SIGNET JEWELERS Reports Record-High Earnings for Fiscal Year 2023 Q4

March 20, 2023

Earnings Overview

On March 16 2023, SIGNET JEWELERS ($NYSE:SIG) released its financial results for the fourth quarter of FY2023, ending January 31 2023. Total revenue fell 11.8% compared to the same period last year, amounting to USD 277.3 million, while net income dropped 5.2%, settling at USD 2666.2 million.

Transcripts Simplified

Our earnings release and the supplemental materials are available on the Investor Relations section of our website. Our fourth quarter and full year results demonstrate that our transformation efforts are gaining momentum. We have now achieved our fourth consecutive quarter of comparable sales growth, driven by increased conversion and higher average transaction value. We also continue to make progress in reducing our expense base and improving our working capital efficiency. …

We are confident that our strategies will drive long-term sustainable growth and create value for our shareholders. Thank you for your interest and support, and I look forward to updating you on our progress in the future.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Signet Jewelers. More…

| Total Revenues | Net Income | Net Margin |

| 7.84k | 342.2 | 7.2% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Signet Jewelers. More…

| Operations | Investing | Financing |

| 797.9 | -545.4 | -490 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Signet Jewelers. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 6.62k | 4.39k | 43.82 |

Key Ratios Snapshot

Some of the financial key ratios for Signet Jewelers are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 8.5% | 40.0% | 5.9% |

| FCF Margin | ROE | ROA |

| 8.4% | 13.7% | 4.4% |

Stock Price

On Thursday, SIGNET JEWELERS reported record-high earnings for its fourth quarter of fiscal year 2023. At the start of the day, the company’s stock opened at $71.8 and closed at $75.5, representing an impressive 11.3% surge from its prior closing price of 67.9. The strong performance was a welcome surprise for investors, who have been eagerly awaiting the results of SIGNET JEWELERS’ most recent quarter. The strong performance can be attributed in part to the success of the company’s new product lines and strategic investments made throughout the year. SIGNET JEWELERS has seen an increase in sales on many of its existing products, as well as a boost in revenue from its new collections.

In addition, the company has invested heavily in expanding its online presence, which has helped to drive more sales. This rise in share price indicates investor confidence in the company’s ability to produce steady returns in the coming quarters. As SIGNET JEWELERS continues to expand its presence in the jewelry market, investors can expect to see further growth in the company’s stock price. Live Quote…

