SHOWS STRONG Earnings In 4th Quarter And Outlook For 2022

April 13, 2023

Trending News ☀️

The company provides banking, insurance, and other financial services to individuals and businesses. Recently, SAGICOR ($TSX:SFC) Financial reported strong earnings in its fourth quarter of 2020, with an Earnings Per Share (EPS) of US$0.092 or C$0.125. For the full year, SAGICOR Financial posted an EPS of US$0.809 or C$1.053. The strong performance in the fourth quarter of 2020 and the anticipated strong performance in 2022 demonstrate the resilience of SAGICOR Financial’s business model and their ability to capitalize on new opportunities in the Caribbean market. The financial services industry is poised for growth in the coming years, and SAGICOR Financial is well positioned to benefit from this trend.

The company has already taken steps to expand its presence in the Caribbean, partnering with other financial services providers to offer customers more comprehensive services. The strong earnings performance in the fourth quarter of 2020 and outlook for 2022 demonstrate that SAGICOR Financial is well positioned to continue to drive growth and profitability in the years ahead. With its diversified portfolio of products, experienced management team, and wide geographic reach in the Caribbean, SAGICOR Financial is well-poised to capitalize on new opportunities and remain a leader in the financial services industry.

Stock Price

On Monday, the stock opened at CA$4.9 and closed at the same price, indicating a slight 0.6% increase from the prior closing price. This shows that SAGICOR FINANCIAL’s financial performance is heading in the right direction, indicating good future prospects. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Sagicor Financial. More…

| Total Revenues | Net Income | Net Margin |

| 2.55k | 115.56 | 4.5% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Sagicor Financial. More…

| Operations | Investing | Financing |

| -154.5 | -26.62 | -65.27 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Sagicor Financial. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 10.77k | 9.26k | 7.6 |

Key Ratios Snapshot

Some of the financial key ratios for Sagicor Financial are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 10.8% | – | 14.3% |

