Saturn Oil & Gas Reports Strong Earnings for Q1 of FY 2023

May 28, 2023

Earnings Overview

On March 31, 2023, SATURN OIL & GAS ($TSXV:SOIL) released its earnings report for the first quarter of Fiscal Year 2023. Total revenue for the period was CAD 133.4 million, an increase of 93.0% compared to the same quarter of the prior year. Net income for the quarter was CAD 219.0 million, significantly higher than the net loss of -97.6 million reported in the corresponding period of the previous fiscal year.

Stock Price

On Tuesday, SATURN OIL & GAS reported strong earnings for the first quarter of the fiscal year 2023. The company’s stock opened at CA$2.3 and closed at CA$2.2, down by 2.6% from its last closing price of CA$2.3. Despite the slight dip in stock prices, investors remain optimistic about the company’s future prospects. This was mainly driven by higher revenue and improved operational efficiency. The strong earnings report has been well received by analysts and investors alike.

Analysts have estimated that SATURN OIL & GAS will continue to show strong growth in the coming quarters, with revenue expected to increase by up to 10%. The company has also indicated plans to invest heavily in research and development in order to increase production capacity and efficiency. Overall, SATURN OIL & GAS’s strong Q1 earnings report has instilled confidence in investors and analysts, indicating a prosperous future for the company. With strong growth prospects and plans for further investments, SATURN OIL & GAS is well-positioned to benefit from the current market trends. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for SOIL. More…

| Total Revenues | Net Income | Net Margin |

| 435.38 | 391.48 | 35.2% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for SOIL. More…

| Operations | Investing | Financing |

| 138.77 | -803.27 | 671.34 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for SOIL. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.4k | 870.81 | 3.8 |

Key Ratios Snapshot

Some of the financial key ratios for SOIL are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 195.5% | 276.1% | 101.6% |

