Sally Beauty Intrinsic Value Calculation – Sally Beauty Q4 Earnings Expected to Take a Dip

November 11, 2023

☀️Trending News

Sally Beauty ($NYSE:SBH) Holdings, Inc. is a global distributor and retailer of professional beauty supplies with operations in the United States, Canada, Mexico, and Europe. The company’s product categories include hair color, hair care, nails, skin care, beauty tools, and makeup. Recent indications suggest that Sally Beauty’s fourth quarter earnings are likely to take a dip. The company reported a decline in same-store sales for the third quarter of this year, and market analysts predict that the trend will continue into the fourth quarter. The company has also been facing a number of challenges, such as rising labor costs and competition from mass market retailers.

With these headwinds in place, Sally Beauty’s Q4 earnings are expected to be lower than what they have been in the past. Despite the anticipated decrease in earnings, investors are still hopeful that Sally Beauty can find a way to turn things around. The company has been making efforts to focus on providing customers with the latest products and services, as well as improving their online capabilities. If these initiatives are successful, then Sally Beauty could potentially see an uptick in sales and earnings in the future.

Earnings

SALLY BEAUTY recently released their earning report for FY2023 Q3 as of June 30 2021, revealing total revenue of 1022.39M USD and net income of 76.21M USD for the period. This marks a 6.3% increase in total revenue and a 63.6% increase in net income compared to the same period last year. Unfortunately, this may not be a sustained trend as SALLY BEAUTY’s total revenue has decreased from 1022.39M USD to 931.01M USD in the past 3 years.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Sally Beauty. More…

| Total Revenues | Net Income | Net Margin |

| 3.77k | 163.36 | 5.2% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Sally Beauty. More…

| Operations | Investing | Financing |

| 240.04 | -98.32 | -168.1 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Sally Beauty. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 2.68k | 2.19k | 4.53 |

Key Ratios Snapshot

Some of the financial key ratios for Sally Beauty are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 2.3% | 7.7% | 7.6% |

| FCF Margin | ROE | ROA |

| 3.8% | 39.3% | 6.7% |

Share Price

On Wednesday, SALLY BEAUTY stock experienced a drop in its share price. The stock opened at $8.9 in the morning and closed at $8.7, a decrease of 3.7% from the previous closing price of $9.0. This dip in share prices is a worrying sign for investors, as it suggests that the company may not be performing well in the fourth quarter of the fiscal year.

Analysts are predicting that SALLY BEAUTY’s Q4 earnings will take a dip, which could have a significant impact on its share price moving forward. Investors should keep an eye on the company’s financial performance in the coming weeks and months, as this could influence their decision to buy or sell the stock. Live Quote…

