SCHNEIDER NATIONAL Reports Fourth Quarter FY2022 Earnings Results on December 31 2022

March 13, 2023

Earnings Overview

SCHNEIDER NATIONAL ($NYSE:SNDR) announced their fourth quarter FY2022 earnings results on December 31 2022, with total revenue of USD 110.1 million, a 17.9% decrease year-over-year. Net income for the quarter stood at USD 1561.7 million, a 0.8% decrease compared to the year prior.

Transcripts Simplified

Schneider National released its fourth quarter and full year earnings results for 2022, posting adjusted earnings of $148 million and $617 million respectively. This was the second most profitable fourth quarter in the company’s history, behind only the $177 million earned in the fourth quarter of 2021. Adjusted EPS for the fourth quarter was $0.64 compared to the record high of $0.76 in 4Q, 2021. The company saw growth in its dedicated, intermodal, and logistics business, with dedicated revenues within the Truckload segment growing 45% over 2021. For the year, dedicated revenues were 53% of Truckload segment revenues as compared to 42% in 2021.

Intermodal and Logistics both posted record revenues and earnings in 2022 and together, they delivered about half of segment earnings. In 2022, Schneider National generated $856 million of cash from operations which was an all-time high and compares to $566 million in 2021. Net capital expenditures finished 2022 at $462 million, just below their most recent guidance of $475 million. During 2022, they reduced their debt by over $60 million and their total debt currently stands at $205 million.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Schneider National. More…

| Total Revenues | Net Income | Net Margin |

| 6.6k | 457.8 | 6.9% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Schneider National. More…

| Operations | Investing | Financing |

| 856.4 | -598.8 | -116.7 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Schneider National. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 4.32k | 1.48k | 15.38 |

Key Ratios Snapshot

Some of the financial key ratios for Schneider National are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 11.6% | 25.2% | 9.3% |

| FCF Margin | ROE | ROA |

| 13.0% | 14.0% | 8.9% |

Stock Price

Upon the announcement, SCHNEIDER NATIONAL stock opened at $27.7 and closed at $30.4, soaring by 10.8% from its prior closing price of 27.4. The company reported large profits for the quarter, thanks to an increase in demand for their services, as well as successful expense management and cost-cutting initiatives. The company attributed its success to a strong focus on customer satisfaction and continuous innovation. In particular, they highlighted the launch of their new cutting-edge technology platform, which allowed them to offer more efficient, personalized services to their customers.

Additionally, their strategic investment in data-driven solutions allowed them to better track customer trends and adjust their services accordingly. This impressive quarter has led to increased optimism among analysts and investors alike, who believe that SCHNEIDER NATIONAL is well-positioned for the future. With a focus on delivering quality services and solutions to their customers, they are continuing to position themselves as a leader in the industry. Live Quote…

