SEALED AIR Reports Fourth Quarter FY 2022 Earnings Results for February 9, 2023.

February 15, 2023

Earnings report

Sealed Air ($NYSE:SEE) Corporation, a publicly traded company that produces food packaging, industrial products and consumer items, released its earnings report for the fourth quarter of fiscal year 2022 on February 9, 2023. The company reported a total revenue of USD 94.3 million, a decrease of 47.9% compared to the same quarter the previous year. Net income was USD 1405.9 million, a decrease of 8.2% year over year. The company attributed the large decrease in revenue to the pandemic, as it had to reduce its production due to supply chain disruptions and an overall decrease in demand. Despite the pandemic-related losses, the company was still able to remain profitable and saw increased sales in its consumer division, thanks to an increase in takeaway food packaging. He added that the company is actively looking for new markets to expand its presence and capitalize on new opportunities.

Sealed Air is also looking to make investments in technology and automation to improve efficiency and boost profits. The company is working on introducing new packaging solutions for its customers that will provide better flexibility and cost savings. Overall, Sealed Air reported strong fourth quarter earnings results on February 9th despite the challenges posed by the pandemic. The company is confident in its capability to adapt to changing market conditions and remain profitable. It is actively looking for new opportunities and making investments in technology and automation to ensure long-term success.

Market Price

The company opened at $52.6 and closed at $50.0, representing a drop of 6.6% from the prior closing price of 53.6. Despite the overall positive financial performance for the quarter, investors reacted negatively to some of the other news that was shared on Thursday. Specifically, analysts were concerned that increased costs associated with innovation and investments in the future would cut into margins and profits going forward. This led to a selloff in the stock, as investors decided to take their profits from the quarter and move into less risky investments.

Overall, SEALED AIR shareholders were disappointed with the news on Thursday. While the company’s financial performance for the quarter was strong, the potential for decreased margins going forward due to higher costs is seen by some as a red flag for the future of SEALED AIR. Investors will be keeping a close eye on the company going forward to see if these concerns are justified or not. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Sealed Air. More…

| Total Revenues | Net Income | Net Margin |

| 5.64k | 491.6 | 8.8% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Sealed Air. More…

| Operations | Investing | Financing |

| 613.3 | -243 | -446.7 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Sealed Air. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 6.21k | 5.87k | 1.51 |

Key Ratios Snapshot

Some of the financial key ratios for Sealed Air are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 5.6% | 15.3% | 15.8% |

