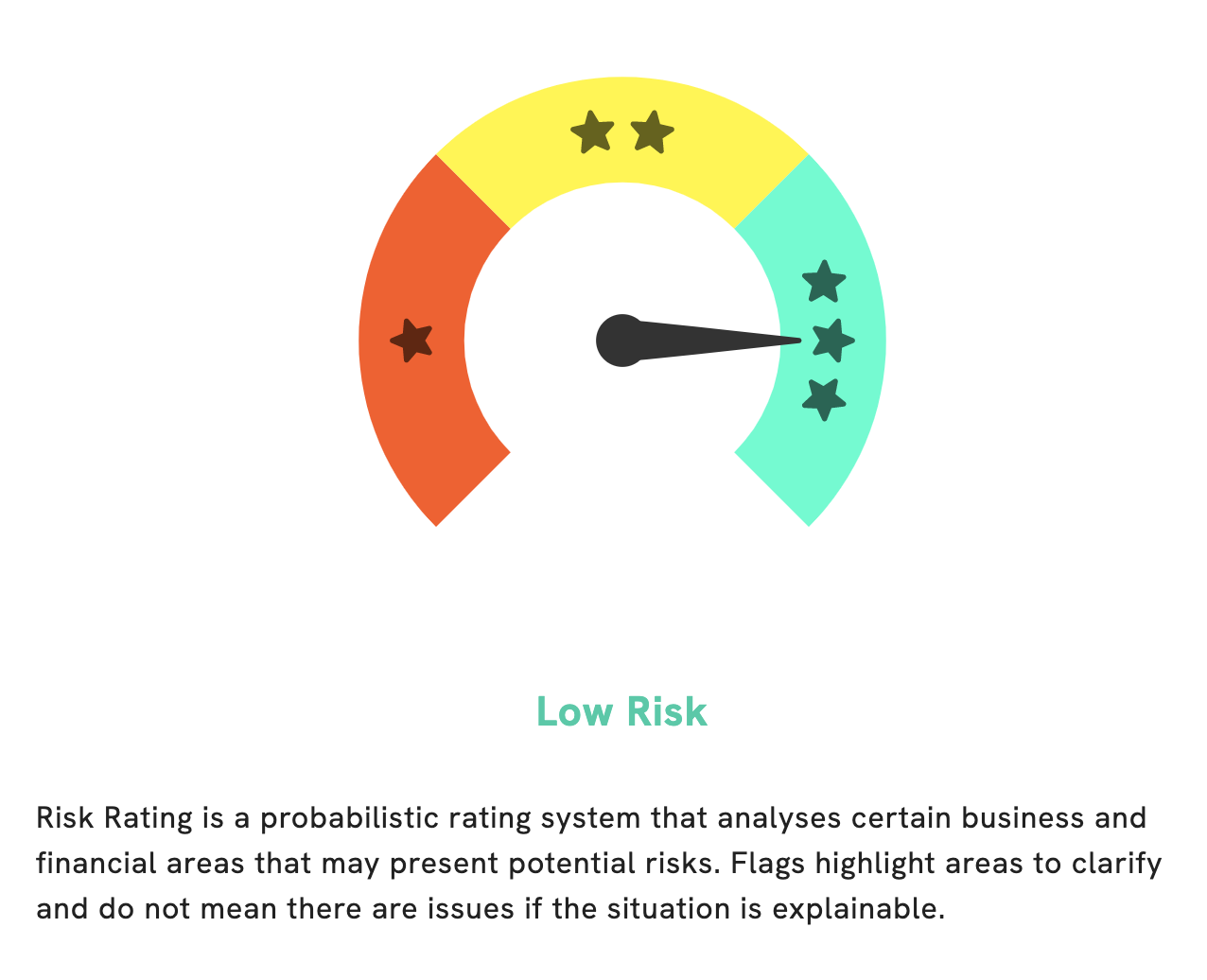

GoodWhale has conducted an analysis of SILVERCORP METALS‘s wellbeing and found that it is a low risk investment according to our Risk Rating. We have taken into account financial and business aspects of the company in order to arrive at this conclusion. However, GoodWhale has detected some risks that require further investigation. We have found two risk warnings in SILVERCORP METALS’s income sheet and balance sheet. If you’re interested in learning more, please register with us and we’ll be happy to provide further information. More…

Peers

In the mining industry, competition is fierce. Companies are constantly vying for the best properties and the most favorable terms. Silvercorp Metals Inc is no exception. The company has been locked in competition with Headwater Gold Inc, Metals Exploration PLC, and Platinex Inc for years. Each company has its own strengths and weaknesses, but Silvercorp has consistently come out on top.

– Headwater Gold Inc ($OTCPK:HWAUF)

Headwater Gold Inc is a Canadian junior mining company with a focus on gold exploration and development in the Northwest Territories of Canada. The company has a market capitalization of $12.21 million and a negative return on equity of 23.76%. Headwater Gold is engaged in the business of exploring, developing, and mining mineral properties. The company’s flagship property is the Yellowknife Gold Project, which consists of 9 claims totaling approximately 5,000 hectares located in the Yellowknife greenstone belt.

– Metals Exploration PLC ($LSE:MTL)

As of 2022, Metals Exploration PLC has a market cap of 17.23M. Metals Exploration PLC is a Return on Equity of 130.94%. The company is engaged in the exploration, development and production of metals. The company’s principal activity is the operation of the Rengo open-pit mine in Chile.

– Platinex Inc ($OTCPK:PANXF)

Platinex Inc is a junior mining exploration company with a focus on gold and platinum group metals. The company has a market capitalization of 5.27 million as of 2022 and a return on equity of -30.94%. The company’s primary operations are located in the Canadian province of Ontario.

Summary

SILVERCORP METALS‘ third quarter of fiscal year 2023 ended with impressive results, with total revenue of USD 11.9 million, representing a 135.6% year-over-year increase. However, net income saw a slight 0.7% decrease compared to the previous year. Despite this minor decline, the company’s stock price rose on the same day, indicating that investors are confident in SILVERCORP METALS’ future prospects. In light of this recent success, those looking to invest in SILVERCORP METALS should consider the company’s long-term growth potential and whether it is well-positioned for future success.

Recent Posts