RED ROCK RESORTS Announces Fourth Quarter Fiscal Year 2022 Earnings Results on December 31 2022

March 8, 2023

Earnings Overview

RED ROCK RESORTS ($NASDAQ:RRR) reported total revenue of USD 91.8 million for the fourth quarter of its Fiscal Year 2022, a decrease of 38.3% compared to the same period in the prior year. Net income for the quarter was USD 425.5 million, a 0.7% increase from the same quarter of the previous year. These earnings were announced on December 31, 2022.

Transcripts Simplified

Red Rock Resorts reported strong fourth quarter and full year financial results, with fourth quarter net revenue at $425.5 million, up $3.1 million from the prior year’s fourth quarter, and adjusted EBITDA of $194.4 million, up 2.5% from the prior year’s fourth quarter. Las Vegas operations, excluding the impact from closed properties, reported fourth quarter net revenue of $419.7 million, up 1.9% from the prior year’s fourth quarter. Frank and Lorenzo Fertitta and Scott Kreeger were pleased with the record financial performance despite challenges such as COVID-19 restrictions, historically high inflation and the disrupted supply chain.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for RRR. More…

| Total Revenues | Net Income | Net Margin |

| 1.66k | 205.46 | 14.1% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for RRR. More…

| Operations | Investing | Financing |

| 550.59 | 586.26 | -1.01k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for RRR. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 3.2k | 3.2k | 0.56 |

Key Ratios Snapshot

Some of the financial key ratios for RRR are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -3.6% | 30.3% | 33.9% |

| FCF Margin | ROE | ROA |

| 9.1% | 1088.6% | 11.0% |

Price History

RED ROCK RESORTS announced its fourth quarter fiscal year 2022 earnings results on Tuesday, December 31 2022. Trading opened on Tuesday at $46.9, and closed at $48.5, up by 3.1% from the prior closing price of 47.0. The positive results were attributed to ongoing initiatives across all divisions, including the successful rollout of new gaming and entertainment offerings at Red Rock‘s flagship Las Vegas casino and resort.

The company also saw gains in its online gaming operations, which contributed over 10% of total revenue for the quarter. RED ROCK RESORTS is looking forward to the upcoming fiscal year, and is confident that its investments in new gaming and entertainment offerings will continue to drive strong results in the coming quarters. Live Quote…