| FCF Margin | ROE | ROA |

| 6.7% | 198.2% | 9.0% |

Analysis

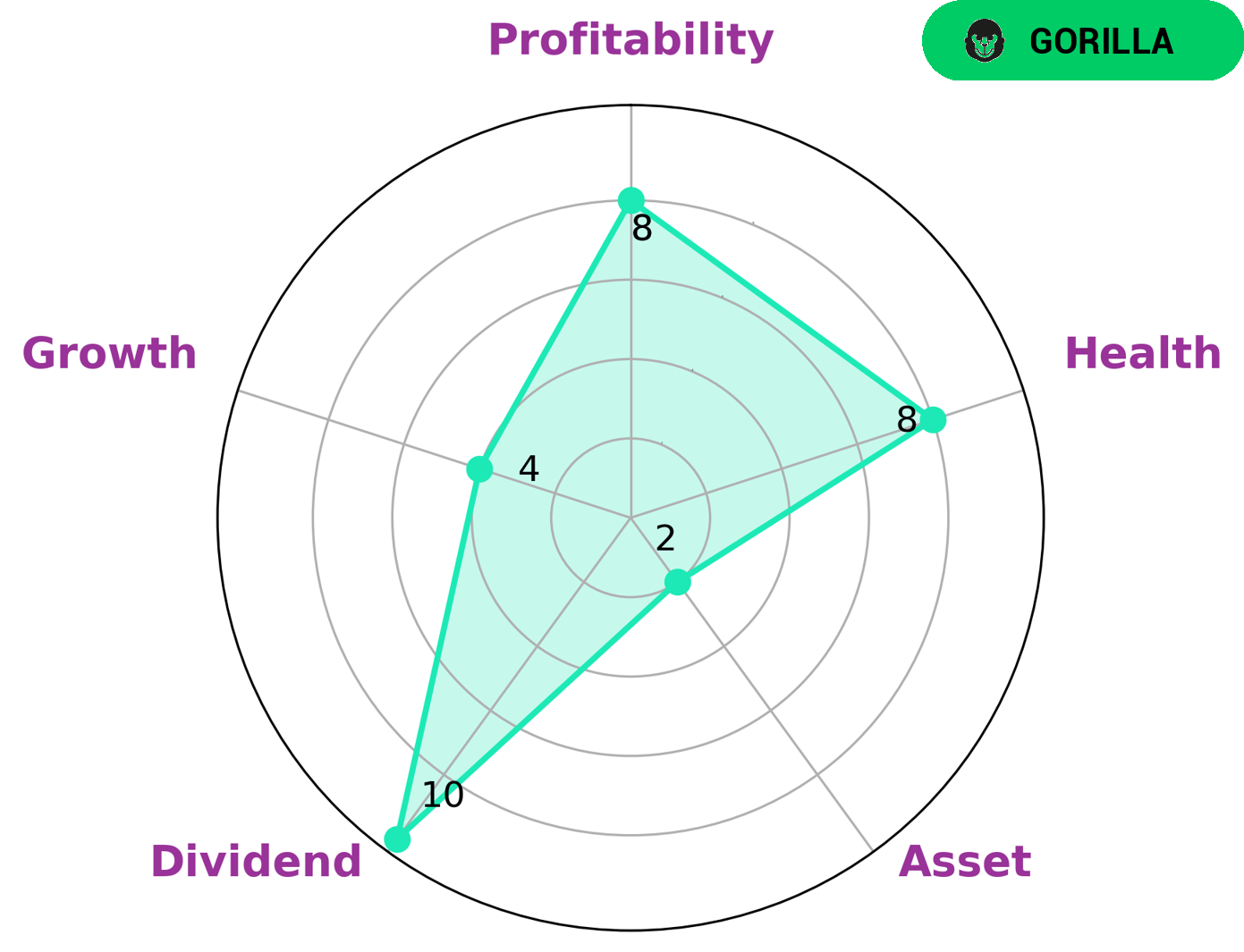

SEALED AIR is a company that is highly attractive to investors due to its strong financial health. According to the GoodWhale Star Chart, SEALED AIR has a high health score of 8/10 in terms of cashflows and debt. This means that the company is able to sustain operations in times of crisis. Furthermore, SEALED AIR is classified as a ‘gorilla’ by GoodWhale, a term used to describe companies that have achieved stable and high revenue or earning growth due to its strong competitive advantage. This makes it an excellent option for value investors, dividend investors and growth investors. Value investors will appreciate the strong dividend provided by SEALED AIR, while growth investors can benefit from the company’s profitability and competitive advantage. At the same time, since SEALED AIR is not as strong in terms of asset growth, aggressive traders may not be as interested in the company. Ultimately, SEALED AIR looks to be an attractive option for investors due to its strong financial health, competitive advantage and potential for dividend and profitability. However, aggressive traders should consider other options as SEALED AIR is not as strong in terms of asset growth. More…

Peers

The company’s products are used in a variety of industries, including food, beverage, healthcare, and industrial. Sealed Air Corp has a number of competitors, including PT Megalestari Epack Sentosaraya Tbk, Huhtamäki Oyj, Raj Packaging Industries Ltd.

– PT Megalestari Epack Sentosaraya Tbk ($IDX:EPAC)

PT Megalestari Epack Sentosaraya Tbk has a market cap of 165.17B as of 2022. The company is engaged in the production of paper and paperboard products. It has a wide range of products that include corrugated board, Kraft paper, and tissue paper. The company has a strong presence in the Indonesian market and is one of the leading paper and paperboard manufacturers in the country.

– Huhtamäki Oyj ($LTS:0K9W)

Huthamäki Oyj is a Finnish packaging company that specializes in food and beverage packaging. The company has a market capitalization of 3.79 billion as of 2022 and a return on equity of 14.22%. Huthamäki Oyj is a leading provider of flexible packaging solutions and one of the largest manufacturers of plastic cups and lids in Europe. The company’s products are used by major food and beverage brands around the world.

– Raj Packaging Industries Ltd ($BSE:530111)

Raj Packaging Industries Ltd has a market cap of 185.53M as of 2022, a Return on Equity of 11.2%. The company is engaged in the business of manufacturing and marketing of corrugated packaging products and other flexible packaging products. It has a wide range of products catering to different industries such as food and beverage, pharmaceuticals, electronics, textiles, and many others. The company has a strong presence in the domestic market with a market share of around 60%. It also has a significant export business, accounting for around 20% of its total sales.

Summary

Analyzing the investment potential of Sealed Air is a worthwhile endeavor. The company reported a total revenue of USD 94.3 million and net income of USD 1405.9 million for the fourth quarter of fiscal year 2022, both representing significant decreases year over year. While these figures illustrate a challenging environment, investors ought to consider other aspects such as the company’s competitive advantage, its financial position, and the overall market outlook. In terms of competitive advantage, Sealed Air has a diversified product portfolio that includes high-performance products such as Bubble Wrap, Instapak foam packaging, and Cryovac food packaging. This indicates that the company has ample liquidity to withstand any short-term challenges.

Finally, investors should consider the overall market outlook. Currently, the global economy is recovering from the effects of the pandemic and companies are looking for opportunities to expand their operations and capacity. This could be an opportune time for Sealed Air to capitalize on these trends and boost long-term growth. Overall, while Sealed Air has experienced a challenging environment in the fourth quarter of fiscal year 2022, investors should consider the company’s competitive advantage, financial position, and overall market outlook when determining whether or not to invest in the company.

Recent Posts