| FCF Margin | ROE | ROA |

| 8.1% | 83.1% | 19.8% |

Analysis

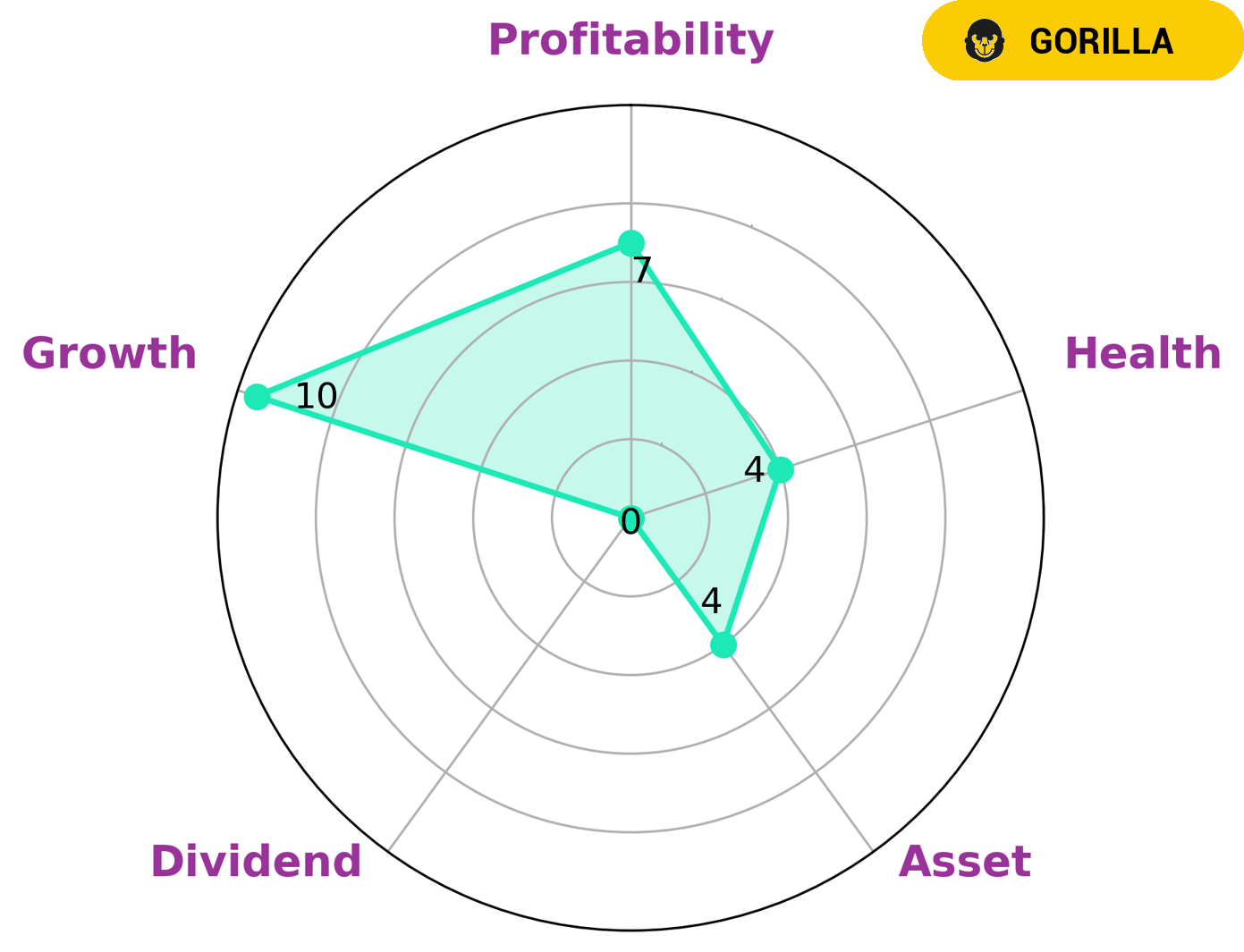

We at GoodWhale performed an analysis of SATURN OIL & GAS’s wellbeing and the results were intriguing. The Star Chart revealed that SATURN OIL & GAS was strong in growth and profitability, medium in asset, and weak in dividend. SATURN OIL & GAS also had an intermediate health score of 4/10 considering its cashflows and debt, a sign that it is likely to sustain future operations in times of crisis. Further, we concluded that SATURN OIL & GAS is ‘gorilla’ type company that has achieved stable and high revenue or earning growth due to its competitive advantage. This type of company may be of interest to value investors who believe in buying quality stocks at attractive prices. Growth investors may also be interested in SATURN OIL & GAS due to its strong growth potential. Investors looking for dividends may be less attracted to this stock given its low dividend score. More…

Peers

The company faces stiff competition from a number of major competitors within the industry, including The Reserve Petroleum Co, Cobra Venture Corp, and ProAm Explorations Corp. All four companies operate in the same field, striving to provide the best services and products to the market.

– The Reserve Petroleum Co ($OTCPK:RSRV)

The Reserve Petroleum Co is an oil and gas exploration and production company based in the United States, with a market cap of 32.79M as of 2023. The company has a Return on Equity (ROE) of 6.84%, which is a measure of its profitability. Reserve Petroleum Co primarily engages in the exploration, development, and production of oil and gas properties. It operates in various regions, including the Gulf of Mexico, Alaska, East Texas, and New Mexico. Significantly, the company produces both crude oil and natural gas and utilizes a variety of technologies to develop new reserves and improve production levels.

– Cobra Venture Corp ($TSXV:CBV)

Cobra Venture Corporation is a publicly traded company that specializes in venture capital investments, providing capital to small businesses and startups. The company is currently valued at 2.17 million dollars as of 2023, and has a return on equity of 4.82%. This indicates that the company has been successful in generating returns from the investments it has made. The value of the company is likely to increase as the investments mature over time. Cobra Venture Corporation’s success in the venture capital market makes it an attractive option for investors interested in investing in small business and startup opportunities.

– ProAm Explorations Corp ($TSXV:PMX)

ProAm Explorations Corp is a Canadian oil and gas company that specializes in exploration and production of natural gas and oil. It has a market capitalization of $413.66k as of 2023, which implies that investors are valuing the company’s current financial position and potential future performance. In addition to its market capitalization, ProAm Explorations Corp has a Return on Equity (ROE) of -7.33%. This means that the company’s current return on invested capital is below the cost of capital and failing to generate an adequate return for its shareholders.

Summary

SATURN OIL & GAS recently reported its earnings results for the first quarter of Fiscal Year 2023, posting total revenue of CAD 133.4 million, a 93.0% increase from the same period in the prior year. The company also reported a net income of CAD 219.0 million, compared to a net loss of -97.6 million in the corresponding quarter of the previous fiscal year. This strong performance suggests that SATURN OIL & GAS is in a favorable position for long-term growth and profitability.

This makes it an attractive investment option for those interested in capitalizing on the company’s progress and potential. Investors should continue to monitor SATURN OIL & GAS for further announcements and developments as they could have a significant impact on the stock price.

Recent Posts