Analysis

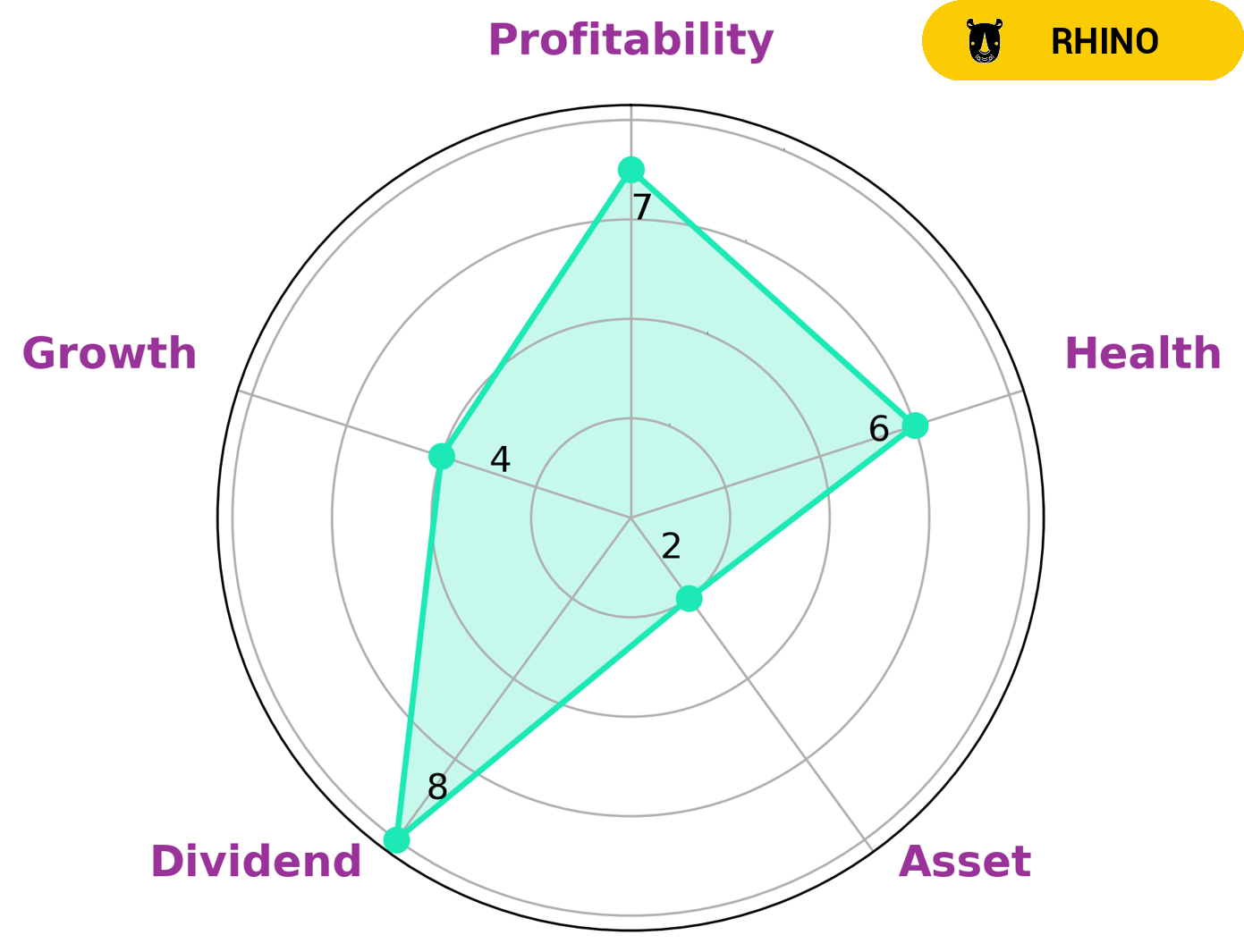

When analyzing RED ROCK RESORTS’s fundamentals with GoodWhale, we can see that it is strong in dividend and profitability, and medium in growth, but weak in asset. RED ROCK RESORTS is classified as a ‘rhino’ type of company, meaning it has achieved moderate revenue or earnings growth. Given these characteristics, investors who are looking for a stable and reliable dividend yield or who are interested in a company’s long-term profitability may be particularly interested in RED ROCK RESORTS. In terms of its financial health, RED ROCK RESORTS has an intermediate health score of 6/10 with regards to its cashflows and debt, indicating that it is likely to sustain future operations in times of crisis. More…

Peers

The company’s main competitors are Boyd Gaming Corp, Golden Entertainment Inc, and Bloomberry Resorts Corp.

– Boyd Gaming Corp ($NYSE:BYD)

Boyd Gaming Corporation is a leading diversified owner and operator of 22 gaming entertainment properties located in Nevada, Illinois, Indiana, Iowa, Kansas, Louisiana, Mississippi and Ohio. Boyd Gaming press releases are available at boydgaming.com. Additional information about Boyd Gaming can be found at https://www.boydgaming.com/.

The company has a market cap of 5.86B as of 2022 and a ROE of 36.77%. The company operates gaming entertainment properties located in various states in the US.

– Golden Entertainment Inc ($NASDAQ:GDEN)

As of 2022, Golden Entertainment, Inc. had a market capitalization of 1.19 billion and a return on equity of 28.98%. The company is a gaming and hospitality company that owns and operates casinos, taverns, and gaming machines in the United States.

– Bloomberry Resorts Corp ($PSE:BLOOM)

The company’s market cap stands at 77.45B as of 2022 and its ROE is 11.83%. The company is engaged in the business of developing, owning and operating resorts.

Summary

RED ROCK RESORTS recently released their fourth quarter earnings results for fiscal year 2022 and experienced a 38.3% drop in total revenue compared to the same period of the prior year. Despite this decrease, net income for the quarter rose 0.7% year over year and totaled USD 425.5 million. The company’s stock price moved up the same day of the release, indicating that investors are pleased with the results. For potential investors, this suggests RED ROCK RESORTS’ business performance is stable and could be a good long-term investment option.

Recent Posts