Sei Investments Co. Cuts Amedisys Holdings Despite Impressive Earnings Performance

June 10, 2023

🌧️Trending News

Sei Investments Co. has cut its holdings in Amedisys ($NASDAQ:AMED) Inc., a leading provider of home health, hospice and personal care services, despite the latter’s impressive earnings performance. Amedisys Inc. is a publicly-traded company that operates in more than fifteen states across the United States. It provides personalized care and support to patients who require complex medical, emotional, spiritual and physical care, as well as to those who are transitioning from hospital to home. Despite Amedisys’ impressive earnings performance, Sei Investments Co. has decided to reduce its holdings in the company.

It’s important to note that Sei Investments Co. is one of Amedisys’ biggest shareholders, and the move signals a shift in sentiment towards the company. While the exact reason for the move has yet to be revealed, it could be indicative of a broader trend in sentiment towards healthcare stocks.

Earnings

In the earning report of FY2023 Q1 as of March 31 2021, AMEDISYS earned a total revenue of 537.14M USD and net income of 49.87M USD. This is a 1.5% decrease in total revenue and a 57.5% increase in net income compared to the previous year. Over the last 3 years, AMEDISYS’s total revenue has increased from 537.14M USD to 556.39M USD. Despite this impressive earnings performance, Sei Investments Co. has recently announced that it is cutting its holdings in AMEDISYS, indicating that the company may be facing some challenges going forward.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Amedisys. More…

| Total Revenues | Net Income | Net Margin |

| 2.23k | 112.18 | 5.1% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Amedisys. More…

| Operations | Investing | Financing |

| 110.62 | -32.51 | -79.92 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Amedisys. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.95k | 813.61 | 33.15 |

Key Ratios Snapshot

Some of the financial key ratios for Amedisys are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 4.1% | -0.1% | 8.0% |