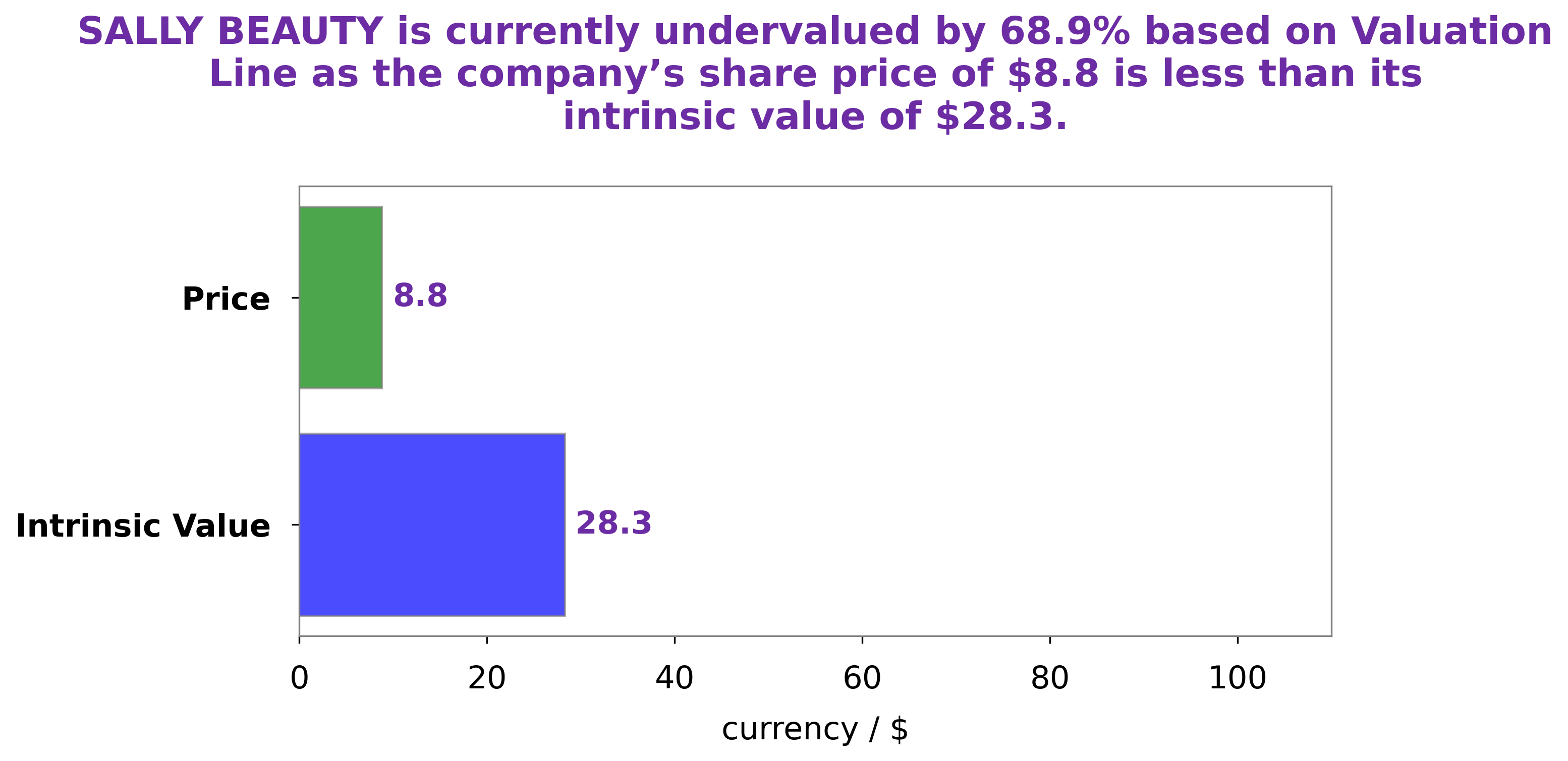

Analysis – Sally Beauty Intrinsic Value Calculation

At GoodWhale, we have conducted an analysis of SALLY BEAUTY‘s fundamentals. Our proprietary Valuation Line shows that SALLY BEAUTY’s intrinsic value is around $28.1. Right now, the stock is trading at $8.7, which is a huge 69.0% discount of its true underlying value. This means that SALLY BEAUTY is highly undervalued and presents a great opportunity for investors looking for a good bargain in the market. More…

Peers

The beauty industry is a competitive one, with many different companies vying for market share. Sally Beauty Holdings Inc is one such company, and it competes against Adore Beauty Group Ltd, Matas A/S, and Boutiques Inc, among others. While each company has its own strengths and weaknesses, Sally Beauty Holdings Inc has been able to stay ahead of the competition and maintain a leading position in the industry.

– Adore Beauty Group Ltd ($ASX:ABY)

Adore Beauty Group Ltd is an Australian-based company that retails beauty products. It has a market capitalization of 150.6 million as of 2022 and a return on equity of 5.82%. The company offers a wide range of products including skincare, haircare, makeup, and fragrances. It also provides a platform for beauty experts to share their tips and tricks with the Adore Beauty community.

– Matas A/S ($LTS:0QFA)

Matas A/S is a large publicly traded company with a market capitalization of 2.84 billion as of 2022. The company has a strong return on equity of 8.02%. Matas A/S is a leading retailer in Denmark with over 1,000 stores. The company offers a wide variety of products including cosmetics, health, and beauty products.

– Boutiques Inc ($TSE:9272)

Boutiques Inc is a publicly traded company that designs, manufactures, and sells women’s clothing and accessories. The company was founded in 2001 and is headquartered in New York City. As of 2022, Boutiques Inc had a market capitalization of $13.97 billion and a return on equity of 20.46%. The company’s products are sold through its own retail stores, as well as through department stores and online retailers.

Summary

Investors should bear in mind that the company has been able to successfully cut costs in response to the pandemic, which could limit the decline in earnings. Additionally, Sally Beauty has a diversified product portfolio, which may help to mitigate any losses from a single product or service. However, analysts predict that the stock price may move down on the day of the earnings report due to the expected decline in earnings. Investors should be aware of this risk and make their decisions accordingly.

Recent Posts