Analysis

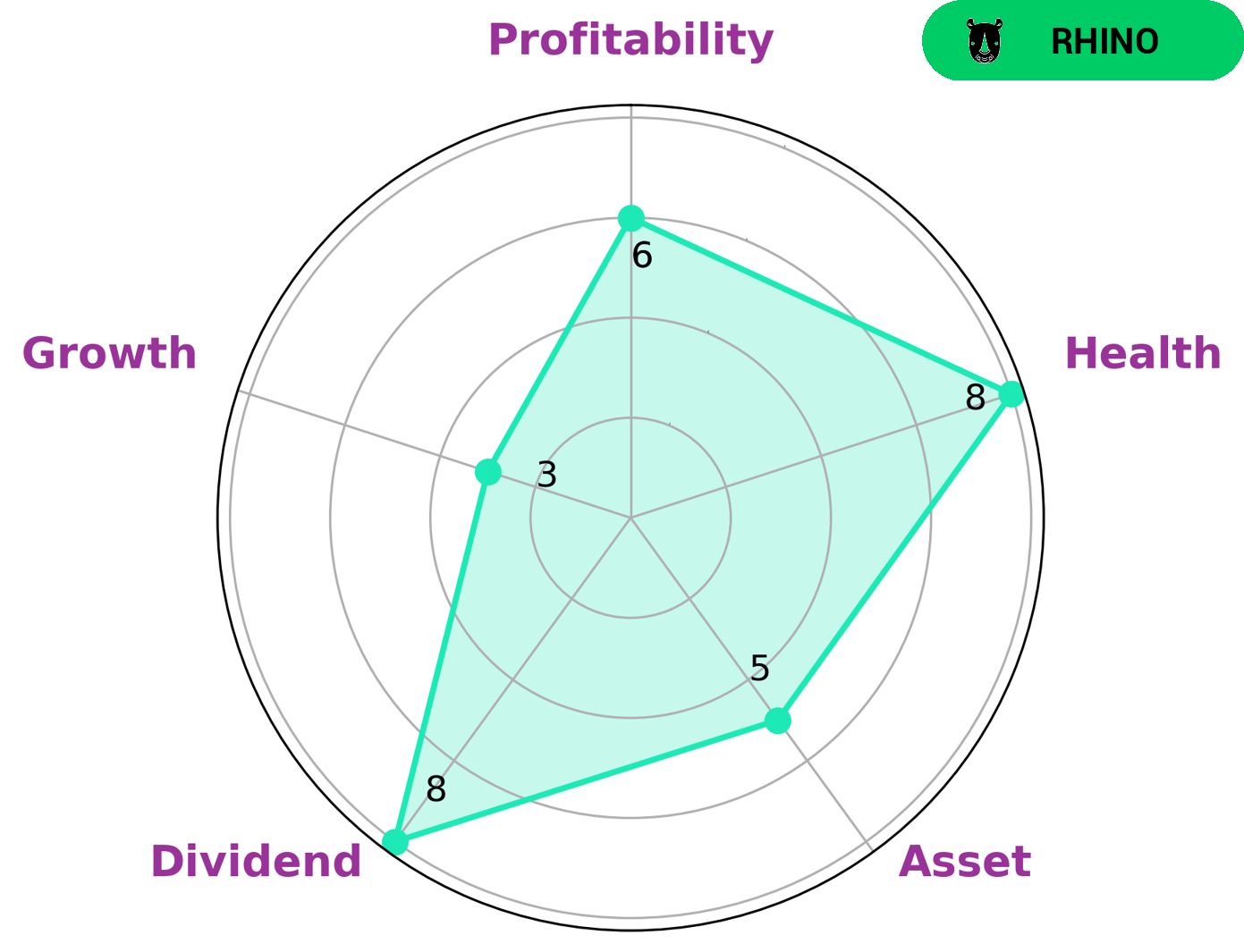

GoodWhale’s analysis of SIGNET JEWELERS reveals that the company is classified as a ‘rhino’, a type of company that has achieved moderate revenue or earnings growth. For this reason, investors who are looking for a steady income from dividends may be interested in SIGNET JEWELERS. The Star Chart for SIGNET JEWELERS shows that it is strong in dividend, medium in asset, profitability, and weak in growth. Although it has some weaknesses in terms of growth, SIGNET JEWELERS has a high health score of 8/10. This score takes into account cashflows and debt, and suggests that the company is capable to pay off debt and fund future operations. More…

Peers

The company is engaged in the retail sale of diamond jewelry, watches, and other related items. Signet Jewelers competes in the jewelry industry with other retailers such as Jakroo Inc, ABC Technologies Holdings Inc, and National Vision Holdings Inc.

– Jakroo Inc ($OTCPK:JKRO)

ATC Technologies Holdings Inc is a global provider of precision machining solutions. The company offers a range of services, including contract manufacturing, machining, and assembly. ATC serves a variety of industries, including aerospace, defense, medical, and semiconductor. The company has a market cap of 559.41M and a ROE of -9.23%.

– ABC Technologies Holdings Inc ($TSX:ABCT)

National Vision Holdings Inc is a holding company that operates through its subsidiaries as one of the largest optical retailers in the United States. The company offers a wide variety of vision care products and services including eyeglasses, contact lenses, eye exams, and prescription sunglasses. As of 2022, the company had a market capitalization of 2.66 billion dollars and a return on equity of 10.47%. National Vision Holdings Inc operates over 1,400 stores in 42 states across the United States.

Summary

SIGNET JEWELERS recently released their FY2023 Q4 earnings, showing a year-over-year decrease in total revenue of 11.8% to USD 277.3 million and in net income of 5.2% to USD 2666.2 million. Despite these declines, the stock price moved up the same day, indicating that investors are optimistic about the company’s financials and future prospects. Investors should closely monitor SIGNET JEWELERS’ financials to ensure that their current performance is sustainable in the long-term and that the company is well-positioned to capitalize on any future growth opportunities.

Recent Posts