Service Corporation International to Release Earnings Report on Tuesday.

February 16, 2023

Trending News 🌥️

SERVICE ($NYSE:SCI): SCI’s reported earnings are expected to provide insight on the company’s financial performance over the last quarter. Investors will be able to assess the company’s financial situation and growth prospects in anticipation of the upcoming fiscal year.

Additionally, the release should reveal any new financial strategies or initiatives that the company has implemented in their operations. The company’s overall financial health will be key to its long-term trajectory, so investors and analysts alike will be paying close attention when the earnings report is released. Further, by viewing the report investors can determine whether or not SCI has adequately adjusted to the current economic climate. Overall, SCI’s upcoming earnings report is sure to tell an intriguing story about the company’s progress in the coming year.

Stock Price

Service Corporation International (SCI) will be releasing its most recent earnings report on Tuesday. This news has been met with mostly positive media exposure. On Thursday, SCI’s stock opened at $71.4 and closed at $70.2, down by 1.1% from the previous closing price of 71.0.

Investors are watching this stock keenly with the anticipation of being able to gauge the company’s financial performance and see how it will affect future developments. As the release of the earnings report draws near, there is much speculation surrounding SCI’s financial future. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Service Corporation. More…

| Total Revenues | Net Income | Net Margin |

| 4.11k | 565.34 | 13.6% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Service Corporation. More…

| Operations | Investing | Financing |

| 825.73 | -447.88 | -448 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Service Corporation. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 15.07k | 13.39k | 10.87 |

Key Ratios Snapshot

Some of the financial key ratios for Service Corporation are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 8.3% | 13.1% | 22.6% |

