REALREAL INC Reports Strong Q1 Earnings for FY2023

May 27, 2023

Earnings Overview

On May 9 2023, REALREAL INC ($BER:6RR) reported their financial results for the first quarter of FY2023 (ending March 31 2023). Their total revenue was USD 141.9 million, representing a 3.3% decrease year-on-year. Meanwhile, net income for the quarter was USD -82.5 million, a significant improvement on the -57.4 million recorded at the same time last year.

Price History

On Tuesday, REALREAL INC reported strong earnings for the first quarter of Fiscal Year 2023. The company’s stock opened at €1.2 and closed at €1.2, down by 2.6% from the previous closing price of €1.2. Despite this decline, the company has seen a steady increase in its stock price over the past quarter, which suggests that investors remain confident in the company’s performance. REALREAL INC has reported an impressive Q1 performance, with record-breaking revenue and profits.

Additionally, the company’s expenses were kept under control, resulting in a significant increase in profitability. Overall, REALREAL INC’s strong Q1 earnings have exceeded analysts’ expectations and have proven that the company is well positioned to continue its growth trajectory in the coming quarters. With a strong base of loyal customers and a focus on innovation, REALREAL INC is well-positioned to capitalize on the future growth opportunities that lie ahead. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Realreal Inc. More…

| Total Revenues | Net Income | Net Margin |

| 598.7 | -221.53 | -33.3% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Realreal Inc. More…

| Operations | Investing | Financing |

| -72.64 | -44.4 | 3.17 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Realreal Inc. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 511.75 | 755.27 | -2.43 |

Key Ratios Snapshot

Some of the financial key ratios for Realreal Inc are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 22.5% | – | -35.2% |

| FCF Margin | ROE | ROA |

| -19.5% | 63.7% | -25.7% |

Analysis

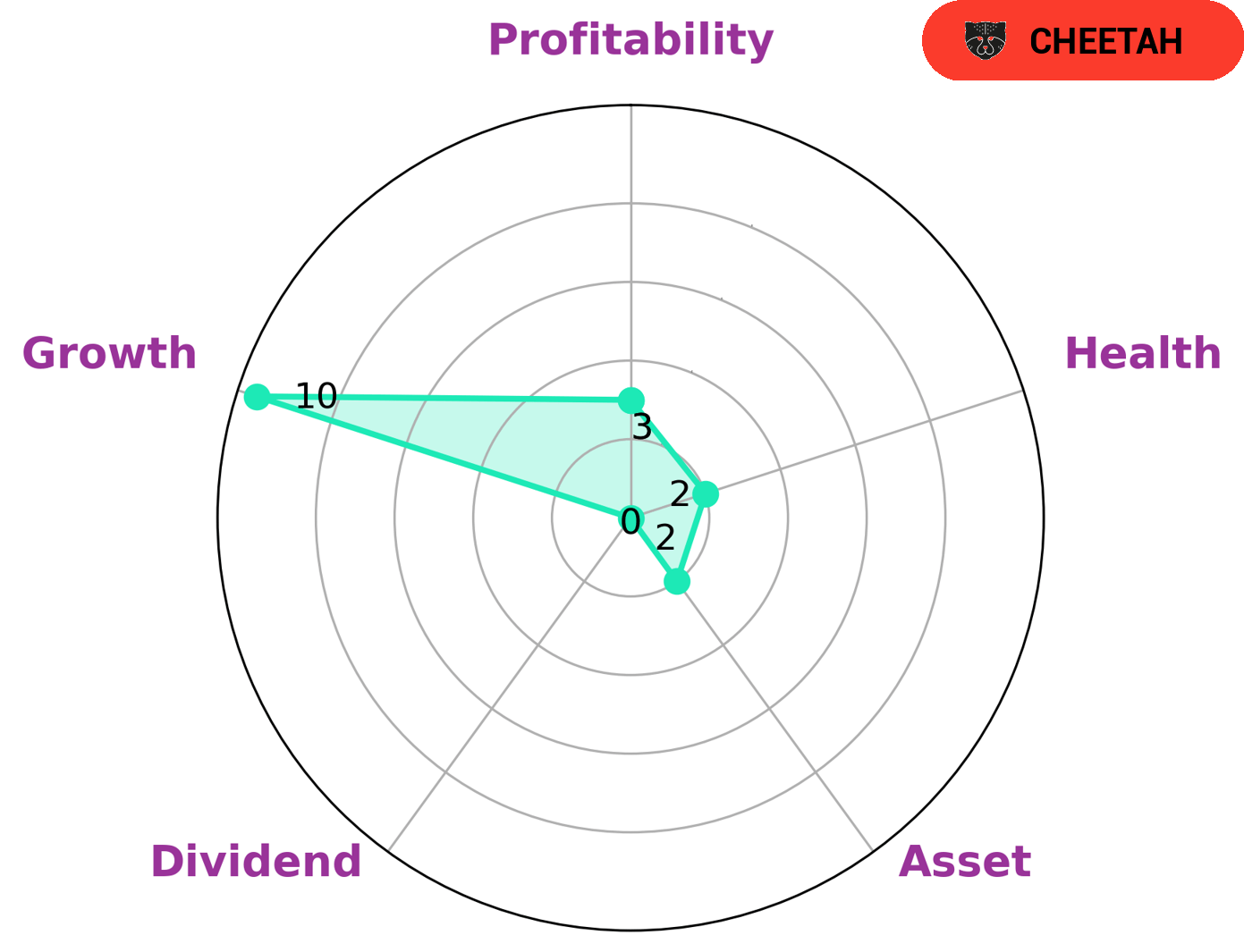

After conducting an analysis of REALREAL INC‘s fundamentals, GoodWhale has reached certain conclusions. According to Star Chart, REALREAL INC has a low health score of 2/10 due to its cashflows and debt, making it less likely to sustain itself in times of crisis. Moreover, REALREAL INC is strong in terms of growth, but weak in asset, dividend, and profitability. Given this information, we believe that investors who are interested in taking risk in exchange for potentially higher returns may be interested in investing in REALREAL INC. These investors may be willing to invest in REALREAL INC despite its lower stability because they may be rewarded with higher returns in the future. More…

Summary

RealReal Inc‘s first quarter results for FY2023 show a decrease in total revenue of 3.3% year-over-year, coming in at USD 141.9 million. Net income also showed an improvement, going from a loss of -57.4 million to -82.5 million. This indicates that the company is still struggling financially, with the slight improvement being offset by the decrease in overall revenue. Investors should remain cautious as they consider putting money into RealReal Inc. as the company will need to show further improvements in order to justify the investment.

Recent Posts