| FCF Margin | ROE | ROA |

| -6.9% | 21.4% | 2.1% |

Analysis

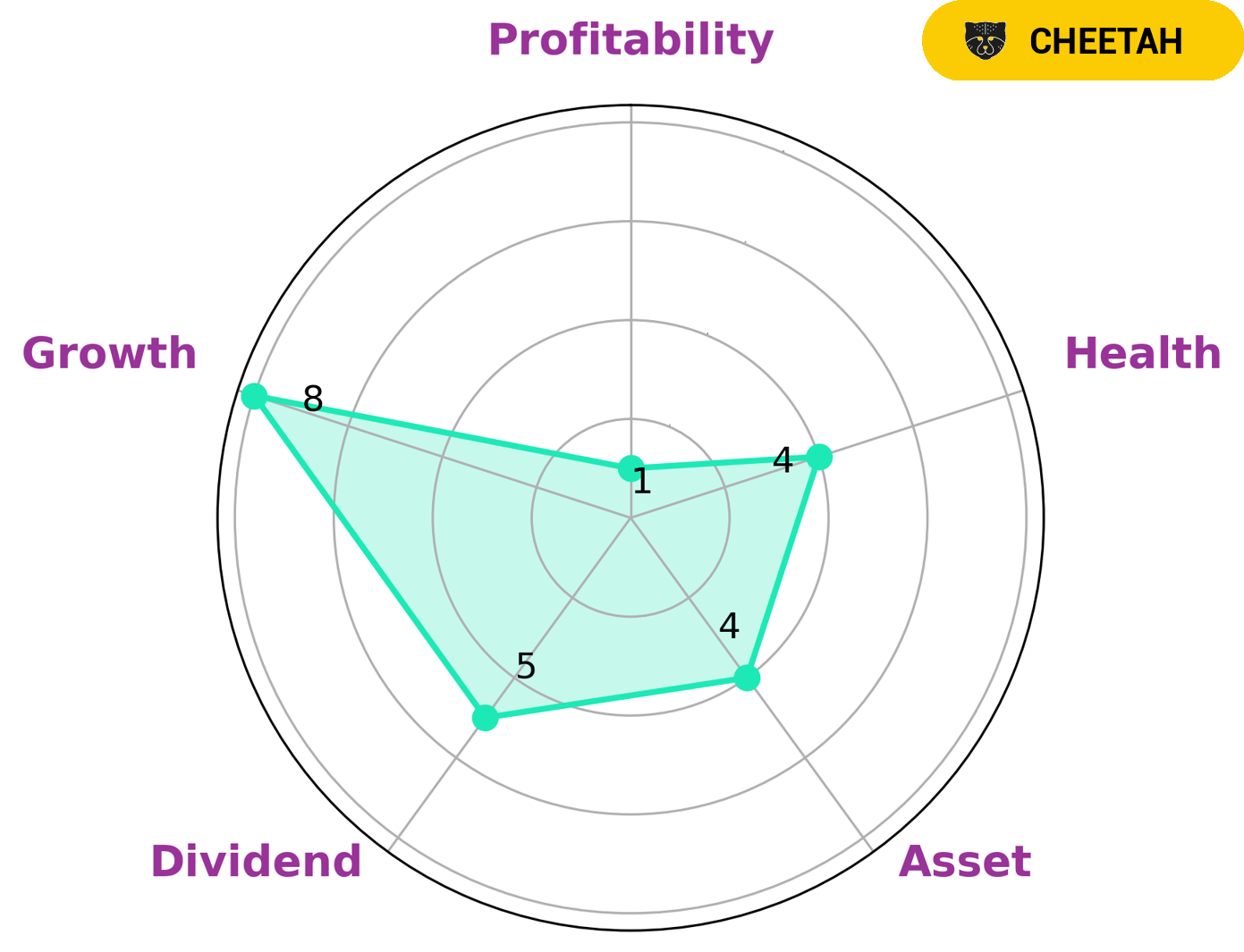

GoodWhale has conducted a thorough analysis of SAGICOR FINANCIAL‘s fundamentals and found that it fits our ‘cheetah’ classification, a type of company that achieved high revenue or earnings growth but is considered less stable due to lower profitability. From our Star Chart, we can see that SAGICOR FINANCIAL is strong in growth, medium in asset, dividend and weak in profitability. Moreover, it has an intermediate health score of 4/10 which indicates that the company should be able to safely ride out any crisis without the risk of bankruptcy. This type of company may be attractive to investors looking for high growth potential but with an awareness of the greater risk that comes along with it. It may appeal to investors looking for a higher return potential, but also those who are open to taking on a higher level of risk. More…

Peers

Sagicor Financial Co Ltd is one of the leading insurance and financial services providers in the world. It has a long history of providing reliable and comprehensive solutions for individuals, businesses and other organizations. Additionally, Sagicor competes with other well-known companies such as Primerica Inc, Ping An Insurance (Group) Co. of China Ltd and Great Eastern Holdings Ltd. These companies have all earned a strong reputation for offering competitive products and services in the market.

– Primerica Inc ($NYSE:PRI)

Primerica Inc is a multi-level marketing company that provides financial services, such as life insurance, mutual funds, variable annuities and other financial products. As of 2022, the company has a market cap of 5.25B, which is a reflection of the company’s strong financial performance and positive outlook. In addition, Primerica Inc’s Return on Equity (ROE) of 15.53% shows that the company is effectively utilizing its resources to generate a high return for its shareholders.

– Ping An Insurance (Group) Co. of China Ltd ($SHSE:601318)

Ping An Insurance (Group) Co. of China Ltd is a leading provider of financial services in China and one of the largest insurers in the world. With a market cap of 823.37B as of 2022, the company is one of the largest and most valuable publicly traded companies in the world. Additionally, its Return on Equity (ROE) is 11.14%, indicating that the company is efficiently utilizing its shareholders’ equity to generate profits. The company offers a variety of services including insurance, banking, asset management, securities, trust and fund management, and other financial services. It is also involved in healthcare, technology, and venture capital activities.

– Great Eastern Holdings Ltd ($SGX:G07)

Great Eastern Holdings Ltd is a leading integrated financial services organisation in Asia, offering a wide range of life and general insurance products and services. As of 2022, the company has a market capitalisation of 8.65 billion and a Return on Equity of 7.45%, indicating a strong financial performance. This market cap reflects the company’s success in providing comprehensive financial solutions to individuals, families and businesses in the region. Great Eastern Holdings Ltd’s financial strength is driven by their commitment to providing excellent customer service, prudent management of resources and a focus on innovation.

Summary

Investing in SAGICOR FINANCIAL can be an attractive option for those looking for long-term growth. Furthermore, SAGICOR FINANCIAL has a strong balance sheet and a good track record of paying out dividends. All these factors make it an attractive option for investors looking for long-term returns.

Recent Posts