SANYO SPECIAL STEEL Reports 70.4% Increase in Total Revenue for FY2023 Q3.

March 25, 2023

Earnings Overview

For the quarter ending December 31, 2022, SANYO SPECIAL STEEL ($TSE:5481) saw total revenue increase by 70.4% year-on-year to JPY 4.9 billion for FY2023 Q3 and net income was also up 15.0%, amounting to JPY 99.0 billion compared to the same period in the prior year.

Share Price

This impressive growth was driven by increased demand for its products from the automotive and industrial sectors. On Tuesday, SANYO SPECIAL STEEL stock opened at JP¥2596.0 and closed at JP¥2589.0, up by 1.4% from its prior closing price of JP¥2554.0. The impressive performance of SANYO SPECIAL STEEL can be attributed to its focus on developing high-quality products in response to the changing needs of the industries it serves. By investing in modern technologies and advanced manufacturing processes, the company has been able to stay ahead of its competitors.

In addition, the company has also expanded its reach into new markets, such as Europe, China and India. Looking ahead, SANYO SPECIAL STEEL expects to maintain its impressive growth streak in the coming quarters. With a strong order book and robust demand for its products, the company is confident of delivering on its financial targets for FY2023. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Sanyo Special Steel. More…

| Total Revenues | Net Income | Net Margin |

| 388.33k | 19.87k | 5.2% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Sanyo Special Steel. More…

| Operations | Investing | Financing |

| -190 | -13.3k | 2.29k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Sanyo Special Steel. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 393.77k | 184.32k | 3.87k |

Key Ratios Snapshot

Some of the financial key ratios for Sanyo Special Steel are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 15.8% | 100.0% | 7.2% |

