Qorvo Stock Intrinsic Value – QORVO Reports Strong Earnings Results for First Quarter of FY2024

August 6, 2023

☀️Earnings Overview

QORVO ($NASDAQ:QRVO) reported their first quarter FY2024 financials on June 30 2023, with a total revenue of USD 651.2 million, a 37.1% decrease compared to the same period in the prior year. Net income for the period was USD -43.6 million, compared to 68.9 million in the first quarter of FY2023.

Share Price

On Wednesday, QORVO announced strong earnings results for the first quarter of the fiscal year 2024. Despite a turbulent market, the company reported robust performance across its product portfolio, indicating sustained financial strength and healthy outlook for the rest of the fiscal year. QORVO stock opened at $108.4 and closed at $106.1, representing a 3.7% decline from its previous closing price of $110.2. This was in line with a broader market trend as investors adjusted to the news.

Nevertheless, the company outperformed expectations with higher revenues and net profits, further proof of its strong growth trajectory. QORVO’s CEO, Mark Arthur, expressed confidence in the company’s performance in a statement accompanying the results: “We are pleased to report another strong quarter of financial results…The strong financial performance reflects our ability to execute on strategic initiatives and leverage our technology leadership to drive innovation and value creation for our customers and shareholders.” Overall, QORVO reported impressive year-on-year growth in several key metrics, including revenues and earnings per share (EPS), while maintaining a healthy balance sheet, underscoring its financial strength and long-term prospects. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Qorvo. More…

| Total Revenues | Net Income | Net Margin |

| 3.19k | -9.31 | -0.3% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Qorvo. More…

| Operations | Investing | Financing |

| 615.11 | -118.46 | -612.6 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Qorvo. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 6.69k | 2.87k | 38.85 |

Key Ratios Snapshot

Some of the financial key ratios for Qorvo are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -0.7% | -58.4% | 1.9% |