Analysis

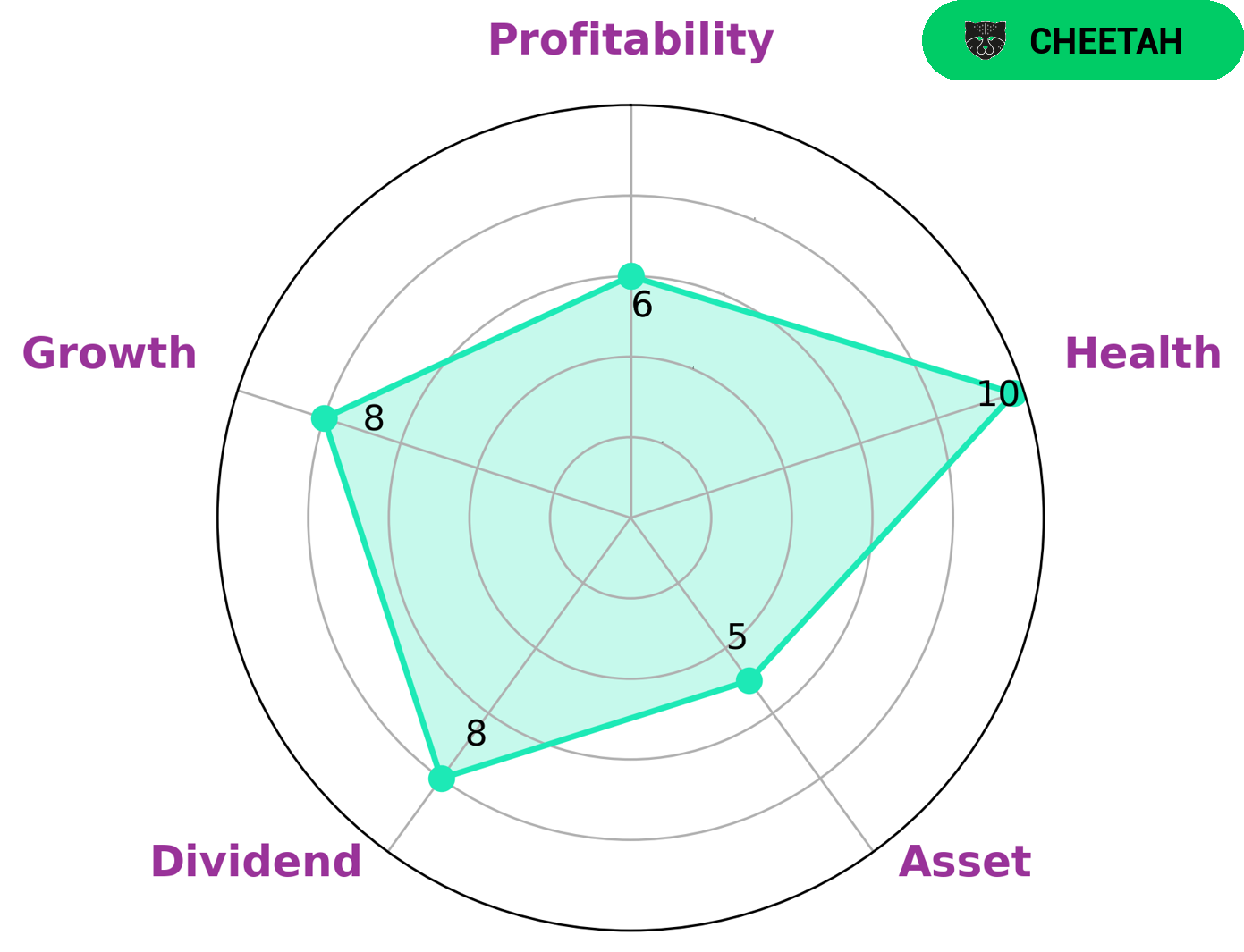

GoodWhale recently analysed the financials of SCHNEIDER NATIONAL and the results are very encouraging. Our Star Chart shows that SCHNEIDER NATIONAL is strong in dividend and growth, and medium in asset and profitability. We classified SCHNEIDER NATIONAL as a ‘cheetah’ company, which is a company that has achieved high revenue or earnings growth but is considered less stable due to lower profitability. This kind of company may be attractive to investors looking to benefit from high growth potential while taking lower risks. Moreover, SCHNEIDER NATIONAL also has a high health score of 10/10 in terms of cashflows and debt, meaning that the company is capable of safely riding out any crisis without the risk of bankruptcy. More…

Peers

It has a wide variety of competitors, including Xinjiang Tianshun Supply Chain Co Ltd, Shanghai Ace Investment & Development Co Ltd, and Deppon Logistics Co Ltd.

– Xinjiang Tianshun Supply Chain Co Ltd ($SZSE:002800)

Xinjiang Tianshun Supply Chain Co Ltd is a company that operates in the supply chain industry. The company has a market cap of 2.48B as of 2022 and a return on equity of 8.22%. The company has a strong market position and is a well-known player in the industry. The company’s main business is the provision of supply chain services to businesses. The company has a diversified client base and a strong track record. The company is headquartered in Xinjiang, China.

– Shanghai Ace Investment & Development Co Ltd ($SHSE:603329)

Shanghai Ace Investment & Development Co Ltd is a 3B market cap company with an ROE of 18.67%. The company is involved in the development and management of real estate projects.

– Deppon Logistics Co Ltd ($SHSE:603056)

Deppon Logistics Co Ltd is a leading Chinese logistics company with a market cap of 18.11B as of 2022. The company provides comprehensive logistics services to businesses and individuals in China, including transportation, warehousing, distribution, and e-commerce logistics. The company has a strong focus on customer service and has a reputation for providing high-quality, reliable logistics services. Deppon Logistics Co Ltd has a return on equity of 4.31%. The company is well-positioned to continue its growth in the Chinese logistics market.

Summary

Schneider National, a leading provider of transportation, logistics, and supply chain solutions, reported its fourth quarter of FY2022 earnings. Total revenue for the period dropped by 17.9%, amounting to USD 110.1 million compared to the same period a year prior. Net income for the quarter was down 0.8% at USD 1561.7 million. Following the announcement, the stock price of the company moved up.

Investors and analysts may want to consider their long-term prospects in the company, as it continues to adapt to changing market conditions and strives to improve profitability. Evaluating the company’s balance sheet, financial performance over the past few years, and its competitive advantages in the industry can be useful for determining investment potential.

Recent Posts