| FCF Margin | ROE | ROA |

| -3.2% | 8.4% | 4.4% |

Analysis

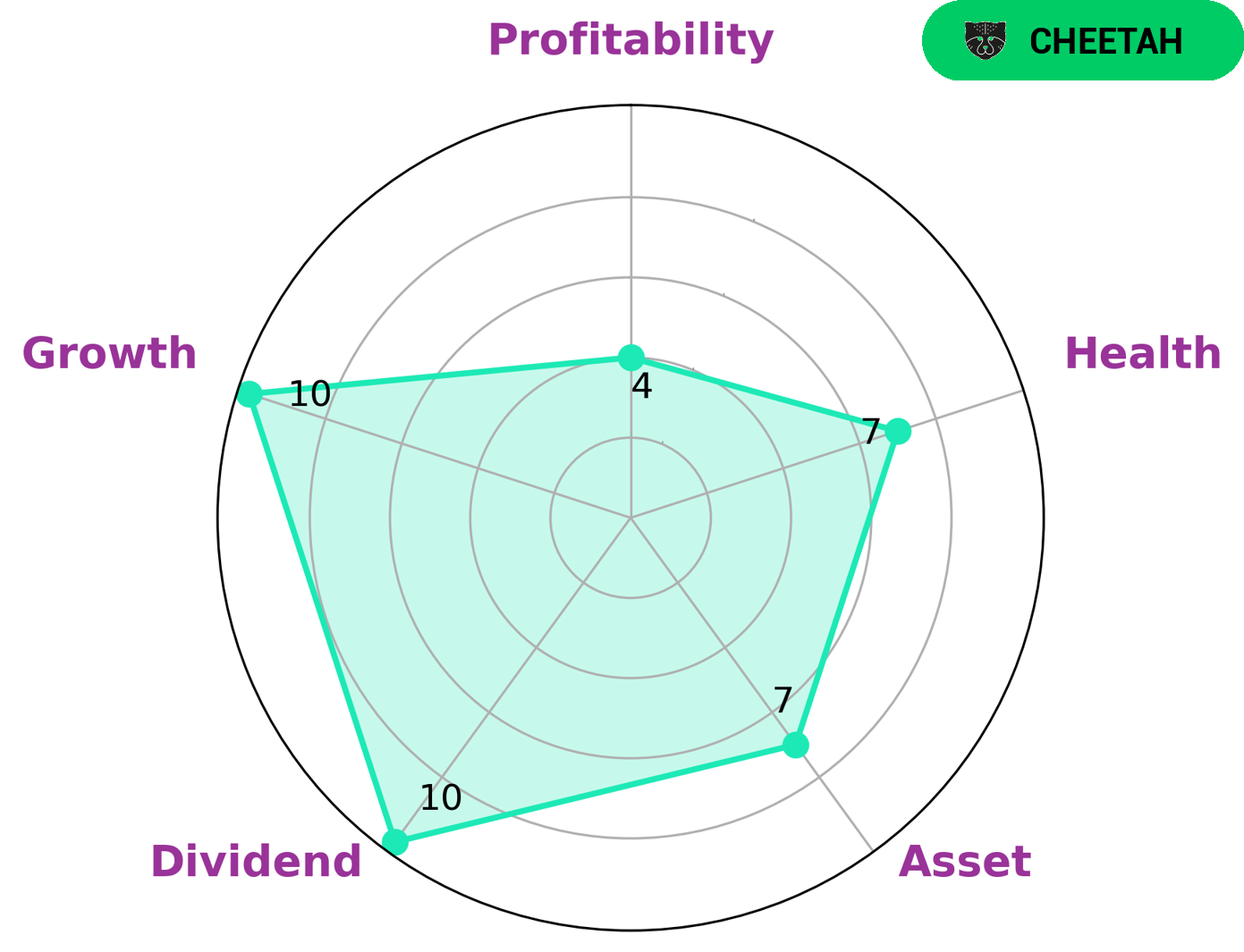

GoodWhale has conducted an analysis of SANYO SPECIAL STEEL’s fundamentals, and according to Star Chart we have classified the company as a ‘cheetah’. This type of company is typically one that has achieved high revenue or earnings growth, but is considered less stable due to lower profitability. Nonetheless, our analysis reveals that SANYO SPECIAL STEEL is strong in assets, dividend, and growth, and medium in profitability. Additionally, SANYO SPECIAL STEEL has a high health score of 7/10 with regard to its cashflows and debt, meaning that it is capable to pay off debt and fund future operations. Given these positive indicators, we believe that SANYO SPECIAL STEEL may be attractive to a variety of investors. Those interested in capital appreciation and growth may be especially attracted to this company due to its low risk profile, whereas those looking for more income may benefit from its dividend yield. In any case, SANYO SPECIAL STEEL is certainly worth further investigation. More…

Peers

It is up against formidable competitors in Yodogawa Steel Works Ltd, Liuzhou Iron & Steel Co Ltd, and Shandong Iron & Steel Co Ltd, all of which are committed to providing quality products and services to their customers. Despite the competition, Sanyo Special Steel Co Ltd continues to strive for excellence and is determined to remain a leader in the industry.

– Yodogawa Steel Works Ltd ($TSE:5451)

Yodogawa Steel Works Ltd is a Japanese steel manufacturer with a market cap of 71.9B as of 2023. It has a Return on Equity of 7.37%. Yodogawa Steel Works Ltd is a leading steel producer in Japan, providing high-quality products and services to customers in a wide range of industries, including automotive, construction, and shipbuilding. The company has an extensive network of sales offices and production facilities across the country, enabling them to deliver products to customers quickly and efficiently. Yodogawa Steel Works Ltd has a highly diversified portfolio of products, which includes cold rolled steel sheets, hot rolled steel sheets, galvanized steel sheets, stainless steel sheets, and other steel related products.

– Liuzhou Iron & Steel Co Ltd ($SHSE:601003)

Liuzhou Iron & Steel Co Ltd is a Chinese steel manufacturer located in Liuzhou, Guangxi Province. Its market capitalization as of 2023 is 9.53 billion, indicating the company’s size and strength within the industry. Its Return on Equity (ROE) meanwhile is -26.77%, which is significantly lower than the average ROE of other steel manufacturers in China. This suggests that Liuzhou Iron & Steel Co Ltd may need to focus on improving its profitability in order to become more competitive in the industry.

– Shandong Iron & Steel Co Ltd ($SHSE:600022)

Shandong Iron & Steel Co Ltd is a Chinese steel manufacturing company with a market cap of 16.05B as of 2023. The company has a Return on Equity of 1.12%, which is an indicator of its profitability. Shandong Iron & Steel Co Ltd produces and sells a range of steel products and services, including steel plates, hot-rolled strips and sections, and has a presence throughout China. The company also offers services such as processing, trading and logistics.

Summary

SANYO SPECIAL STEEL recently reported strong financial results for the quarter ending December 31, 2022 for FY2023 Q3. Total revenue grew 70.4% year over year to JPY 4.9 billion, while net income increased 15.0% to JPY 99.0 billion compared to the same period in the prior year. These positive figures suggest that SANYO SPECIAL STEEL is performing well and could be a good investment opportunity. Investors should consider monitoring the company’s financial performance in the future and consider using their own financial tools and analysis to assess whether investing in this company is a good option.

Recent Posts