| FCF Margin | ROE | ROA |

| 14.4% | 1.0% | 0.6% |

Analysis – Qorvo Stock Intrinsic Value

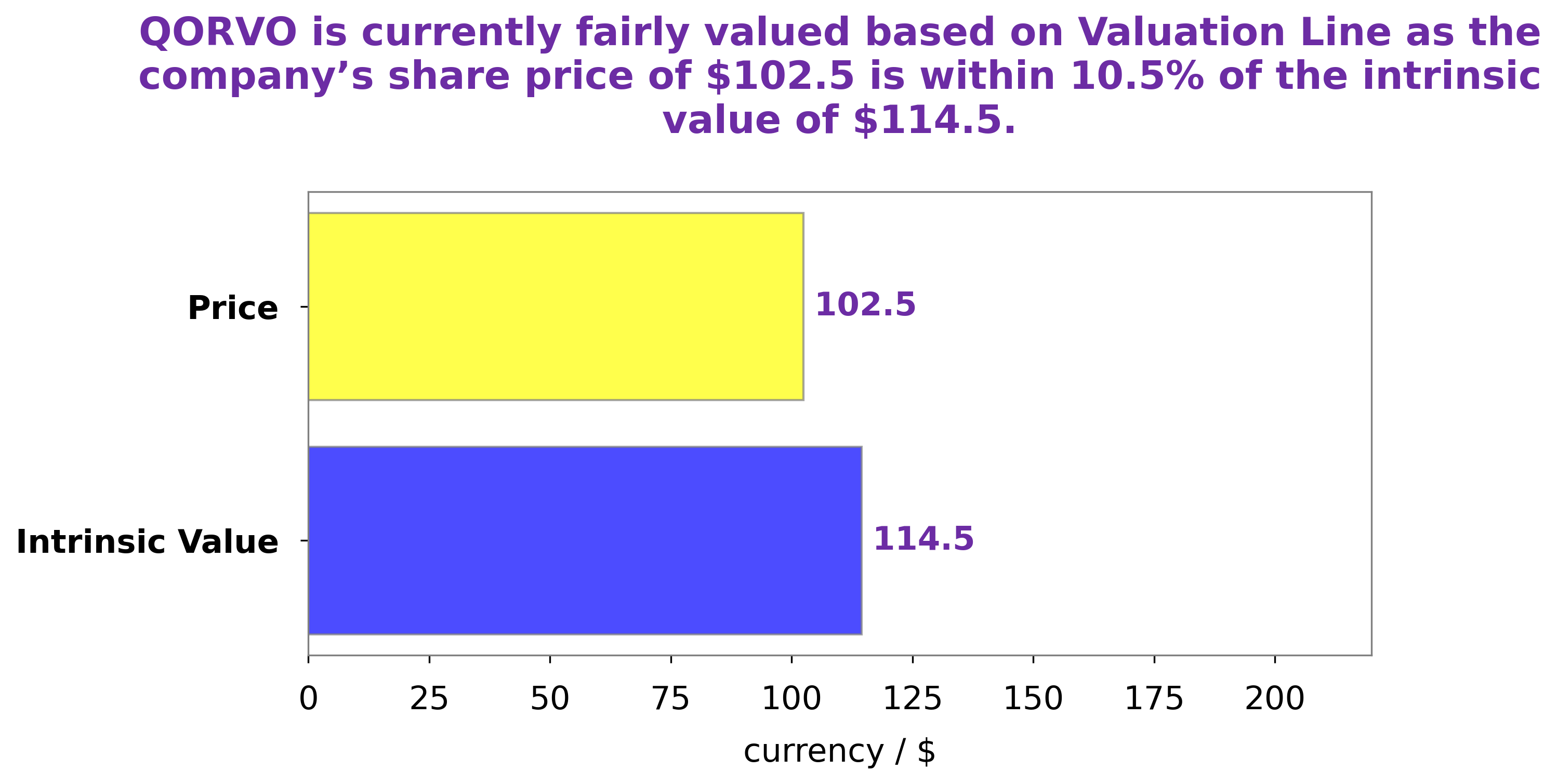

GoodWhale recently conducted an analysis of QORVO‘s wellbeing. Our proprietary Valuation Line calculated the fair value of QORVO to be around $126.5. Currently, however, QORVO stock is traded at $106.1, a price which is undervalued by 16.1%. We believe that this discrepancy presents an excellent buying opportunity for investors who are looking for quality stocks at attractive prices. More…

Peers

In the world of semiconductor companies that provide radio frequency products, Qorvo Inc. has stiff competition. Its main competitors are Skyworks Solutions Inc, Broadcom Inc, and Qualcomm Inc. All of these companies are vying for a share of the market in order to provide their customers with the best products possible.

– Skyworks Solutions Inc ($NASDAQ:SWKS)

Skyworks Solutions Inc is a semiconductor company that designs, manufactures, and markets radio frequency and mixed signal semiconductor solutions for mobile, base station, satellite communications, WiFi, cable television, and other wireless communications applications. The company has a market cap of 13.87B as of 2022 and a return on equity of 17.47%.

– Broadcom Inc ($NASDAQ:AVGO)

Broadcom Inc is a global technology leader that designs, develops and supplies semiconductor and infrastructure software solutions. The company’s products enable the delivery of voice, video, data and multimedia content over fixed and mobile networks to homes, businesses and public places. Broadcom’s product portfolio includes switching, routing, security and storage solutions. The company markets its products to enterprises, service providers and consumers worldwide.

– Qualcomm Inc ($NASDAQ:QCOM)

Qualcomm Inc is a leading telecommunications company with a market cap of 131.76B as of 2022. The company has a strong focus on research and development and has a return on equity of 65.09%. Qualcomm’s products and services include chipsets, modems, and other technology solutions for the wireless industry. The company has a strong presence in the global market and is a major player in the development of 5G technology.

Summary

Qorvo reported its first quarter FY2024 earnings results ending August 2 2023 with a total revenue of $651.2 million, representing a 37.1% year-over-year decrease. Net income was reported at -$43.6 million, compared to the previous year’s $68.9 million. On the day of the announcement, the stock price dropped accordingly, and this has been concerning investors in the company. Analysts are currently divided on the stock’s short and long-term prospects due to the large year-over-year drop in revenue and net income.

Some believe that the stock may recover while others remain more pessimistic. Despite the uncertainty, investors should remain aware of the latest developments with Qorvo to make an informed decision on the stock.

Recent Posts