| FCF Margin | ROE | ROA |

| 4.6% | 10.4% | 5.7% |

Stock Price

Amedisys_Holdings_Despite_Impressive_Earnings_Performance”>Live Quote…

Analysis

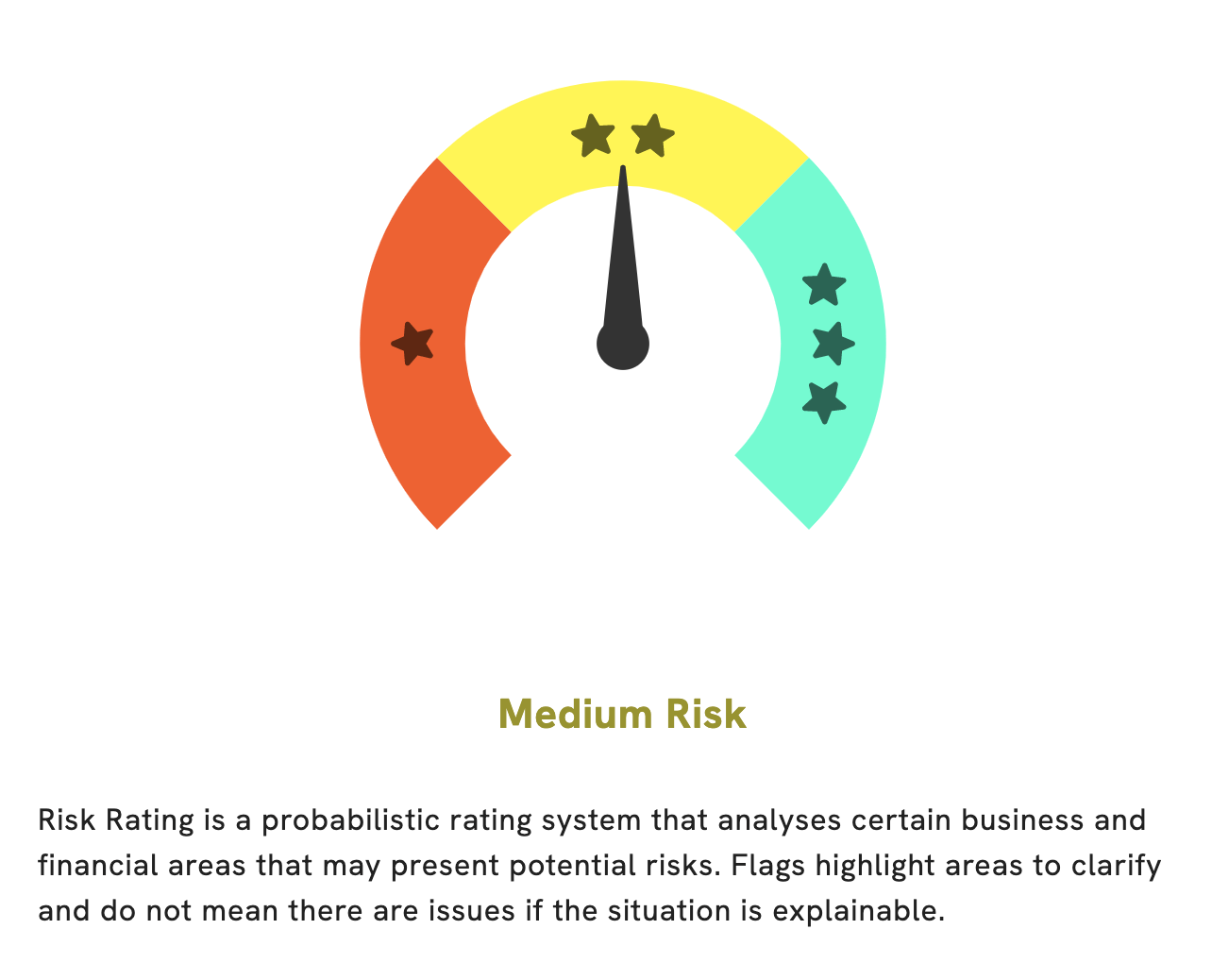

At GoodWhale, we’ve conducted an in-depth analysis of AMEDISYS’s financials and have determined it to be a medium risk investment in terms of financial and business aspects. Our Risk Rating system assesses the potential risks of the company’s financial and non-financial performance, as well as its balance sheet, income sheet, and other core financial documents. We have detected three risk warnings that could potentially impact AMEDISYS’s performance. To gain a full understanding of these risks, become a GoodWhale registered user and you’ll be able to access our comprehensive report. Our report contains the full details of our analysis, along with our recommendations and insights to help you make the most informed decision possible. More…

Peers

Its competitors include National Healthcare Corp, Aveanna Healthcare Holdings Inc, and Nova Leap Health Corp.

– National Healthcare Corp ($NYSEAM:NHC)

National Healthcare Corporation is a diversified healthcare services company that owns and operates long-term care facilities, hospitals, home health agencies, and hospice care businesses. The company has a market capitalization of $942.75 million and a return on equity of 2.65%. National Healthcare Corporation is headquartered in Nashville, Tennessee.

– Aveanna Healthcare Holdings Inc ($NASDAQ:AVAH)

Aveanna Healthcare Holdings Inc is a publicly traded company that provides health care services. The company has a market capitalization of 290.03 million as of 2022 and a return on equity of -71.08%. The company’s primary business is providing in-home health care services to patients. The company operates in the United States, Canada, and Puerto Rico.

– Nova Leap Health Corp ($TSXV:NLH)

Nova Leap Health Corp is a Canadian publicly traded company with a market cap of 23.25M as of 2022. The company is a provider of home health care services. The company has a Return on Equity of 1.6%. The company’s services include personal care, nursing, and homemaking services.

Summary

Amedisys Inc., a provider of home health care services, has recently seen a decrease in investments from Sei Investments Co., despite impressive earnings performance. The company’s performance remains strong and is marked as a strong value investment. Given the positive performance, investors are encouraged to research the company carefully as it may offer strong returns. Amedisys Inc. continues to demonstrate growth in its operations across all segments, with a focus on cost management and strategic acquisitions.

Additionally, the company is looking to expand its footprint within the home health care industry. With such positives, Amedisys Inc. remains a great option for those looking for a strong value investment.

Recent Posts