| FCF Margin | ROE | ROA |

| 11.1% | 34.6% | 3.8% |

Analysis

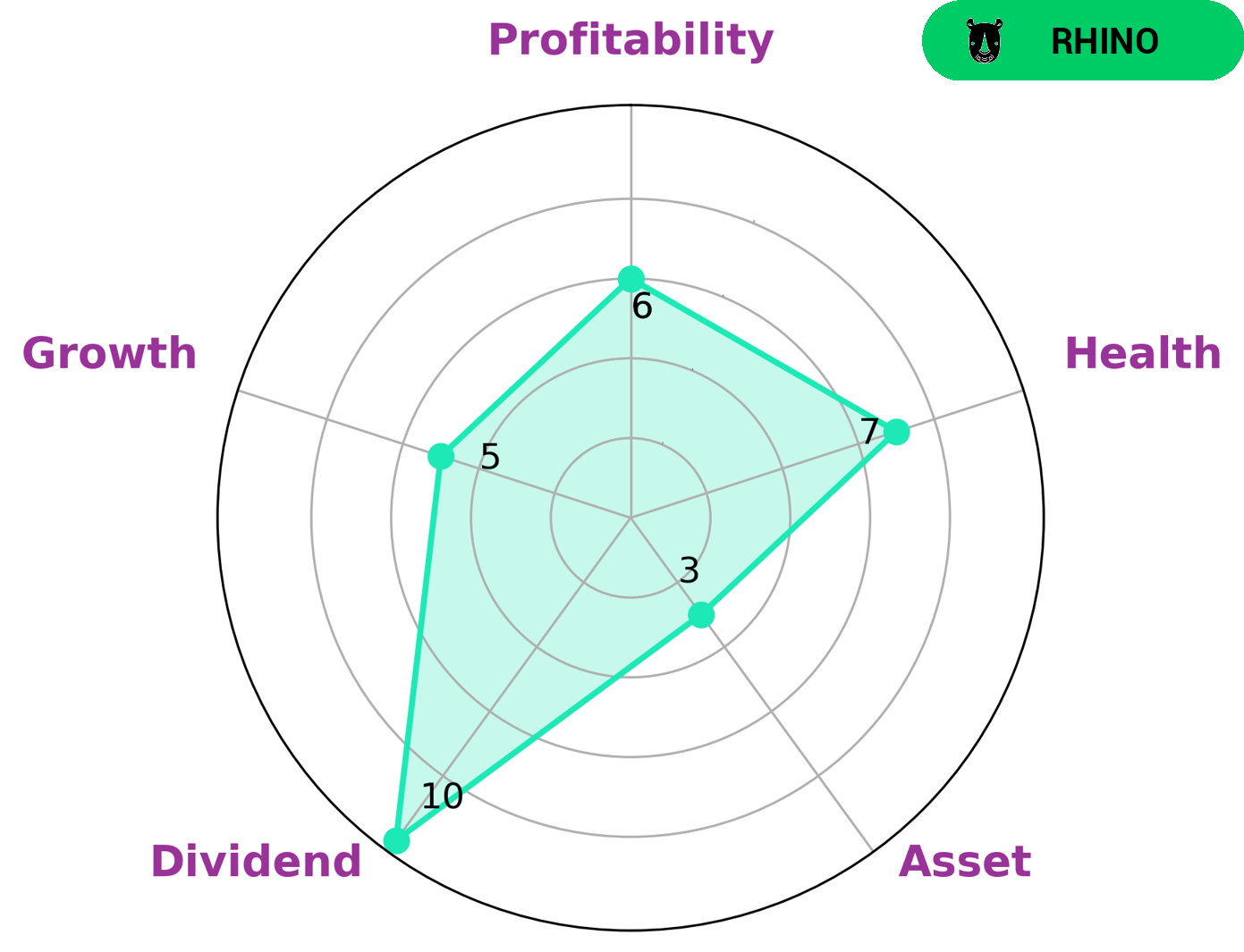

GoodWhale recently conducted an analysis of SERVICE CORPORATION to evaluate their wellbeing. We classified the company as a ‘rhino’, a type of business that has achieved moderate revenue or earnings growth. This type of company may be of interest to investors seeking a steady dividend income as well as moderate capital gains. When evaluating SERVICE CORPORATION’s health score, we found their cashflows and debt to be strong at a rating of 7/10. This indicates that they have a secure cash position and is able to ride out any crisis without the worry of bankruptcy. In terms of growth potential, the company is medium, with reasonable sales and earnings growth; in terms of profitability, SERVICE CORPORATION is also medium; however, their asset base is on the weak side, indicating limited liquidity and financial flexibility. More…

Peers

Service Corp International is the largest provider of death care services and products in North America. The company operates more than 2,000 funeral homes and crematories in the United States and Canada. LE Lavoir Ltd is a provider of funeral and cremation services in Japan. HEIAN CEREMONY SERVICE Co Ltd is a leading provider of funeral services in China.

– Park Lawn Corp ($TSX:PLC)

Park Lawn Corporation is a provider of death care products and services in North America. The Company owns and operates cemeteries, funeral homes, crematoria, burial vaults, urn gardens, memorialization products and services, and cemetery property. Park Lawn’s products and services include interment rights, such as graves, crypts or niches in cemeteries, and funeral and cremation services.

– LE Lavoir Ltd ($BSE:539814)

In 2022, the market capitalization of Lavoir Ltd was 108.86 million, with a return on equity of 1.66%. The company provides laundry and dry-cleaning services.

– HEIAN CEREMONY SERVICE Co Ltd ($TSE:2344)

The Heian Ceremony Service Co Ltd has a market capitalization of 9.16 billion as of 2022. The company has a return on equity of 4.27%. Heian Ceremony Service Co Ltd is a company that provides services for ceremonies.

Summary

Investors are keeping a close eye on Service Corporation International, as the company is set to release its earnings report on Tuesday. The outlook on the release has been relatively positive, with analysts noting the high potential for solid earnings. While the exact financial performance of Service Corporation International remains uncertain, consensus estimates indicate an increase in revenue for the period.

Analysts suggest that investors should monitor the report for signs of increasing efficiency operations and potential cost savings that could affect the company’s future profits. With the stock currently trading at a slightly discounted price, investors should consider taking a long position in the company in anticipation of the earnings release.

Recent Posts